Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You want to accumulate $500,000 in 10 years. So you are looking for investment opportunities to make it happen. There are two independent investment options,

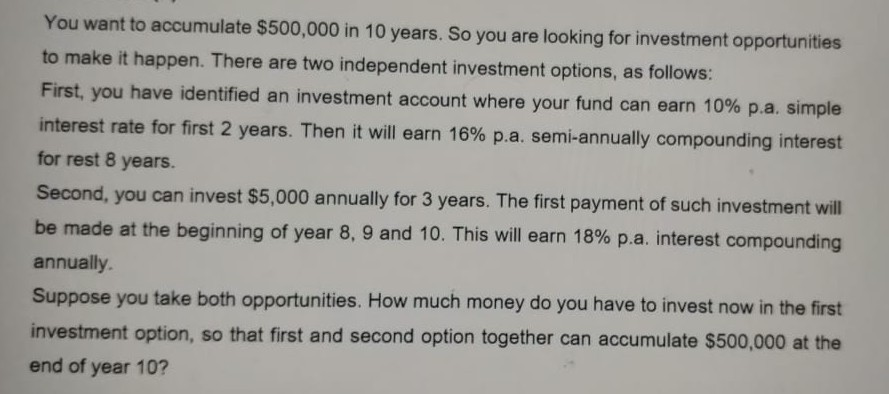

You want to accumulate $500,000 in 10 years. So you are looking for investment opportunities to make it happen. There are two independent investment options, as follows: First, you have identified an investment account where your fund can earn 10% p.a. simple interest rate for first 2 years. Then it will earn 16% p.a. semi-annually compounding interest for rest 8 years. Second, you can invest $5,000 annually for 3 years. The first payment of such investment will be made at the beginning of year 8, 9 and 10. This will earn 18% p.a. interest compounding annually. Suppose you take both opportunities. How much money do you have to invest now in the first investment option, so that first and second option together can accumulate $500,000 at the end of year 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started