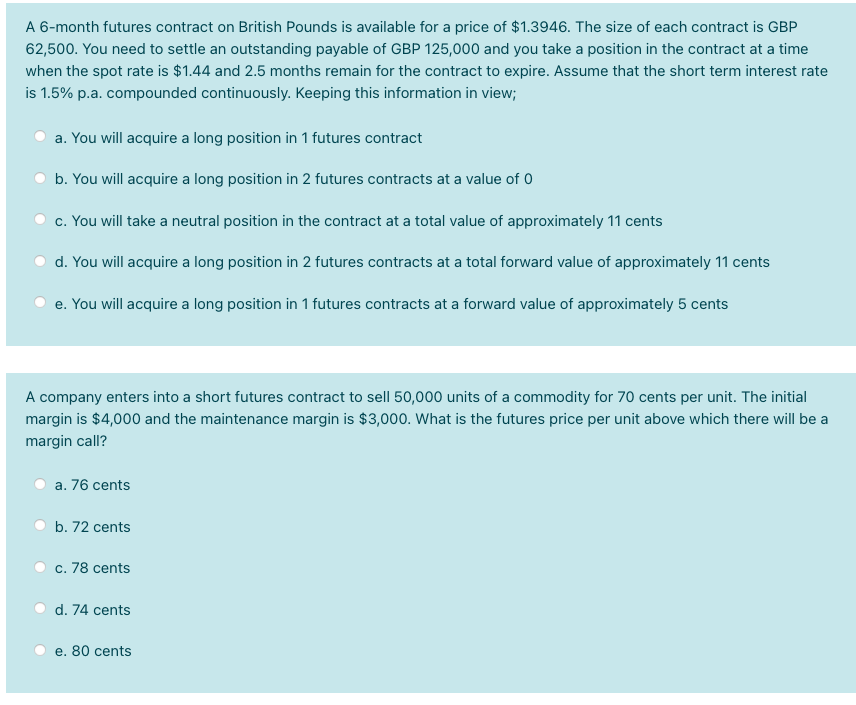

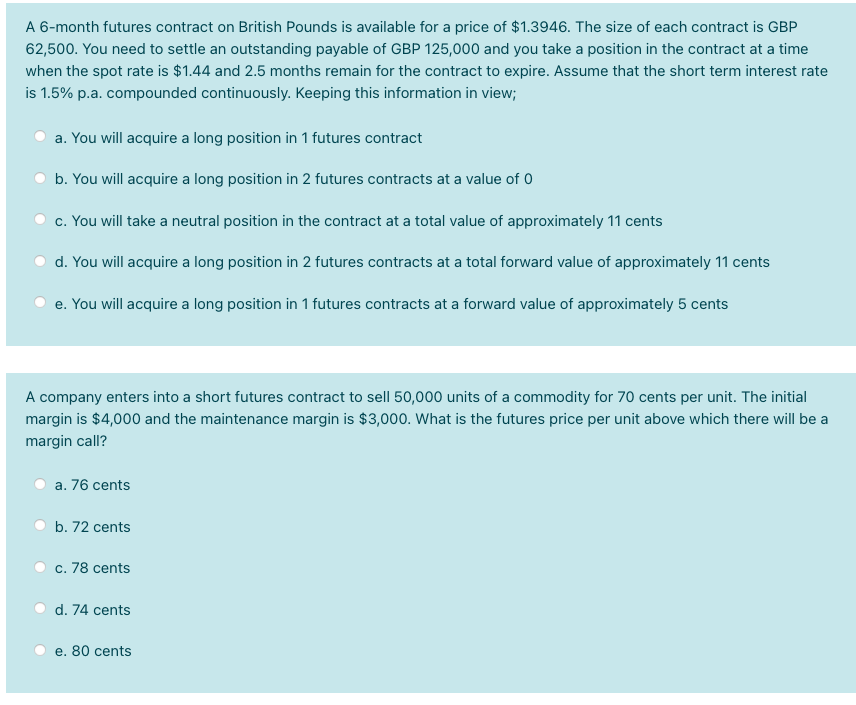

A 6-month futures contract on British Pounds is available for a price of $1.3946. The size of each contract is GBP 62,500. You need to settle an outstanding payable of GBP 125,000 and you take a position in the contract at a time when the spot rate is $1.44 and 2.5 months remain for the contract to expire. Assume that the short term interest rate is 1.5% p.a. compounded continuously. Keeping this information in view; a. You will acquire a long position in 1 futures contract b. You will acquire a long position in 2 futures contracts at a value of 0 c. You will take a neutral position in the contract at a total value of approximately 11 cents d. You will acquire a long position in 2 futures contracts at a total forward value of approximately 11 cents e. You will acquire a long position in 1 futures contracts at a forward value of approximately 5 cents A company enters into a short futures contract to sell 50,000 units of a commodity for 70 cents per unit. The initial margin is $4,000 and the maintenance margin is $3,000. What is the futures price per unit above which there will be a margin call? a. 76 cents b. 72 cents c. 78 cents d. 74 cents e. 80 cents A 6-month futures contract on British Pounds is available for a price of $1.3946. The size of each contract is GBP 62,500. You need to settle an outstanding payable of GBP 125,000 and you take a position in the contract at a time when the spot rate is $1.44 and 2.5 months remain for the contract to expire. Assume that the short term interest rate is 1.5% p.a. compounded continuously. Keeping this information in view; a. You will acquire a long position in 1 futures contract b. You will acquire a long position in 2 futures contracts at a value of 0 c. You will take a neutral position in the contract at a total value of approximately 11 cents d. You will acquire a long position in 2 futures contracts at a total forward value of approximately 11 cents e. You will acquire a long position in 1 futures contracts at a forward value of approximately 5 cents A company enters into a short futures contract to sell 50,000 units of a commodity for 70 cents per unit. The initial margin is $4,000 and the maintenance margin is $3,000. What is the futures price per unit above which there will be a margin call? a. 76 cents b. 72 cents c. 78 cents d. 74 cents e. 80 cents