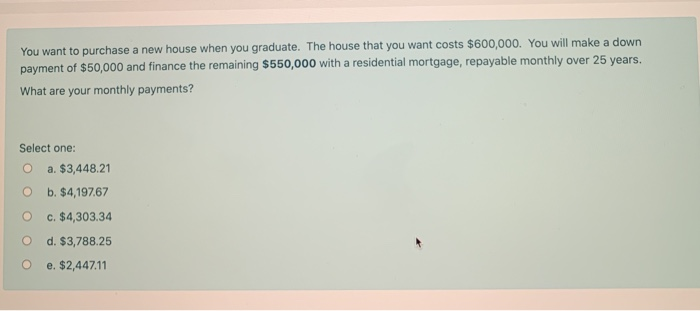

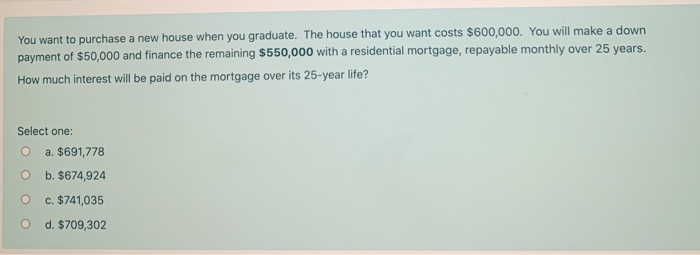

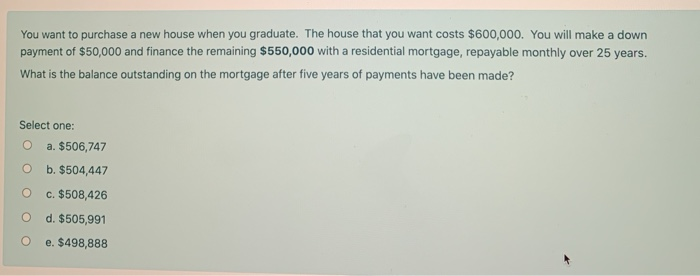

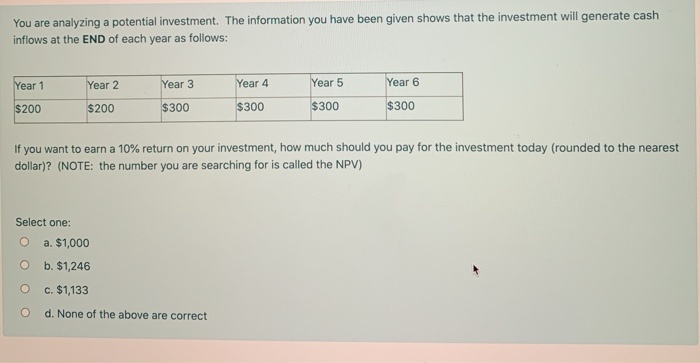

You want to purchase a new house when you graduate. The house that you want costs $600,000. You will make a down payment of $50,000 and finance the remaining $550,000 with a residential mortgage, repayable monthly over 25 years. What are your monthly payments? Select one: a. $3,448.21 b. $4,197.67 c. $4,303.34 d. $3,788.25 e. $2,447.11 You want to purchase a new house when you graduate. The house that you want costs $600,000. You will make a down payment of $50,000 and finance the remaining $550,000 with a residential mortgage, repayable monthly over 25 years. How much interest will be paid on the mortgage over its 25-year life? Select one: a. $691,778 b. $674,924 c. $741,035 d. $709,302 You want to purchase a new house when you graduate. The house that you want costs $600,000. You will make a down payment of $50,000 and finance the remaining $550,000 with a residential mortgage, repayable monthly over 25 years. What is the balance outstanding on the mortgage after five years of payments have been made? Select one: a. $506,747 b. $504,447 c. $508,426 d. $505,991 e. $498,888 You are analyzing a potential investment. The information you have been given shows that the investment will generate cash inflows at the END of each year as follows: Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 $200 $200 $300 $300 $300 $300 If you want to earn a 10% return on your investment, how much should you pay for the investment today (rounded to the nearest dollar)? (NOTE: the number you are searching for is called the NPV) Select one: O a. $1,000 b. $1,246 c. $1,133 O d. None of the above are correct You want to purchase a new house when you graduate. The house that you want costs $600,000. You will make a down payment of $50,000 and finance the remaining $550,000 with a residential mortgage, repayable monthly over 25 years. What are your monthly payments? Select one: a. $3,448.21 b. $4,197.67 c. $4,303.34 d. $3,788.25 e. $2,447.11 You want to purchase a new house when you graduate. The house that you want costs $600,000. You will make a down payment of $50,000 and finance the remaining $550,000 with a residential mortgage, repayable monthly over 25 years. How much interest will be paid on the mortgage over its 25-year life? Select one: a. $691,778 b. $674,924 c. $741,035 d. $709,302 You want to purchase a new house when you graduate. The house that you want costs $600,000. You will make a down payment of $50,000 and finance the remaining $550,000 with a residential mortgage, repayable monthly over 25 years. What is the balance outstanding on the mortgage after five years of payments have been made? Select one: a. $506,747 b. $504,447 c. $508,426 d. $505,991 e. $498,888 You are analyzing a potential investment. The information you have been given shows that the investment will generate cash inflows at the END of each year as follows: Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 $200 $200 $300 $300 $300 $300 If you want to earn a 10% return on your investment, how much should you pay for the investment today (rounded to the nearest dollar)? (NOTE: the number you are searching for is called the NPV) Select one: O a. $1,000 b. $1,246 c. $1,133 O d. None of the above are correct