Question

You second client acts on behalf of a large Australian company who is looking to invest in a major project at the end of the

You second client acts on behalf of a large Australian company who is looking to invest in a major project at the end of the year. This client knows that the company will need to borrow $20,000,000 in December for 3 months through debt instruments and is concerned about an increase in interest rates between now and then. They would like you to set up an interest rate hedge to protect them from any such increases in interest rates. The contract will be established today (19th February 2021) and should be in place until at least December 19th, 2021.

Step 1 - Choose an appropriate futures contract.

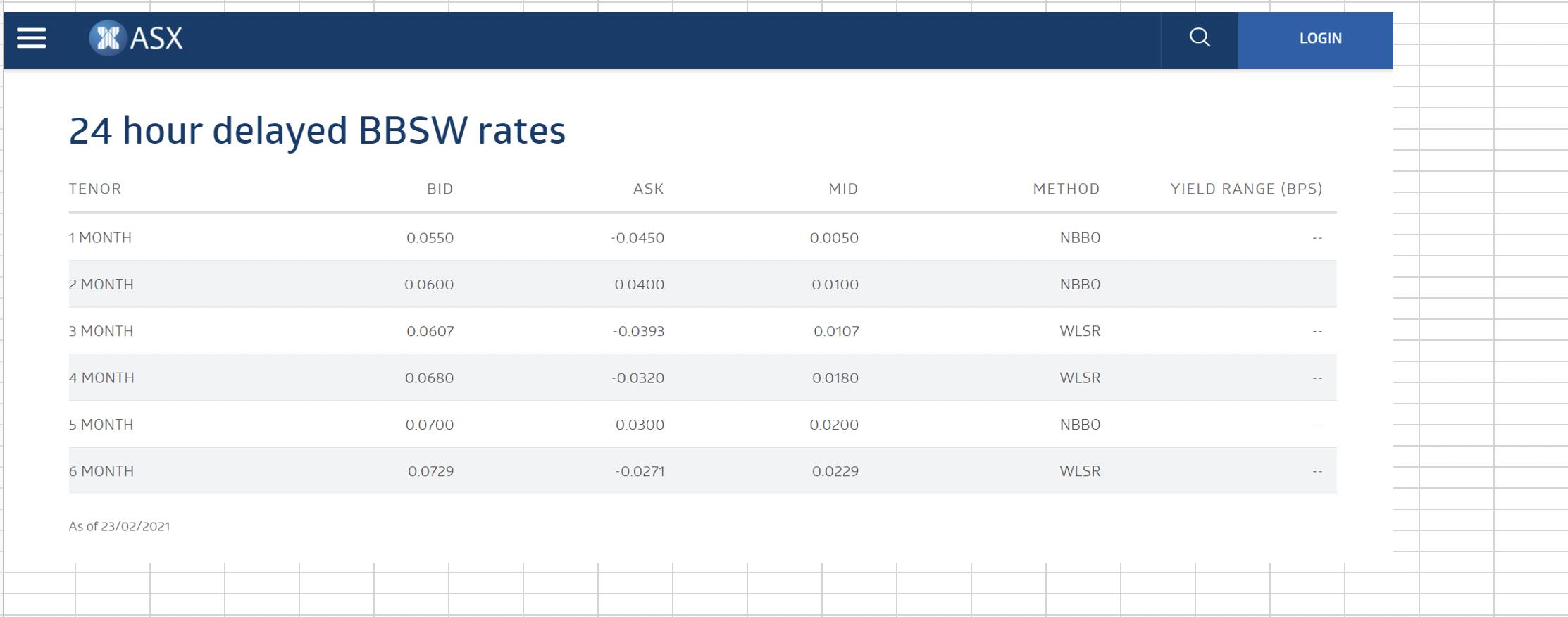

A snapshot of BAB futures prices as of February 19th is provided.

Determine which contract should be chosen stating the day of expiry for the contract.

Determine the price and yield of the appropriate contract.

= X ASX 24 hour delayed BBSW rates TENOR 1 MONTH 2 MONTH 3 MONTH 4 MONTH 5 MONTH 6 MONTH As of 23/02/2021 BID 0.0550 0.0600 0.0607 0.0680 0.0700 0.0729 ASK -0.0450 -0.0400 -0.0393 -0.0320 -0.0300 -0.0271 MID 0.0050 0.0100 0.0107 0.0180 0.0200 0.0229 METHOD NBBO NBBO WLSR WLSR NBBO WLSR LOGIN YIELD RANGE (BPS) 1 1

Step by Step Solution

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To choose an appropriate futures contract for the interest rate hedge we need to consider the time p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started