Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You want to buy a new computer for your firm. Whenever you buy the computer, you will achieve $35k in cost savings (in that time's

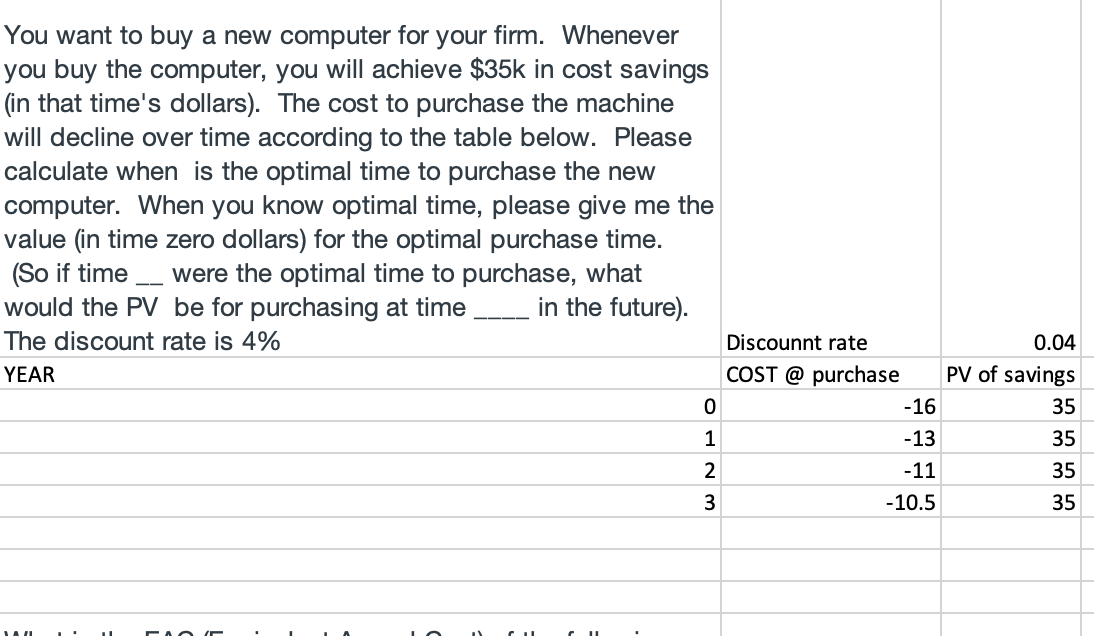

You want to buy a new computer for your firm. Whenever you buy the computer, you will achieve $35k in cost savings (in that time's dollars). The cost to purchase the machine will decline over time according to the table below. Please calculate when is the optimal time to purchase the new computer. When you know optimal time, please give me the value (in time zero dollars) for the optimal purchase time. (So if time __ were the optimal time to purchase, what would the PV be for purchasing at time in the future). The discount rate is 4% \begin{tabular}{l|r} \hline Discounnt rate & 0.04 \\ \hline \end{tabular} YEAR COST @ purchase PV of savings \begin{tabular}{r|r|r|} \hline 0 & -16 & 35 \\ \hline 1 & -13 & 35 \\ \hline 2 & -11 & 35 \\ \hline 3 & -10.5 & 35 \\ \hline \end{tabular} You want to buy a new computer for your firm. Whenever you buy the computer, you will achieve $35k in cost savings (in that time's dollars). The cost to purchase the machine will decline over time according to the table below. Please calculate when is the optimal time to purchase the new computer. When you know optimal time, please give me the value (in time zero dollars) for the optimal purchase time. (So if time __ were the optimal time to purchase, what would the PV be for purchasing at time in the future). The discount rate is 4% \begin{tabular}{l|r} \hline Discounnt rate & 0.04 \\ \hline \end{tabular} YEAR COST @ purchase PV of savings \begin{tabular}{r|r|r|} \hline 0 & -16 & 35 \\ \hline 1 & -13 & 35 \\ \hline 2 & -11 & 35 \\ \hline 3 & -10.5 & 35 \\ \hline \end{tabular}

You want to buy a new computer for your firm. Whenever you buy the computer, you will achieve $35k in cost savings (in that time's dollars). The cost to purchase the machine will decline over time according to the table below. Please calculate when is the optimal time to purchase the new computer. When you know optimal time, please give me the value (in time zero dollars) for the optimal purchase time. (So if time __ were the optimal time to purchase, what would the PV be for purchasing at time in the future). The discount rate is 4% \begin{tabular}{l|r} \hline Discounnt rate & 0.04 \\ \hline \end{tabular} YEAR COST @ purchase PV of savings \begin{tabular}{r|r|r|} \hline 0 & -16 & 35 \\ \hline 1 & -13 & 35 \\ \hline 2 & -11 & 35 \\ \hline 3 & -10.5 & 35 \\ \hline \end{tabular} You want to buy a new computer for your firm. Whenever you buy the computer, you will achieve $35k in cost savings (in that time's dollars). The cost to purchase the machine will decline over time according to the table below. Please calculate when is the optimal time to purchase the new computer. When you know optimal time, please give me the value (in time zero dollars) for the optimal purchase time. (So if time __ were the optimal time to purchase, what would the PV be for purchasing at time in the future). The discount rate is 4% \begin{tabular}{l|r} \hline Discounnt rate & 0.04 \\ \hline \end{tabular} YEAR COST @ purchase PV of savings \begin{tabular}{r|r|r|} \hline 0 & -16 & 35 \\ \hline 1 & -13 & 35 \\ \hline 2 & -11 & 35 \\ \hline 3 & -10.5 & 35 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started