Question

You think there is a market for washing out dirty trash cans for residential and business customers. The reason you think this is last year

You think there is a market for washing out dirty trash cans for residential and business customers. The reason you think this is last year you spent $20,000 on consulting fees to assess the viability of starting a business like this. With this report in hand, you now would like to determine the financial soundness of this investment opportunity. Using the information provided estimate the free cash flows for this investment opportunity. 1. The equipment necessary to begin cleaning trash cans on the scale you envision will require an initial investment of $560,000 2. You expect sales in the first year to be $750,000, then increase in year 2 to $900,000 before beginning to decline. 3. Operating costs, excluding depreciation, are forecast at $450,000 in the first year, then will decline as you become more efficient. 4. You estimate that this project will last 5 years until competition saturates the market 5. After year 5 you will end operations 6. The equipment you purchase to start operations will have a depreciable life of 7 years but at the end of the project, the equipment will have no value. 7. For the purposes of this analysis, you will use straight-line depreciation. 8. The company will use a mix of debt and equity to finance the project. Thus, additional interest expense will be $15,000 per year. 9. You estimate that net operating working capital requirements will be 12% of sales and those working capital requirements will end after year 5. 10. The federal-plus-state tax rate is estimated at 27%.

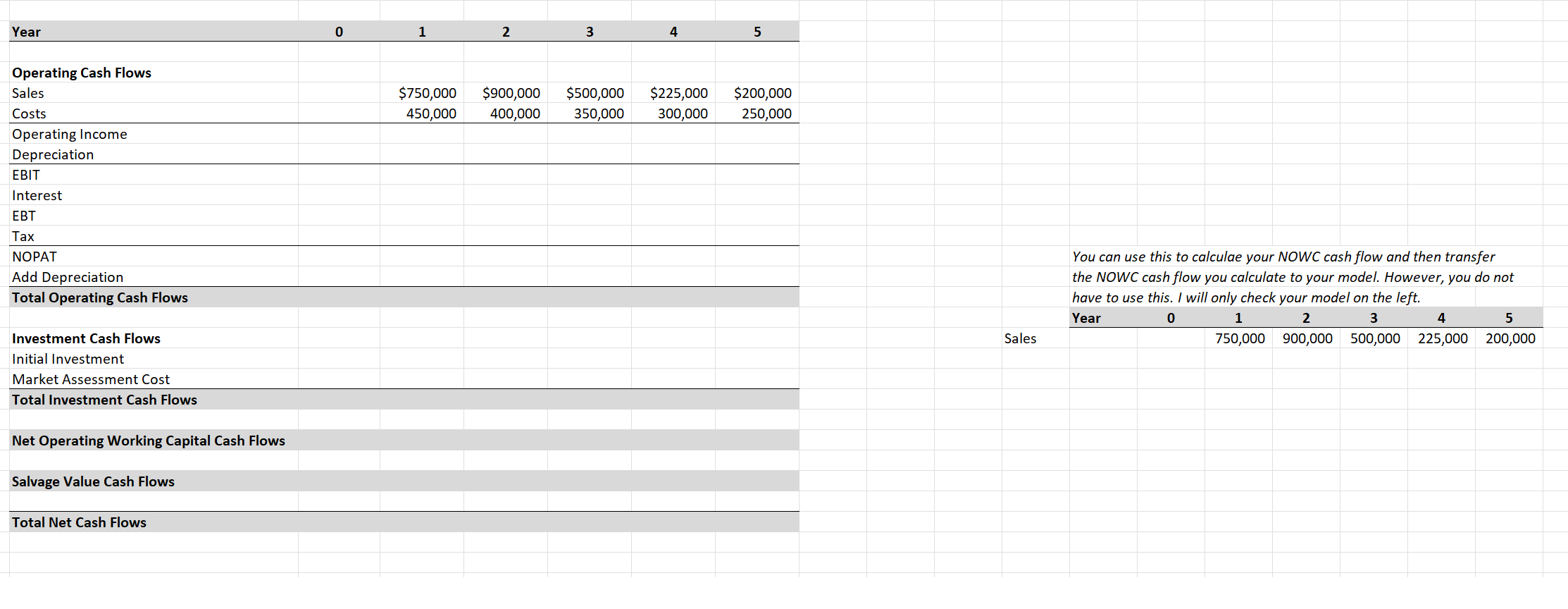

You have a friend who took Walker's class last year and you asked him to help you do this analysis. Your friend didn't pay enough attention in class and was unsure of how to handle several key parts of the analysis. Some of the things listed in what he prepared for you may apply while others may not. Complete his spreadsheet (see attached image) using the appropriate information and calculate the net free cash flows for your investment opportunity.  Followup Assuming a weighted average cost of capital of 20%, determine whether the company should accept or reject the proposed project. a.Justify your answer using the NPV, IRR and MIRR approaches Answers to part a here NPV = IRR = MIRR = b. One of the investment decision rules you calculated in part a may be problematic if there are multiple sign changes in the CF stream. State which rule may be a problem and explain the cause(s) of the problem.

Followup Assuming a weighted average cost of capital of 20%, determine whether the company should accept or reject the proposed project. a.Justify your answer using the NPV, IRR and MIRR approaches Answers to part a here NPV = IRR = MIRR = b. One of the investment decision rules you calculated in part a may be problematic if there are multiple sign changes in the CF stream. State which rule may be a problem and explain the cause(s) of the problem.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started