Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You run Wereinit, a profitable conglomerate, that is considering an investment in a gelati project. You have the following data obtained after spending $3

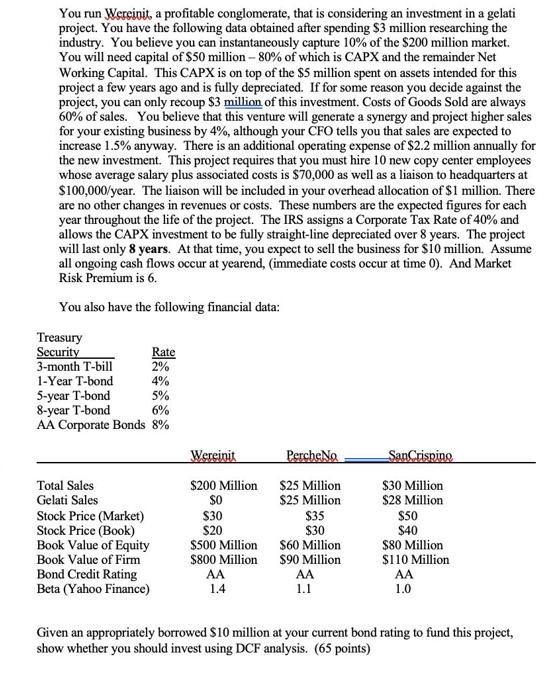

You run Wereinit, a profitable conglomerate, that is considering an investment in a gelati project. You have the following data obtained after spending $3 million researching the industry. You believe you can instantaneously capture 10% of the $200 million market. You will need capital of $50 million - 80% of which is CAPX and the remainder Net Working Capital. This CAPX is on top of the $5 million spent on assets intended for this project a few years ago and is fully depreciated. If for some reason you decide against the project, you can only recoup $3 million of this investment. Costs of Goods Sold are always 60% of sales. You believe that this venture will generate a synergy and project higher sales for your existing business by 4%, although your CFO tells you that sales are expected to increase 1.5% anyway. There is an additional operating expense of $2.2 million annually for the new investment. This project requires that you must hire 10 new copy center employees whose average salary plus associated costs is $70,000 as well as a liaison to headquarters at $100,000/year. The liaison will be included in your overhead allocation of $1 million. There are no other changes in revenues or costs. These numbers are the expected figures for each year throughout the life of the project. The IRS assigns a Corporate Tax Rate of 40% and allows the CAPX investment to be fully straight-line depreciated over 8 years. The project will last only 8 years. At that time, you expect to sell the business for $10 million. Assume all ongoing cash flows occur at yearend, (immediate costs occur at time 0). And Market Risk Premium is 6. You also have the following financial data: Treasury Security 3-month T-bill Rate 2% 1-Year T-bond 4% 5-year T-bond 5% 8-year T-bond 6% AA Corporate Bonds 8% Total Sales Gelati Sales Stock Price (Market) Stock Price (Book) Book Value of Equity Book Value of Firm Bond Credit Rating Beta (Yahoo Finance) Wereinit $200 Million so $30 $20 $500 Million $800 Million AA 1.4 Perche No $25 Million $25 Million $35 $30 $60 Million $90 Million AA 1.1 SanCrisping $30 Million $28 Million $50 $40 $80 Million $110 Million AA 1.0 Given an appropriately borrowed $10 million at your current bond rating to fund this project, show whether you should invest using DCF analysis. (65 points)

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether you should invest in the gelati project using a discounted cash flow DCF analysis we need to calculate the net present value NPV ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started