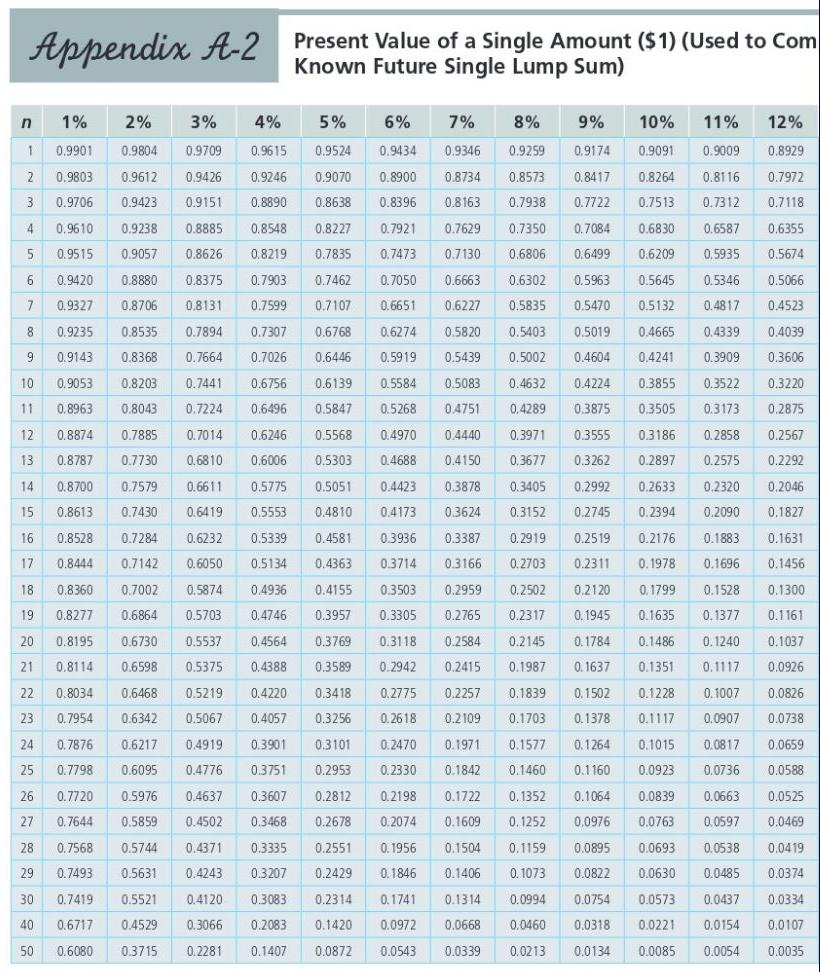

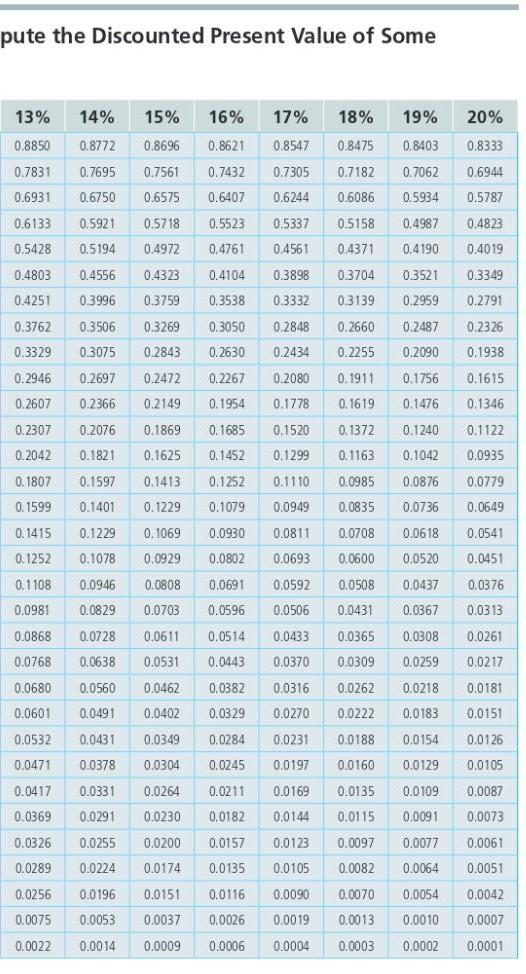

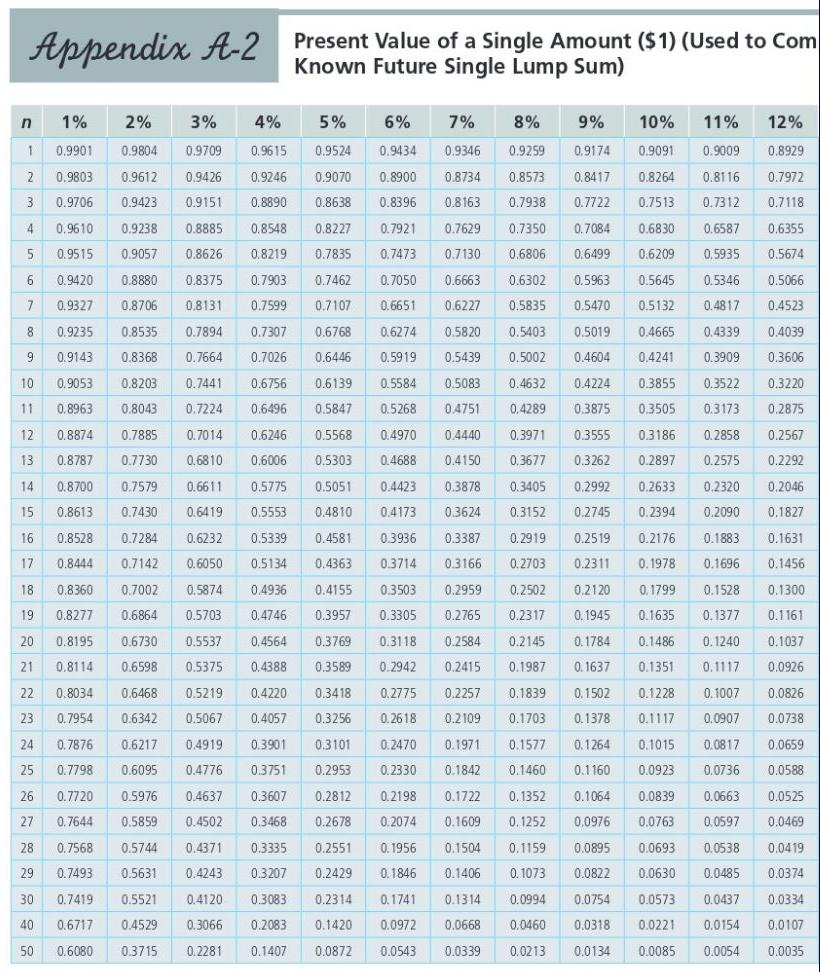

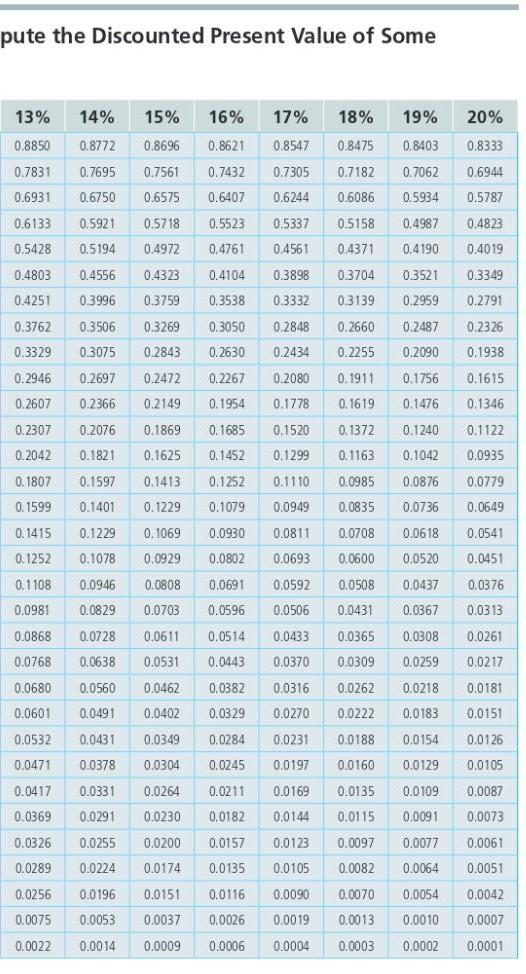

You want to create a college fund for a child who is now 5 years old. The fund should grow to $40,000 in 13 years. If an investment was made available to you that would yield 5% per year, how much must you invest in a lump sum NOW to realize the $40,000 when needed? (Hint: Use Appendix A.2)

Appendix A-2 Present Value of a Single Amount ($ 1) (Used to Com Known Future Single Lump Sum) n 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 1 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 0.9803 0.9612 0.9426 0.9246 0.8900 0.8734 0.8573 0.8417 0.8264 0.8116 0.7972 2 3 0.9070 0.8638 0.9706 0.9423 0.9151 0.8890 0.8396 0.8163 0.7938 0.7722 0.7513 0.7312 0.7118 4 0.9610 0.9238 0.8885 0.8548 0.8227 0.7921 0.7629 0.7350 0.7084 0.6830 0.6587 0.6355 5 0.9515 0.9057 0.8626 0.8219 0.7835 0.7473 0.7130 0.6806 0.6499 0.6209 0.5935 0.5674 6 0.9420 0.8880 0.8375 0.7903 0.6663 0.6302 0.5645 0.7050 0.6651 0.5346 0.4817 7 0.5066 0.4523 0.9327 0.7462 0.7107 0.6768 0.8706 0.8131 0.7599 0.5963 0.5470 0.5019 0.6227 0.5835 0.5132 8 0.9235 0.8535 0.7894 0.7307 0.6274 0.5820 0.4665 0.4339 0.4039 0.5403 0.5002 9 0.9143 0.8368 0.7664 0.7026 