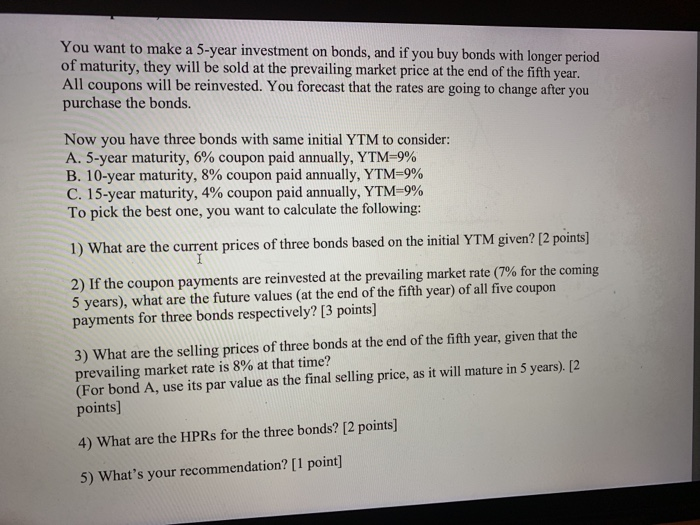

You want to make a 5-year investment on bonds, and if you buy bonds with longer period of maturity, they will be sold at the prevailing market price at the end of the fifth year. All coupons will be reinvested. You forecast that the rates are going to change after you purchase the bonds. Now you have three bonds with same initial YTM to consider: A. 5-year maturity, 6% coupon paid annually, YTM-9% B. 10-year maturity, 8% coupon paid annually, YTM-9% C. 15-year maturity, 4% coupon paid annually, YTM-9% To pick the best one, you want to calculate the following 1) What are the current prices of three bonds based on the initial YTM given? [2 points] 2) If the coupon payments are reinvested at the prevailing market rate (7% for the coming 5 years), what are the future values (at the end of the fifth year) of all five coupon payments for three bonds respectively? [3 points] 3) What are the selling prices of three bonds at the end of the fifth year, given that the prevailing market rate is 8% at that time? (For bond A, use its par value as the final selling price, as it will mature in 5 years). [2 points] 4) What are the HPRs for the three bonds? [2 points] 5) What's your recommendation? [1 point] You want to make a 5-year investment on bonds, and if you buy bonds with longer period of maturity, they will be sold at the prevailing market price at the end of the fifth year. All coupons will be reinvested. You forecast that the rates are going to change after you purchase the bonds. Now you have three bonds with same initial YTM to consider: A. 5-year maturity, 6% coupon paid annually, YTM-9% B. 10-year maturity, 8% coupon paid annually, YTM-9% C. 15-year maturity, 4% coupon paid annually, YTM-9% To pick the best one, you want to calculate the following 1) What are the current prices of three bonds based on the initial YTM given? [2 points] 2) If the coupon payments are reinvested at the prevailing market rate (7% for the coming 5 years), what are the future values (at the end of the fifth year) of all five coupon payments for three bonds respectively? [3 points] 3) What are the selling prices of three bonds at the end of the fifth year, given that the prevailing market rate is 8% at that time? (For bond A, use its par value as the final selling price, as it will mature in 5 years). [2 points] 4) What are the HPRs for the three bonds? [2 points] 5) What's your recommendation? [1 point]