Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You suspect that Next uses too low depreciation rates. Therefore, you want see what is the effect of increasing the annual depreciation expense for both

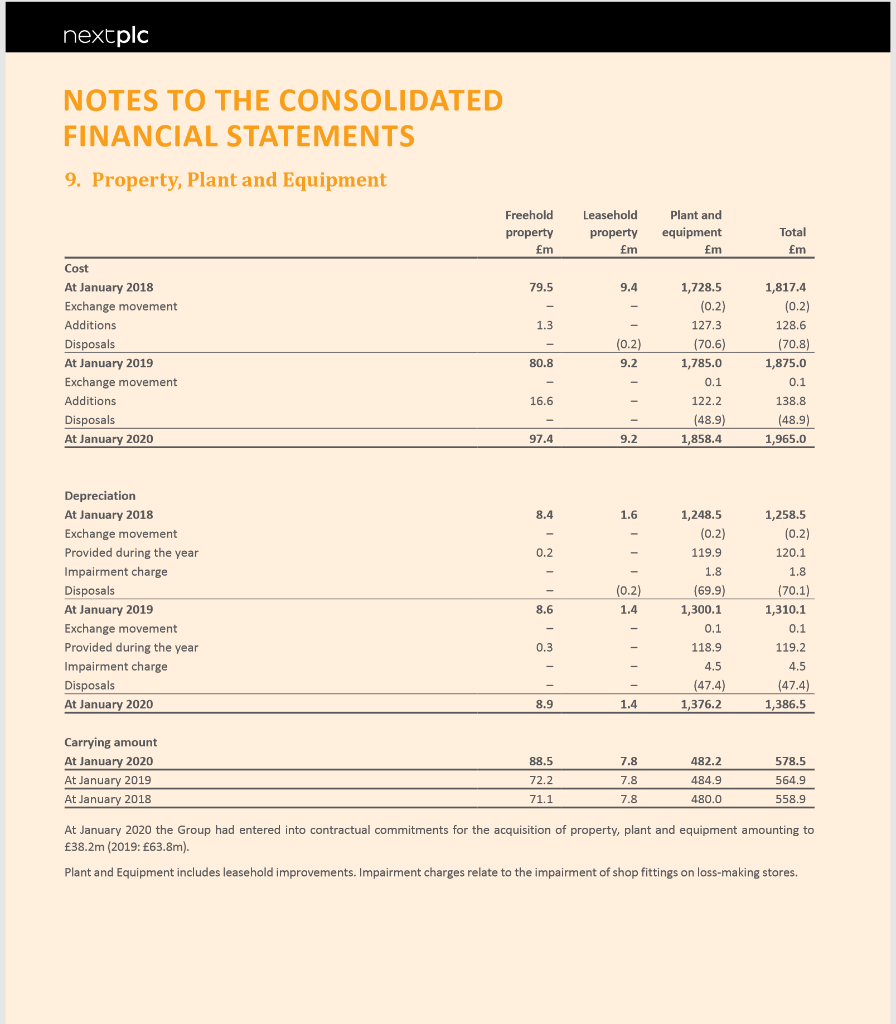

You suspect that Next uses too low depreciation rates. Therefore, you want see what is the effect of increasing the annual depreciation expense for both 2019 and 2020 by 10%. Specifically, recalculate the following after making the necessary adjustment (ignore tax implications):

You suspect that Next uses too low depreciation rates. Therefore, you want see what is the effect of increasing the annual depreciation expense for both 2019 and 2020 by 10%. Specifically, recalculate the following after making the necessary adjustment (ignore tax implications):

a. Profit for the year ending 1/2020, assuming that as a result of the higher depreciation expense there is no need to record impairment loss in either year;

nextplc NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 9. Property, Plant and Equipment Freehold property m Leasehold property m Plant and equipment m Total m Em 79.5 9.4 1.3 Cost At January 2018 Exchange movement Additions Disposals At January 2019 Exchange movement Additions Disposals At January 2020 1,728.5 (0.2) 127.3 (70.6) 1,785.0 (0.2) 9.2 80.8 1,817.4 (0.2) 128.6 (70.8) 1,875.0 0.1 138.8 (48.9) 1,965.0 0.1 16.6 122.2 (48.9) 1,858.4 97.4 9.2 8.4 1.6 1,248.5 (0.2) 119.9 0.2 1.8 Depreciation At January 2018 Exchange movement Provided during the year Impairment charge Disposals At January 2019 Exchange movement Provided during the year Impairment charge Disposals At January 2020 (0.2) 1.4 8.6 (69.9) 1,300.1 0.1 1,258.5 (0.2) 120.1 1.8 (70.1) 1,310.1 0.1 119.2 4.5 (47.4) 1,386.5 0.3 118.9 4.5 (47.4) 1,376.2 8.9 1.4 88.5 7.8 482.2 578.5 Carrying amount At January 2020 At January 2019 At January 2018 72.2 7.8 484.9 564.9 558.9 71.1 7.8 480.0 At January 2020 the Group had entered into contractual commitments for the acquisition of property, plant and equipment amounting to 38.2m (2019: 63.8m). Plant and Equipment includes leasehold improvements. Impairment charges relate to the impairment of shop fittings on loss-making stores. nextplc NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 9. Property, Plant and Equipment Freehold property m Leasehold property m Plant and equipment m Total m Em 79.5 9.4 1.3 Cost At January 2018 Exchange movement Additions Disposals At January 2019 Exchange movement Additions Disposals At January 2020 1,728.5 (0.2) 127.3 (70.6) 1,785.0 (0.2) 9.2 80.8 1,817.4 (0.2) 128.6 (70.8) 1,875.0 0.1 138.8 (48.9) 1,965.0 0.1 16.6 122.2 (48.9) 1,858.4 97.4 9.2 8.4 1.6 1,248.5 (0.2) 119.9 0.2 1.8 Depreciation At January 2018 Exchange movement Provided during the year Impairment charge Disposals At January 2019 Exchange movement Provided during the year Impairment charge Disposals At January 2020 (0.2) 1.4 8.6 (69.9) 1,300.1 0.1 1,258.5 (0.2) 120.1 1.8 (70.1) 1,310.1 0.1 119.2 4.5 (47.4) 1,386.5 0.3 118.9 4.5 (47.4) 1,376.2 8.9 1.4 88.5 7.8 482.2 578.5 Carrying amount At January 2020 At January 2019 At January 2018 72.2 7.8 484.9 564.9 558.9 71.1 7.8 480.0 At January 2020 the Group had entered into contractual commitments for the acquisition of property, plant and equipment amounting to 38.2m (2019: 63.8m). Plant and Equipment includes leasehold improvements. Impairment charges relate to the impairment of shop fittings on loss-making storesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started