0.6446 0.5919 0.5439 0.4604 0.4241 0.3909 0.3606 0.9053 0.8203 0.7441 0.6756 0.6139 0.5584 0.5083 0.4632 0.4224 0.3855 0.3522 0.3220 10 11 0.8963 0.8043 0.7224 0.6496 0.5847 0.5268 0.4751 0.4289 0.3875 0.3505 0.3173 0.2875 12 0.8874 0.7885 0.7014 0.6246 0.5568 0.4970 0.4440 0.3971 0.3555 0.3186 0.2858 0.2567 13 0.8787 0.7730 0.6810 0.6006 0.5303 0.4688 0.4150 0.3677 0.3262 0.2897 0.2575 0.2292 14 0.8700 0.7579 0.6611 0.5775 0.5051 0.4423 0.3878 0.3405 0.2992 0.2633 0.2320 0.2046 15 0.8613 0.7430 0.6419 0.5553 0.4810 0.4173 0.3624 0.3152 0.2745 0.2394 0.2090 0.1827 0.8528 0.7284 0.6232 0.5339 0.4581 0.3936 0.3387 0.2919 0.2519 0.2176 0.1883 0.1631 16 17 0.8444 0.7142 0.6050 0.5134 0.4363 0.3714 0.3166 0.2703 0.2311 0.1978 0.1696 0.1456 18 0.8360 0.7002 0.5874 0.4936 0.4155 0.3503 0.2959 0.2502 0.2120 0.1799 0.1528 0.1300 19 0.8277 0.6864 0.5703 0.4746 0.3957 0.3305 0.2765 0.2317 0.1945 0.1635 0.1377 0.1161 20 0.8195 0.6730 0.5537 0.4564 0.3769 0.3118 0.2584 0.2145 0.1784 0.1486 0.1240 0.1037 21 0.8114 0.6598 0.5375 0.4388 0.3589 0.2942 0.2415 0.1987 0.1637 0.1351 0.1117 0.0926 22 0.8034 0.6468 0.5219 0.4220 0.3418 0.2775 0.2257 0.1502 0.1228 0.1007 0.0826 0.1839 0.1703 23 0.7954 0.6342 0.5067 0.4057 0.3256 0.2618 0.2109 0.1378 0.1117 0.0907 0.0738 24 0.7876 0.6217 0.4919 0.3901 0.3101 