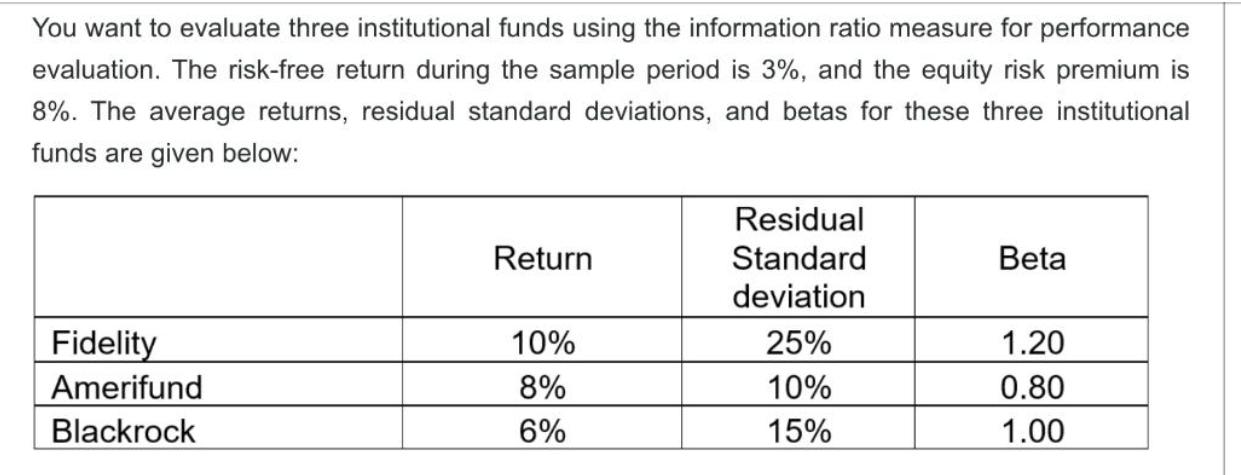

You want to evaluate three institutional funds using the information ratio measure for performance evaluation. The risk-free return during the sample period is 3%,

You want to evaluate three institutional funds using the information ratio measure for performance evaluation. The risk-free return during the sample period is 3%, and the equity risk premium is 8%. The average returns, residual standard deviations, and betas for these three institutional funds are given below: Fidelity Amerifund Blackrock Return 10% 8% 6% Residual Standard deviation 25% 10% 15% Beta 1.20 0.80 1.00 Based on the Information Ratio of performance evaluation, which of the following institutional funds represents a profitable investment opportunity?

Step by Step Solution

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the information ratio for each institutional fund well first need to determine the exce...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started