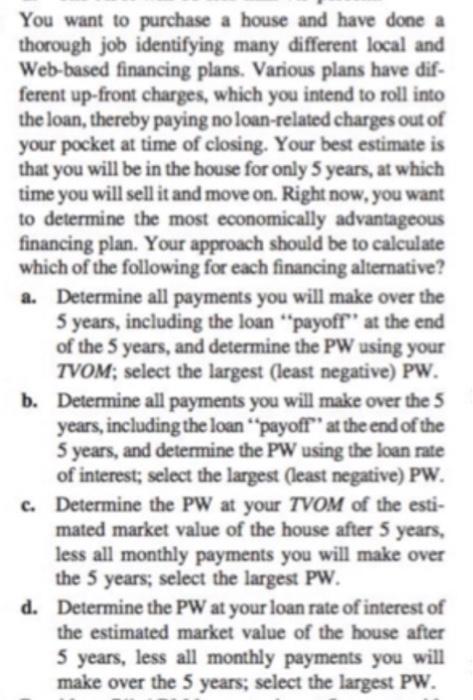

You want to purchase a house and have done a thorough job identifying many different local and Web-based financing plans. Various plans have dif- ferent up-front charges, which you intend to roll into the loan, thereby paying no loan-related charges out of your pocket at time of closing. Your best estimate is that you will be in the house for only 5 years, at which time you will sell it and move on. Right now, you want to determine the most economically advantageous financing plan. Your approach should be to calculate which of the following for each financing alternative? a. Determine all payments you will make over the 5 years, including the loan payoff" at the end of the 5 years, and determine the PW using your TVOM, select the largest (least negative) PW. b. Determine all payments you will make over the 5 years, including the loan payoff"' at the end of the 5 years, and determine the PW using the loan rate of interest; select the largest (least negative) PW. c. Determine the PW at your TVOM of the esti- mated market value of the house after 5 years, less all monthly payments you will make over the 5 years, select the largest PW. d. Determine the PW at your loan rate of interest of the estimated market value of the house after 5 years, less all monthly payments you will make over the 5 years; select the largest PW. You want to purchase a house and have done a thorough job identifying many different local and Web-based financing plans. Various plans have dif- ferent up-front charges, which you intend to roll into the loan, thereby paying no loan-related charges out of your pocket at time of closing. Your best estimate is that you will be in the house for only 5 years, at which time you will sell it and move on. Right now, you want to determine the most economically advantageous financing plan. Your approach should be to calculate which of the following for each financing alternative? a. Determine all payments you will make over the 5 years, including the loan payoff" at the end of the 5 years, and determine the PW using your TVOM, select the largest (least negative) PW. b. Determine all payments you will make over the 5 years, including the loan payoff"' at the end of the 5 years, and determine the PW using the loan rate of interest; select the largest (least negative) PW. c. Determine the PW at your TVOM of the esti- mated market value of the house after 5 years, less all monthly payments you will make over the 5 years, select the largest PW. d. Determine the PW at your loan rate of interest of the estimated market value of the house after 5 years, less all monthly payments you will make over the 5 years; select the largest PW