0.2470 0.1971 0.1577 0.1264 0.1015 0.0817 0.0659 25 0.7798 0.6095 0.4776 0.3751 0.2953 0.2330 0.1842 0.1460 0.1160 0.0923 0.0736 0.0588 26 0.7720 0.5976 0.4637 0.3607 0.2812 0.1722 0.1352 0.1064 0.0839 0.0663 0.0525 0.2198 0.2074 27 0.7644 0.5859 0.4502 0.3468 0.2678 0.1609 0.1252 0.0976 0.0763 0.0597 0.0469 28 0.7568 0.5744 0.4371 0.3335 0.2551 0.1956 0.1504 0.1159 0.0895 0.0693 0.0538 0.0419 29 0.7493 0.5631 0.4243 0.3207 0.2429 0.1846 0.1406 0.1073 0.0822 0.0630 0.0485 0.0374 30 0.7419 0.5521 0.4120 0.3083 0.2314 0.1741 0.1314 0.0994 0.0754 0.0573 0.0437 0.0334 40 0.6717 0.4529 0.3066 0.2083 0.1420 0.0972 0.0668 0.0460 0.0318 0.0221 0.0154 0.0107 50 0.6080 0.3715 0.2281 0.1407 0.0872 0.0543 0.0339 0.0213 0.0134 0.0085 0.0054 0.0035 pute the Discounted Present Value of Some 13% 14% 15% 17% 18% 20% 16% 0.8621 0.8850 0.8772 0.8696 0.8547 0.8475 19% % 0.8403 0.7062 0.8333 0.7831 0.7695 0.7561 0.7432 0.7305 0.7182 0.6944 0.6931 0.6750 0.6575 0.6407 0.6244 0.6086 0.5934 0.5787 0.6133 0.5921 0.5718 0.5523 0.5337 0.5158 0.4987 0.4823 0.5428 0.5194 0.4972 0.4761 0.4561 0.4371 0.4190 0.4019 0.4803 0.4556 0.4323 0.4104 0.3898 0.3704 0.3521 0.3349 0.4251 0.3996 0.3759 0.3538 0.3332 0.3139 0.2959 0.2791 0.3762 0.3506 0.3269 0.3050 0.2848 0.2660 0.2487 0.2326 0.3329 0.3075 0.2843 0.2630 0.2434 