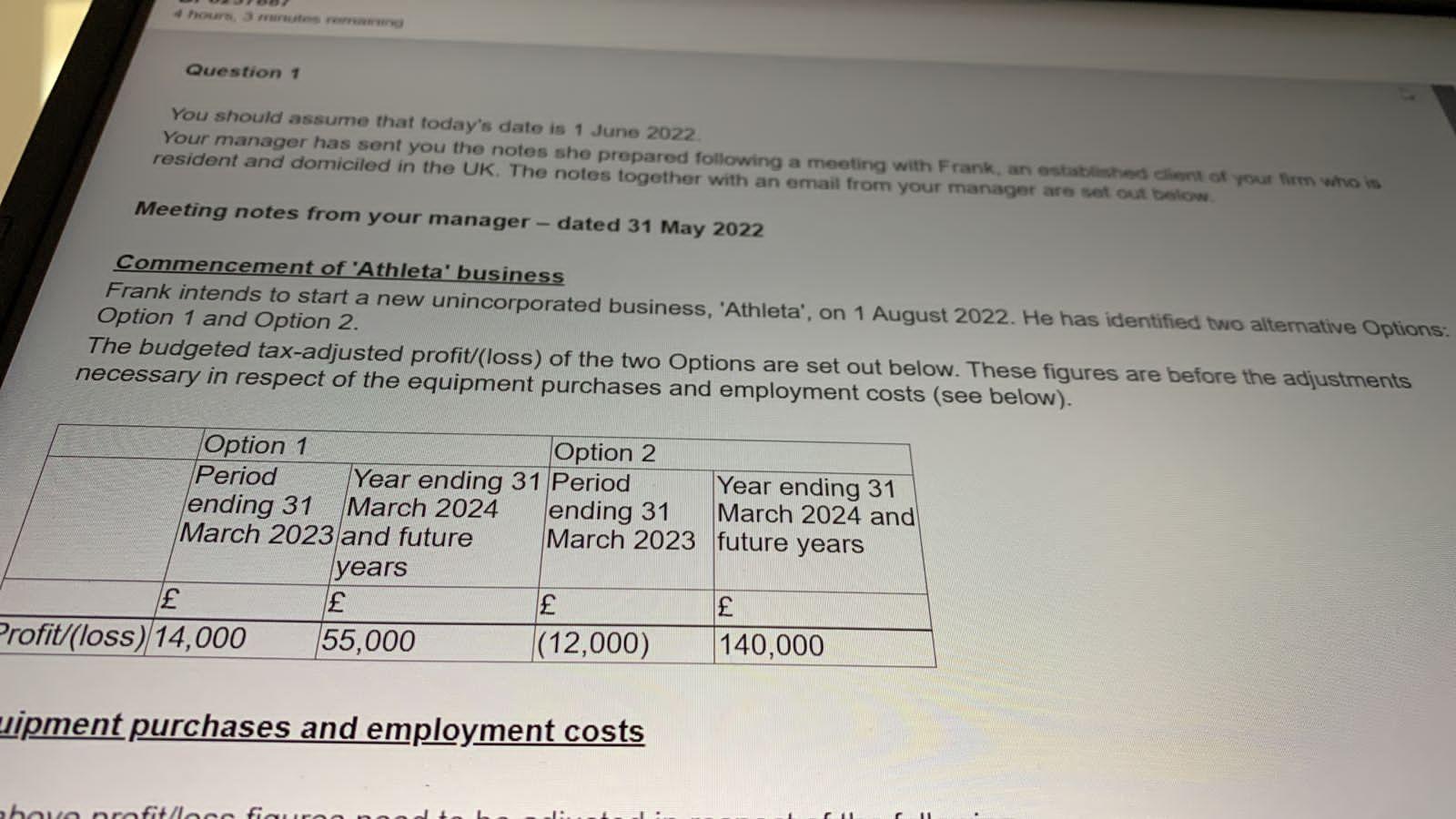

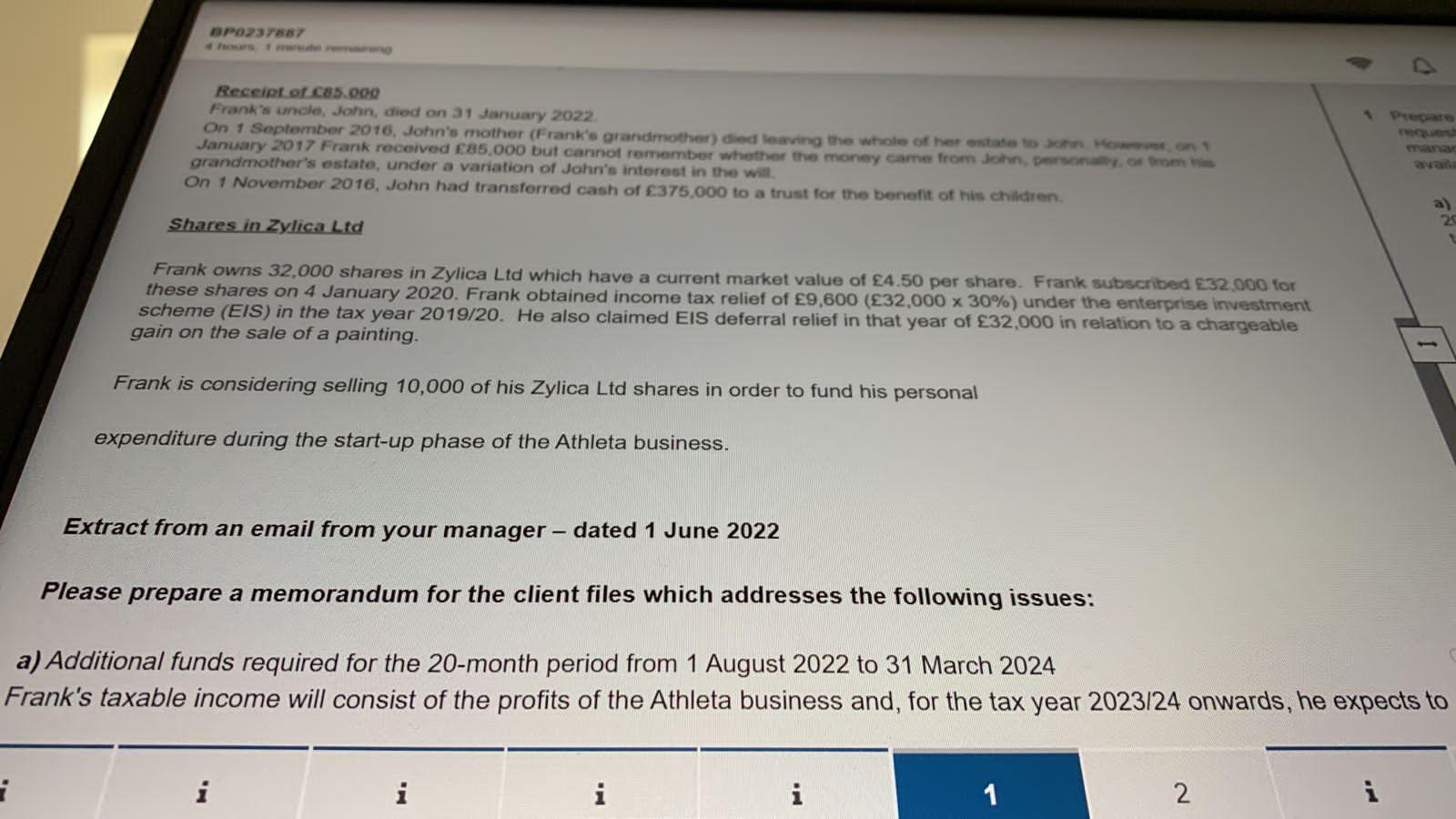

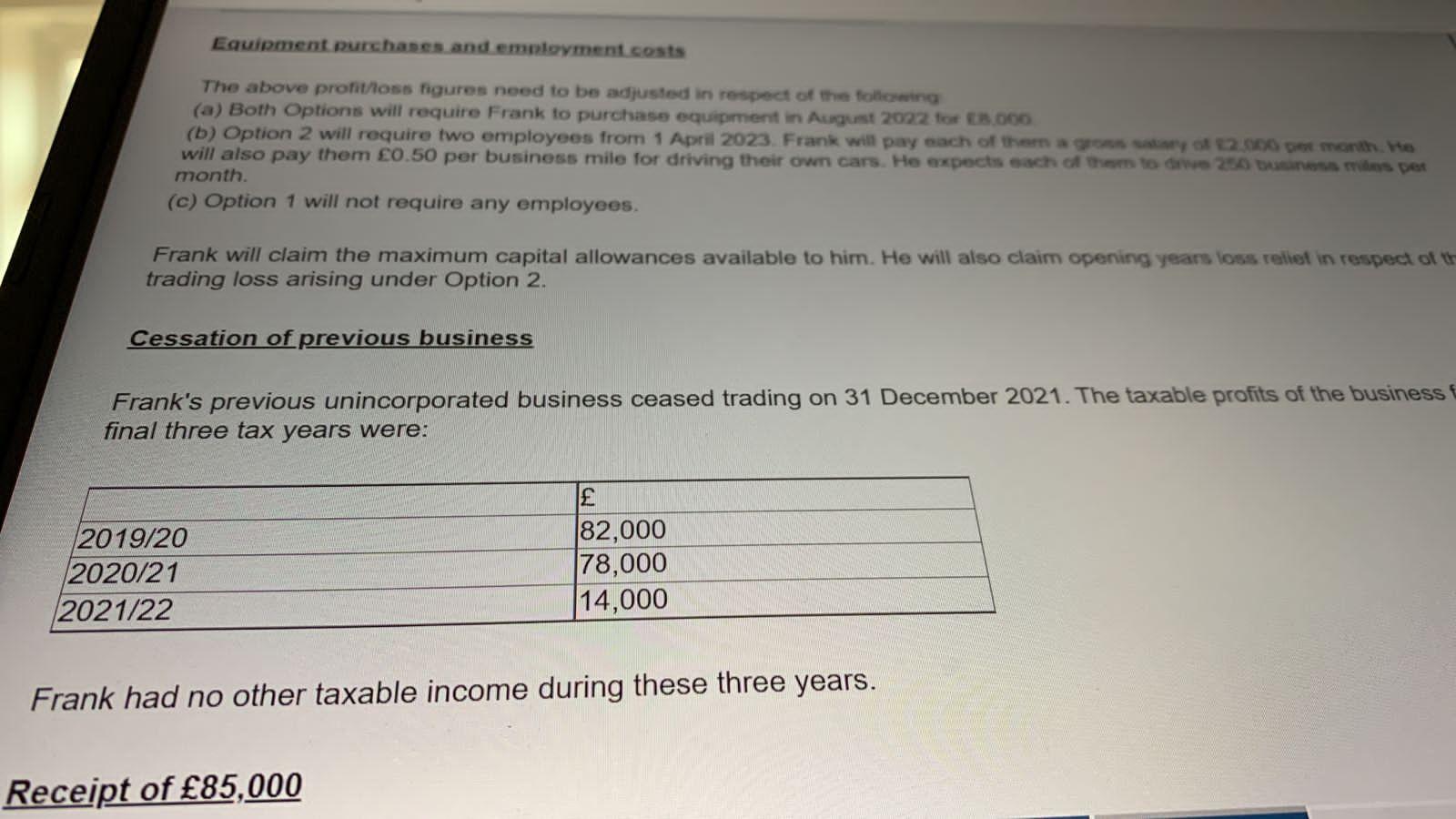

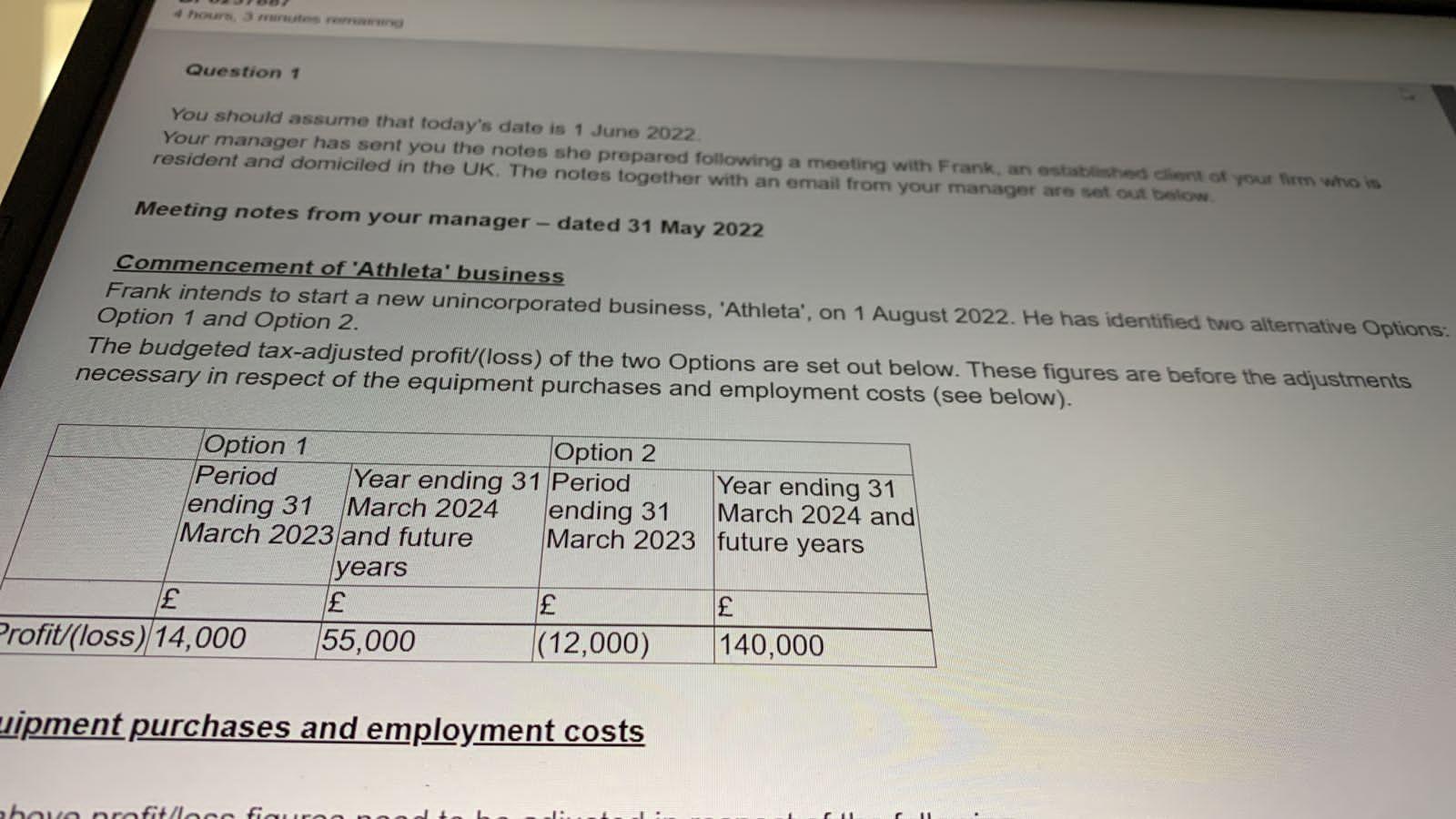

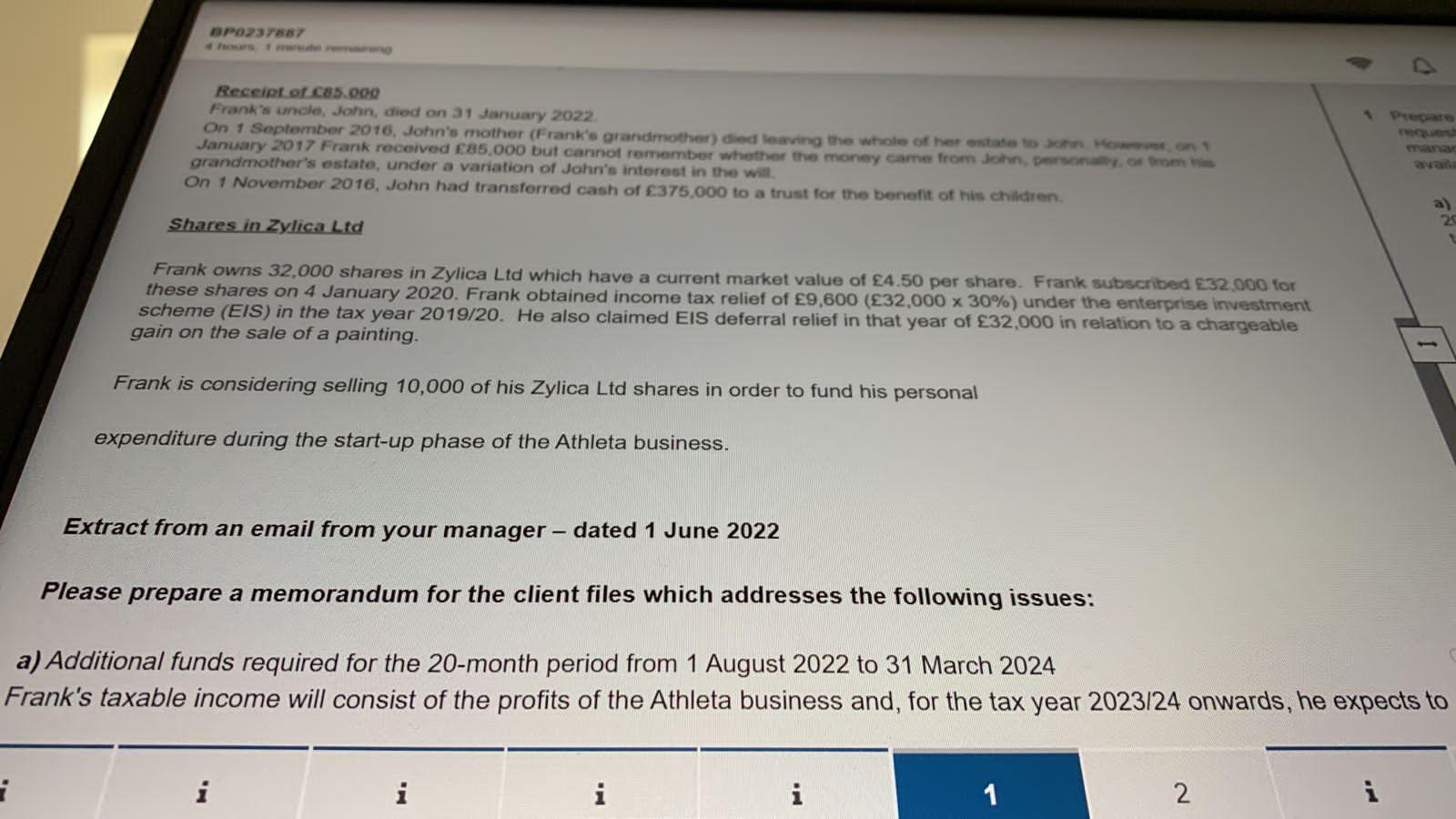

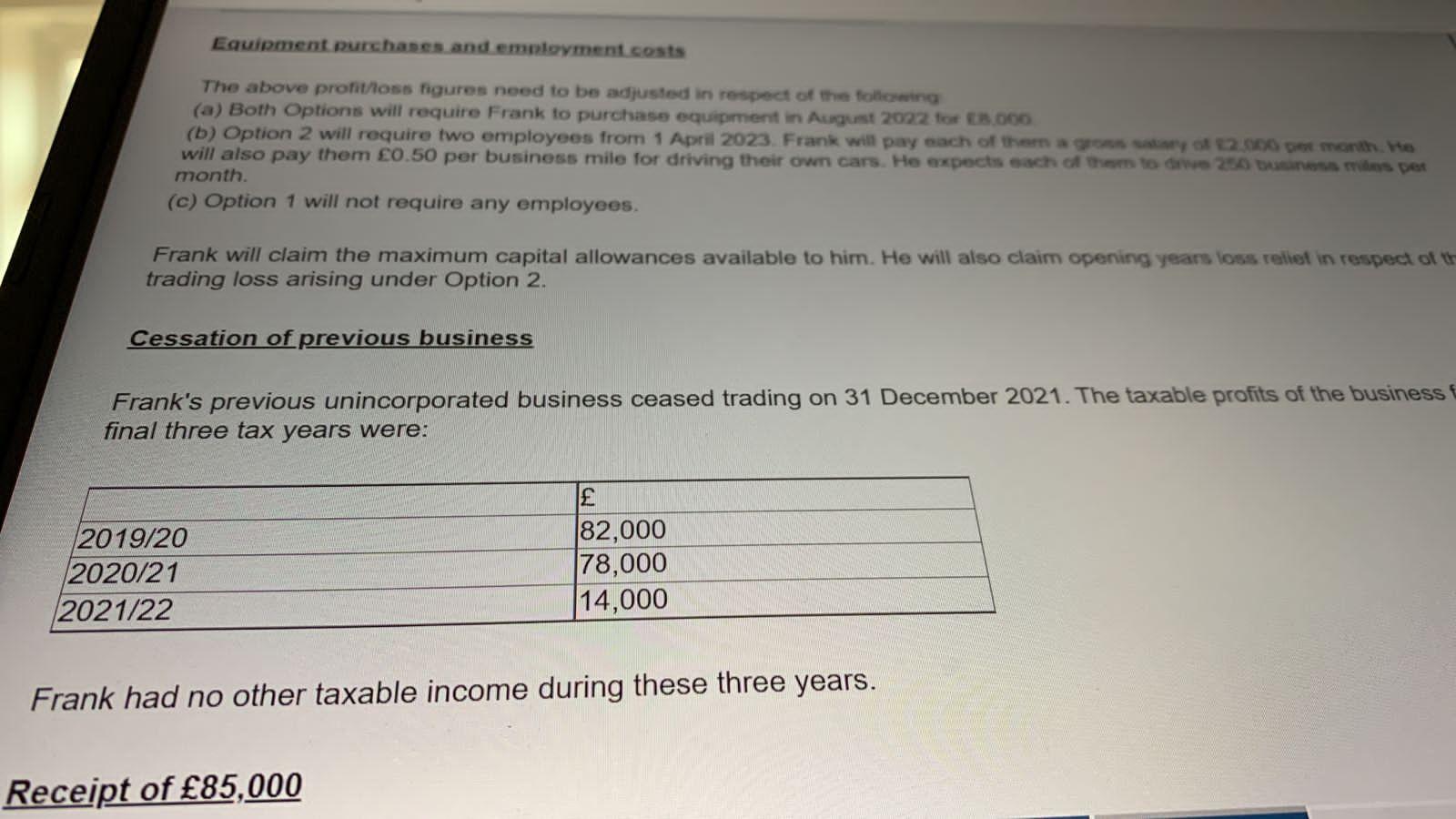

You should assume that today's date is 1 June 2022. Your manager has sent you the notes she prepared following a meeting with Frank, an estatbithed elivent of your firm who is resident and domiciled in the UK. The notes together with an email from your manager are set out below Meeting notes from your manager - dated 