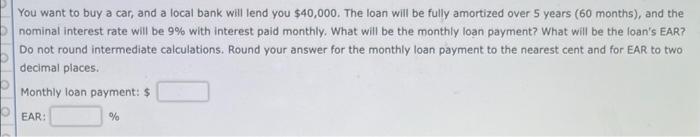

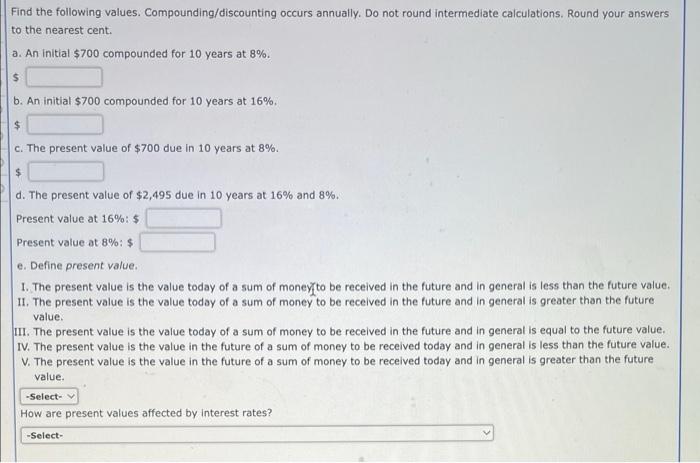

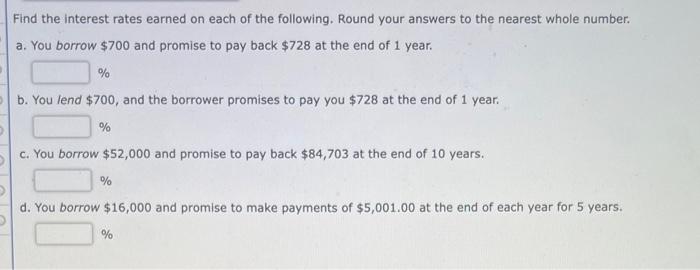

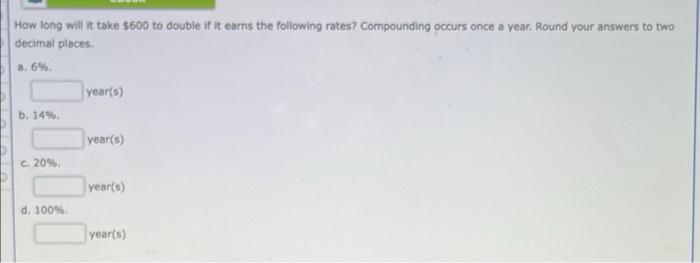

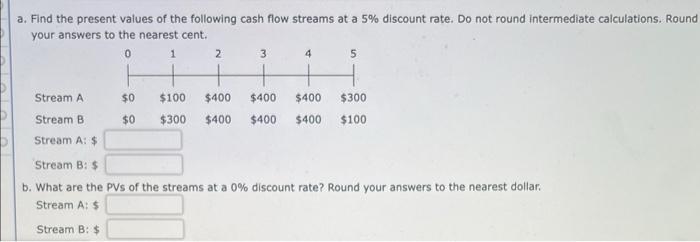

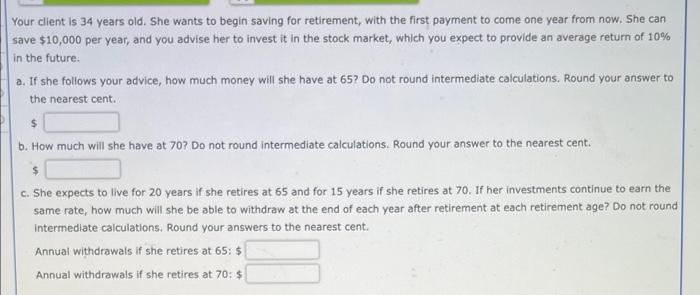

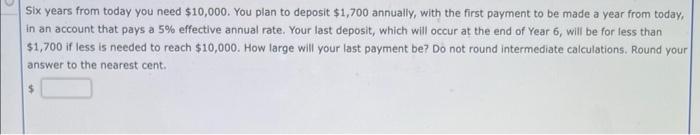

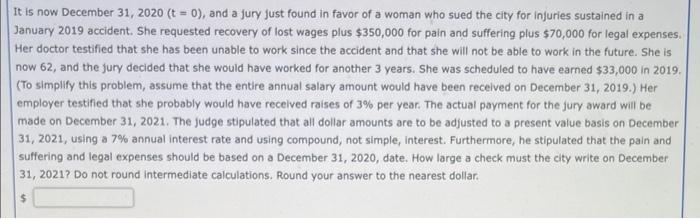

You want to buy a car, and a local bank will lend you $40,000. The loan will be fully amortized over 5 years ( 60 months), and the nominal interest rate will be 9% with interest paid monthly. What will be the monthly loan payment? What will be the loan's EAR? Do not round intermediate calculations. Round your answer for the monthly loan payment to the nearest cent and for EAR to two decimal places. Monthly loan payment: $ EAR: Find the following values. Compounding/discounting occurs annually. Do not round intermediate calculations. Round your answers to the nearest cent. a. An initial $700 compounded for 10 years at 8%. 5 b. An initial $700 compounded for 10 years at 16%. $ c. The present value of $700 due in 10 years at 8%. $ d. The present value of $2,495 due in 10 years at 16% and 8%. Present value at 16%:5 Present value at 8%:$ e. Define present value. 1. The present value is the value today of a sum of money to be received in the future and in general is less than the future value. II. The present value is the value today of a sum of money to be received in the future and in general is greater than the future value. III. The present value is the value today of a sum of money to be received in the future and in general is equal to the future value. IV. The present value is the value in the future of a sum of money to be received today and in general is less than the future value. V. The present value is the value in the future of a sum of money to be received today and in general is greater than the future value. How are present values affected by interest rates? Find the interest rates earned on each of the following. Round your answers to the nearest whole number. a. You borrow $700 and promise to pay back $728 at the end of 1 year. % b. You lend $700, and the borrower promises to pay you $728 at the end of 1 year. % c. You borrow $52,000 and promise to pay back $84,703 at the end of 10 years. % d. You borrow $16,000 and promise to make payments of $5,001,00 at the end of each year for 5 years. % How long will it take $600 to double if it earns the following rates? Compounding occurs once a year. Round your answers to two decimal places. a. 6%. year(s) b. 14%. year(s) c. 20%. year(s) d. 100%. year(s) a. Find the present values of the following cash flow streams at a 5% discount rate. Do not round intermediate calculations. Round your answers to the nearest cent. Stream Stream