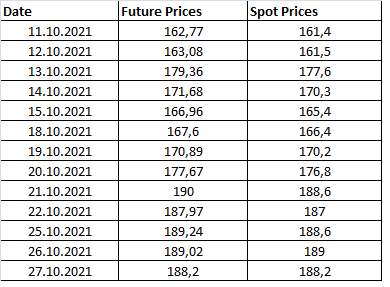

Question: You take long position for your contract. Contract Size = 100 By using the spot and futures prices of Oct. 11, 2021 for your asset,

You take long position for your contract.

Contract Size = 100

By using the spot and futures prices of Oct. 11, 2021 for your asset, if the continuously compounded interest rate is 10% (Use 360 days = 1 year)

1) Calculate the theoretical futures price.

2) State if an arbitrage opportunity exists. If yes, show the long position you would take on Oct. 11, 2021 and what would happen when the contract matures.

3) Calculate the arbitrage profit when you take long position in part (2).

4) Calculate the value of your contract to yourself on Oct. 25, 2021.

Date 11.10.2021 12.10.2021 13.10.2021 14.10.2021 15.10.2021 18.10.2021 19.10.2021 20.10.2021 Future Prices 162,77 163,08 179,36 171,68 166,96 167,6 170,89 177,67 190 187,97 189,24 189,02 188,2 Spot Prices 161,4 161,5 177,6 170,3 165,4 166,4 170,2 176,8 188,6 187 188,6 189 188,2 21.10.2021 22.10.2021 25.10.2021 26.10.2021 27.10.2021 Date 11.10.2021 12.10.2021 13.10.2021 14.10.2021 15.10.2021 18.10.2021 19.10.2021 20.10.2021 Future Prices 162,77 163,08 179,36 171,68 166,96 167,6 170,89 177,67 190 187,97 189,24 189,02 188,2 Spot Prices 161,4 161,5 177,6 170,3 165,4 166,4 170,2 176,8 188,6 187 188,6 189 188,2 21.10.2021 22.10.2021 25.10.2021 26.10.2021 27.10.2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts