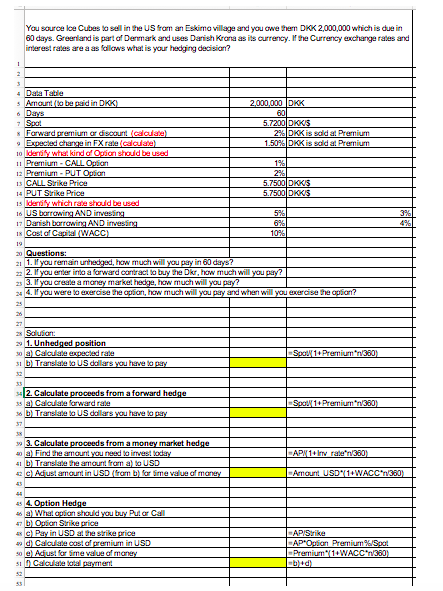

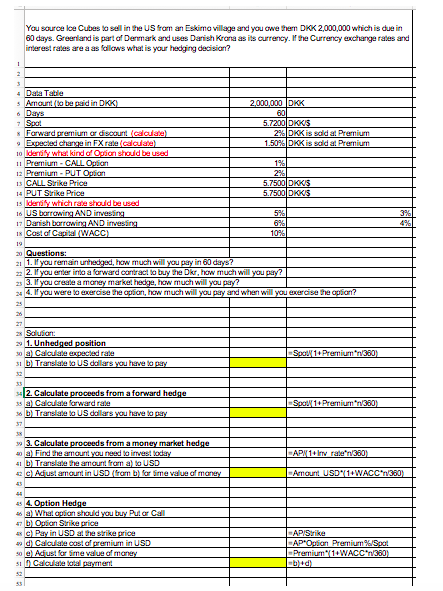

You source Ice Cubes to sell in the US from an Eskimo village and you owe them DKK 2,000,000 which is due in 60 days. Greenland is part of Denmark and use Danish Krona as is currency. I the Currency exchange rates and interest rates are a aflows what is your hedging decision? Data Tate Amourdin DC 2.000.000 DKK 1.7200 DOS 2 DKK 1.50DOK a Dumi dan Premium Forward premium or discount calculate Expected change in FX rate calculate) 10 derby w kind d oon should be use 1. Premium - CALL Option Premium PUT Outon 1 CALL Syike Price 1 PUT Srike Price is der wicht should be used 16 US Barrowing AND investing Darish borrowing AND investing I Casal Capital (WACC) 5.7500 DKK5 5.7500 DKK 1091 Questions: 1 1. you remain u dod, how much will you pay in 60 days 2. you are in a forward contact to buy Pre Okr, how much will you pay? 3. If you are a maney market hedge, how much will you pay? 4. If you were r e pon, how much will you pay and when will you exercise the Httttttttttt H+++++++++++ Salutan 2 1. Unhedged position alcan ced rade 3D Trans US dollars you Sool 1 Premium /380) to pay 2. Calculate proceeds from a forward hedge sal Catarwadrate Translate to US dollars you have to pay Spot 1. Premium 380) 3. Calculate proceeds from a money market hedge Find Our You need t o AD1.In an 380) Transm ettromato USD c) Adjust amount in USD (from by forme value of money Amour USO 11WACC 2001 4. Option Hedge sa W ion should you buy Porca Orion Sigrice Payin k erice Calcul costo premium in USD el Adjust for me valued money Calament You source Ice Cubes to sell in the US from an Eskimo village and you owe them DKK 2,000,000 which is due in 60 days. Greenland is part of Denmark and use Danish Krona as is currency. I the Currency exchange rates and interest rates are a aflows what is your hedging decision? Data Tate Amourdin DC 2.000.000 DKK 1.7200 DOS 2 DKK 1.50DOK a Dumi dan Premium Forward premium or discount calculate Expected change in FX rate calculate) 10 derby w kind d oon should be use 1. Premium - CALL Option Premium PUT Outon 1 CALL Syike Price 1 PUT Srike Price is der wicht should be used 16 US Barrowing AND investing Darish borrowing AND investing I Casal Capital (WACC) 5.7500 DKK5 5.7500 DKK 1091 Questions: 1 1. you remain u dod, how much will you pay in 60 days 2. you are in a forward contact to buy Pre Okr, how much will you pay? 3. If you are a maney market hedge, how much will you pay? 4. If you were r e pon, how much will you pay and when will you exercise the Httttttttttt H+++++++++++ Salutan 2 1. Unhedged position alcan ced rade 3D Trans US dollars you Sool 1 Premium /380) to pay 2. Calculate proceeds from a forward hedge sal Catarwadrate Translate to US dollars you have to pay Spot 1. Premium 380) 3. Calculate proceeds from a money market hedge Find Our You need t o AD1.In an 380) Transm ettromato USD c) Adjust amount in USD (from by forme value of money Amour USO 11WACC 2001 4. Option Hedge sa W ion should you buy Porca Orion Sigrice Payin k erice Calcul costo premium in USD el Adjust for me valued money Calament