Stream A: $ Stream B: 5 b. What are the PVs of the streams at a 0% discount rate? Round your answers to the nearest dollar. Stream At $ Stream B: $ Your client is 34 years old. She wants to begin saving for retirement, with the first payment to come one year from now. She can save $10,000 per year, and you advise her to invest it in the stock market, which you expect to provide an average return of 10% in the future. a. If she follows your advice, how much money will she have at 65 ? Do not round intermediate calculations. Round your answer to the nearest cent. $ b. How much will she have at 70 ? Do not round intermediate calculations. Round your answer to the nearest cent. $ c. She expects to live for 20 years if she retires at 65 and for 15 years if she retires at 70 . If her investments continue to earn the same rate, how much will she be able to withdraw at the end of each year after retirement at each retirement age? Do not round intermediate calculations. Round your answers to the nearest cent. Annual withdrawals if she retires at 65:$ Annual withdrawals if she retires at 70:5 Six years from today you need $10,000. You plan to deposit $1,700 annually, with the first payment to be made a year from today, in an account that pays a 5% effective annual rate. Your last deposit, which will occur at the end of Year 6 , will be for less than $1,700 if less is needed to reach $10,000. How large will your last payment be? Do not round intermediate calculations. Round your answer to the nearest cent. 5 It is now December 31,2020(t=0), and a jury just found in favor of a woman who sued the city for injuries sustained in a January 2019 accident. She requested recovery of lost wages plus $350,000 for pain and suffering plus $70,000 for legal expenses, Her doctor testified that she has been unable to work since the accident and that she will not be able to work in the future. She is now 62, and the jury decided that she would have worked for another 3 years. She was scheduled to have earned $33,000 in 2019 . (To simplify this problem, assume that the entire annual salary amount would have been received on December 31,2019. .) Her employer testified that she probably would have received raises of 3% per year. The actual payment for the jury award will be made on December 31, 2021. The judge stipulated that all dollar amounts are to be adjusted to a present value basis on December 31, 2021, using a 7% annual interest rate and using compound, not simple, interest. Furthermore, he stipulated that the pain and suffering and legal expenses should be based on a December 31, 2020, date. How large a check must the city write on December 31, 2021? Do not round intermediate calculations. Round your answer to the nearest dollar