Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You took out a loan three years ago (February 2018) to purchase your first home. You made a down payment of $80,000 and borrowed

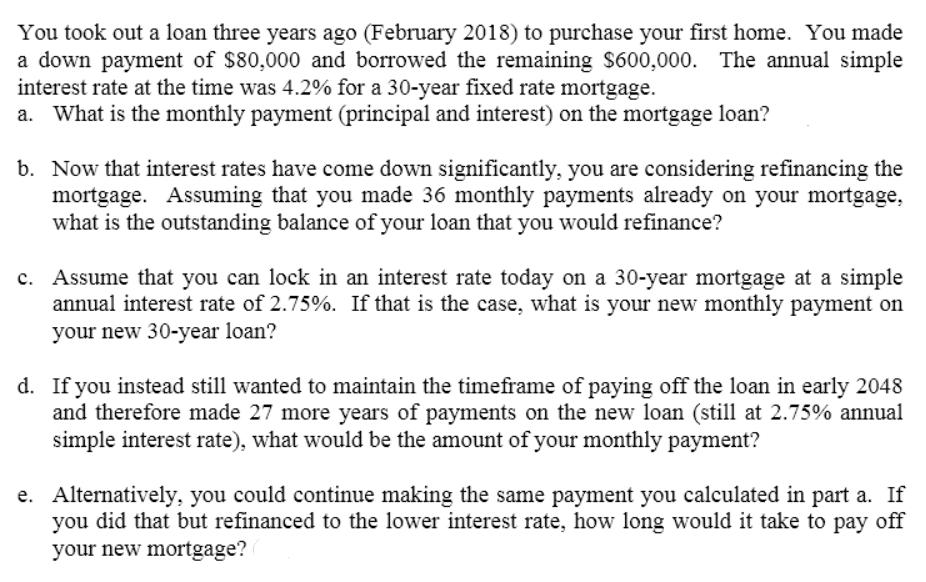

You took out a loan three years ago (February 2018) to purchase your first home. You made a down payment of $80,000 and borrowed the remaining $600,000. The annual simple interest rate at the time was 4.2% for a 30-year fixed rate mortgage. a. What is the monthly payment (principal and interest) on the mortgage loan? b. Now that interest rates have come down significantly, you are considering refinancing the mortgage. Assuming that you made 36 monthly payments already on your mortgage, what is the outstanding balance of your loan that you would refinance? c. Assume that you can lock in an interest rate today on a 30-year mortgage at a simple annual interest rate of 2.75%. If that is the case, what is your new monthly payment on your new 30-year loan? d. If you instead still wanted to maintain the timeframe of paying off the loan in early 2048 and therefore made 27 more years of payments on the new loan (still at 2.75% annual simple interest rate), what would be the amount of your monthly payment? e. Alternatively, you could continue making the same payment you calculated in part a. If you did that but refinanced to the lower interest rate, how long would it take to pay off your new mortgage?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started