Question

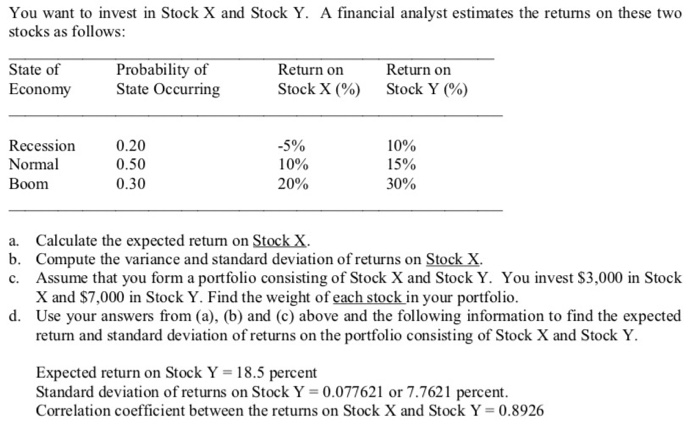

You want to invest in Stock X and Stock Y. A financial analyst estimates the returns on these two stocks as follows: State of Economy

You want to invest in Stock X and Stock Y. A financial analyst estimates the returns on these two stocks as follows:

State of Economy Probability of State Occurring Return on Stock X (%) Return on Stock Y (%)

Recession 0.20 - 5% 10%

Normal 0.50 10% 15%

Boom 0.30 20% 30%

a. Calculate the expected return on Stock X.

b. Compute the variance and standard deviation of returns on Stock X.

c. Assume that you form a portfolio consisting of Stock X and Stock Y. You invest $3,000 in Stock X and $7,000 in Stock Y. Find the weight of each stock in your portfolio.

d. Use your answers from (a), (b) and (c) above and the following information to find the expected return and standard deviation of returns on the portfolio consisting of Stock X and Stock Y.

Expected return on Stock Y = 18.5 percent Standard deviation of returns on Stock Y = 0.077621 or 7.7621 percent. Correlation coefficient between the returns on Stock X and Stock Y = 0.8926

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started