0.2255 0.2090 0.1938 0.2946 0.2697 0.2472 0.2267 0.2080 0.1911 0.1756 0.1615 0.2607 0.2366 0.2149 0.1954 0.1778 0.1619 0.1476 0.1346 0.2307 0.2076 0.1869 0.1685 0.1372 0.1240 0.1122 0.1520 0.1299 0.2042 0.1821 0.1625 0.1452 0.1163 0.1042 0.0935 0.1807 0.1597 0.1413 0.1252 0.1110 0.0985 0.0779 0.0876 0.0736 0.1599 0.1401 0.1229 0.1079 0.0949 0.0835 0.0649 0.1229 0.1069 0.0708 0.0618 0.0541 0.1415 0.1252 0.0930 0.0802 0.0811 0.0693 0.1078 0.0929 0.0600 0.0520 0.0451 0.1108 0.0946 0.0808 0.0691 0.0592 0.0508 0.0437 0.0376 0.0981 0.0829 0.0703 0.0596 0.0506 0.0431 0.0367 0.0313 0.0868 0.0433 0.0365 0.0261 0.0728 0.0638 0.0611 0.0531 0.0514 0.0443 0.0308 0.0259 0.0768 0.0370 0.0309 0.0217 0.0680 0.0560 0.0462 0.0382 0.0316 0.0262 0.0218 0.0181 0.0601 0.0491 0.0402 0.0329 0.0270 0.0222 0.0183 0.0151 0.0532 0.0431 0.0349 0,0284 0.0231 0.0188 0.0154 0.0126 0.0471 0.0378 0.0304 0.0245 0.0197 0.0160 0.0129 0.0105 0.0417 0.0331 0.0264 0.0211 0.0169 0.0135 0.0109 0.0087 0.0369 0.0291 0.0230 0.0182 0.0144 0.0115 0.0091 0.0073 0.0326 0.0255 0.0200 0.0157 0.0123 0.0097 0.0077 0.0061 0.0289 0.0224 0.0174 0.0135 0.0105 0.0082 0.0064 0.0051 0.0256 0.0196 0.0151 0.0116 0.0090 0.0070 0.0054 0.0042 0.0075 0.0053 0.0037 0.0026 0.0019 0.0013 0.0010 0.0007 0.0022 0.0014 0.0009 0.0006 0.0004 0.0003 0.0002 0.0001