You should answer all questions with solution(formula)

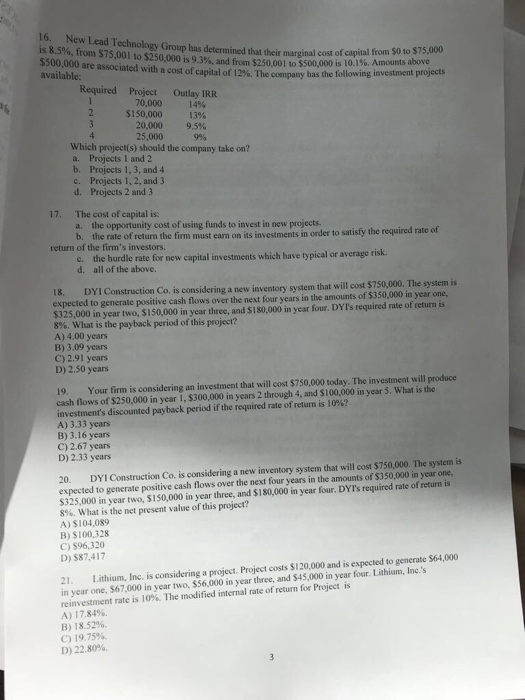

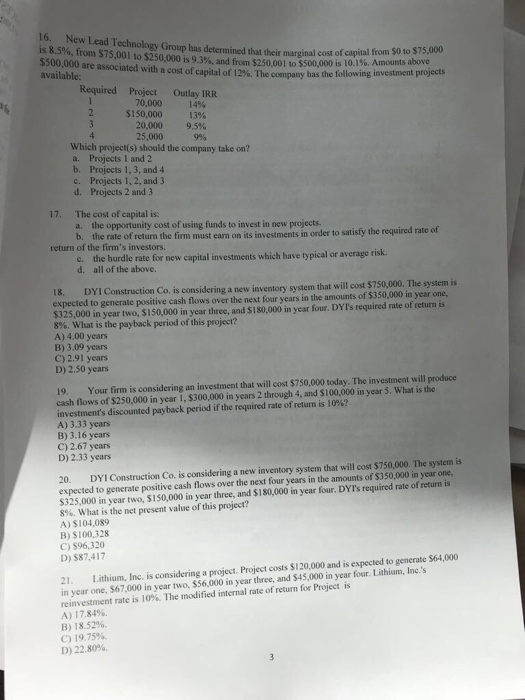

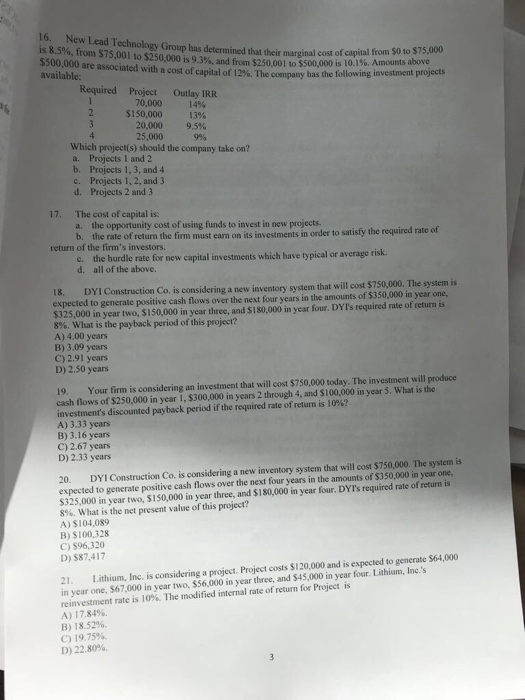

16. New Lead Technology Group has determined that their marginal cost of capital from is 8.5%, from S75,001 1 $250,000 is 93% and f $250,001 t S50 ,000 500,000 are associated with a cost of capital of 12%. The company has the following available: is 10.1%. Amounts above investment projects Required Project Outlay IRR 70,000 14% 13% 9,5% 9% $150,000 20,000 25,000 Which project(s) should the company take on? a. Projects 1 and 2 b. Projects 1,3, and4 c. Projects 1, 2, and 3 d. Projects 2 and 3 17. The cost of capital is: a. the opportunity cost of using funds to invest in new projects. b. the rate of return the firm must earn on its investments in order to satisfy the required rate of return of the firm's investors. c. the hurdle rate for new capital investments which have typical or average risk d. all of the above. onstruction Co. is considering a new inventory system that will cost $750,000. The system is ears in the amounts of $350,000 in year one, expected to generate positive cash flows over the next four y $325,000 in year two, $150,000 in year three, and $180,000 in year four. DYl's required rate of return is 8%, what is the payback period of this project? A) 4.00 years B) 3.09 years C)2.91 yeans D) 2.50 yeans 19. Your firm is considering an investment that will cost $750,000 today. The investment will produce cash flows of $250,000 in year 1, $300,000 in years 2 through 4, and $100,000 in year 5. What is the investment's discounted payback period if the required rate of return is 10%? A) 3.33 years B) 3.16 years C) 2.67 years D) 2.33 yeans 20. DYI Construction Co. is considering a new inventory system that will cost $750,000. The system is expected to generate positive cash flows over the next four years in the amounts of $350,000 in year one, $325,000 in year two, $150,000 in year three, and S180,000 in year four. DYI's required rate of return is 8%, what is the net present value of this project? A) $104,089 B) S100,328 C) $96,320 D) $87,417 21. Lithium, Inc. is considering a project. Project costs $120,000 and is expected to generate $64,000 in year one, 567.000 in year two, $$6,000 in year three, and SA5,000 in year four. Lithium, Inc.'s reinvestment rate is 10%. The modified internal rate of return for Project is A) 17.84%. B) 18.52%. C) 19.75%, D) 22.80%