Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You short 5 contracts of ZC corn futures. Recall that corn futures are quoted in US cents ($0.01) per bushel, and each contract is

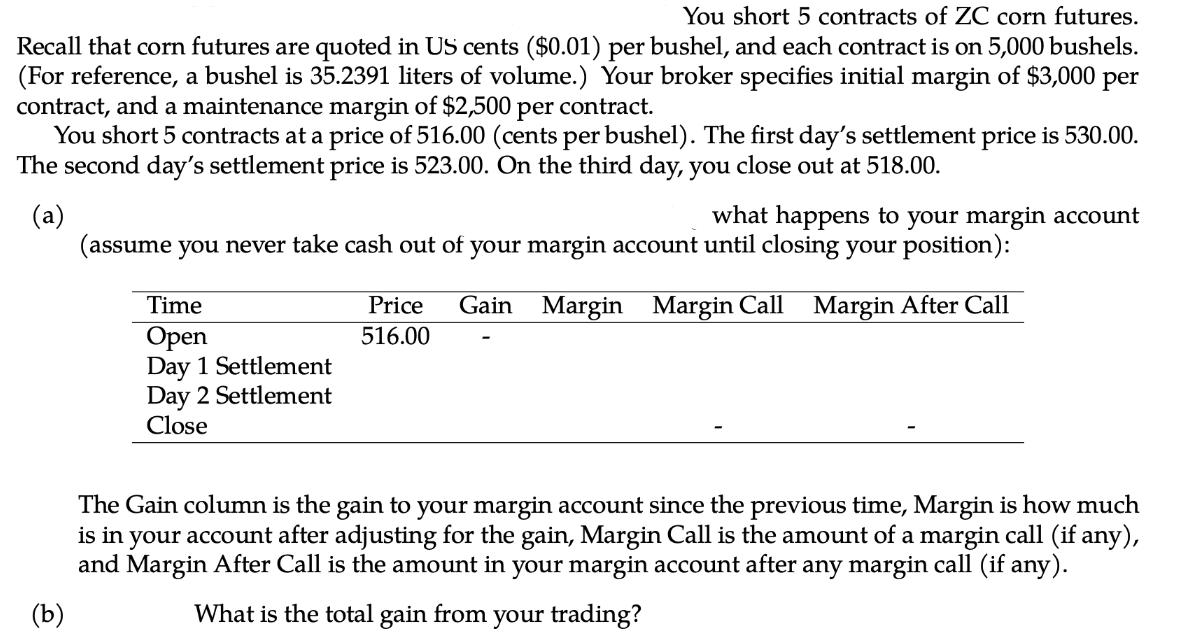

You short 5 contracts of ZC corn futures. Recall that corn futures are quoted in US cents ($0.01) per bushel, and each contract is on 5,000 bushels. (For reference, a bushel is 35.2391 liters of volume.) Your broker specifies initial margin of $3,000 per contract, and a maintenance margin of $2,500 per contract. You short 5 contracts at a price of 516.00 (cents per bushel). The first day's settlement price is 530.00. The second day's settlement price is 523.00. On the third day, you close out at 518.00. (a) what happens to your margin account (assume you never take cash out of your margin account until closing your position): Time Open Day 1 Settlement Day 2 Settlement Close Price 516.00 Gain Margin Margin Call Margin After Call (b) The Gain column is the gain to your margin account since the previous time, Margin is how much is in your account after adjusting for the gain, Margin Call is the amount of a margin call (if any), and Margin After Call is the amount in your margin account after any margin call (if any). What is the total gain from your trading?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Margin Account Calculation TimePriceGainMarginMargin CallMargin After Call Open5160015000 5 contr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started