31 May 2022 Commencement of 'Athleta' business Frank intends to start a new unincorporated business, 'Athleta', on 1 August 2022. He has identified two altemative Options Option 1 and Option 2. The budgeted tax-adjusted profit/(loss) of the two Options are set out below. These figures are before the adjustments necessary in respect of the equipment purchases and employment costs (see below). Iipment purchases and employment costs Receiot of ces.ooo Frank's uncle, John, diod on 31 tanuary 2022 On 1. September 2016, John's mother (Frank's grandmother) died leaving the whiche of her estate to soren iowasm, on 1 grandmother's estate, 2017 Franked C85,000 but cannot remember whether the money came from Jehin, personialis. of trom tis On 1 November 2016, under a variation of Johris interest in the with. Shares in zylica Ltd Frank owns 32,000 shares in Zylica Ltd which have a current market value of 4.50 per share. Frank subscribed 32,000 tor these shares on 4 January 2020 . Frank obtained income tax relief of 9,600(32,00030%) under the enterprise investment scheme (EIS) in the tax year 2019/20. He also claimed EIS deferral relief in that year of 32,000 in relation to a chargeable gain on the sale of a painting. Frank is considering selling 10,000 of his Zylica Ltd shares in order to fund his personal expenditure during the start-up phase of the Athleta business. Extract from an email from your manager - dated 1 June 2022 lease prepare a memorandum for the client files which addresses the following issues: Idditional funds required for the 20-month period from 1 August 2022 to 31 March 2024 K's taxable income will consist of the profits of the Athleta business and, for the tax year 2023/24 onwards, he exp Eauipment purchases and empleyment costs The above profithoss figures need to be acjusted in respect of the follexing (a) Both Options will require Frank to purchase equipment in Augumt 202z tor fit ofon will also (c) Option 1 will not require any employees. Frank will claim the maximum capital allowances available to him. He will also claim opening yeans loss reliet in respect of v trading loss arising under Option 2. Cessation of previous business Frank's previous unincorporated business ceased trading on 31 December 2021. The taxable profits of the business' final three tax years were: Frank had no other taxable income during these three years. Receipt of 85,000 a) Additional funds required for the 20-month period from 1 August 2022 to 31 March 202 A (20 warks) b) Receipt of 85,000 ( 5 marks) c) Sale of shares in Zylica Ltd (6 marks) Professional marks will be awarded for the approach taken to problem solving, the clarity of the explanations a effectiveness with which the information is communicated, and the overall presentation and style of the memo ou should assume that today's date is 1 June 2022