Question

You want to short 100 shares of H&B's stock which is currently selling for $100. The dealer offers you a short position with an

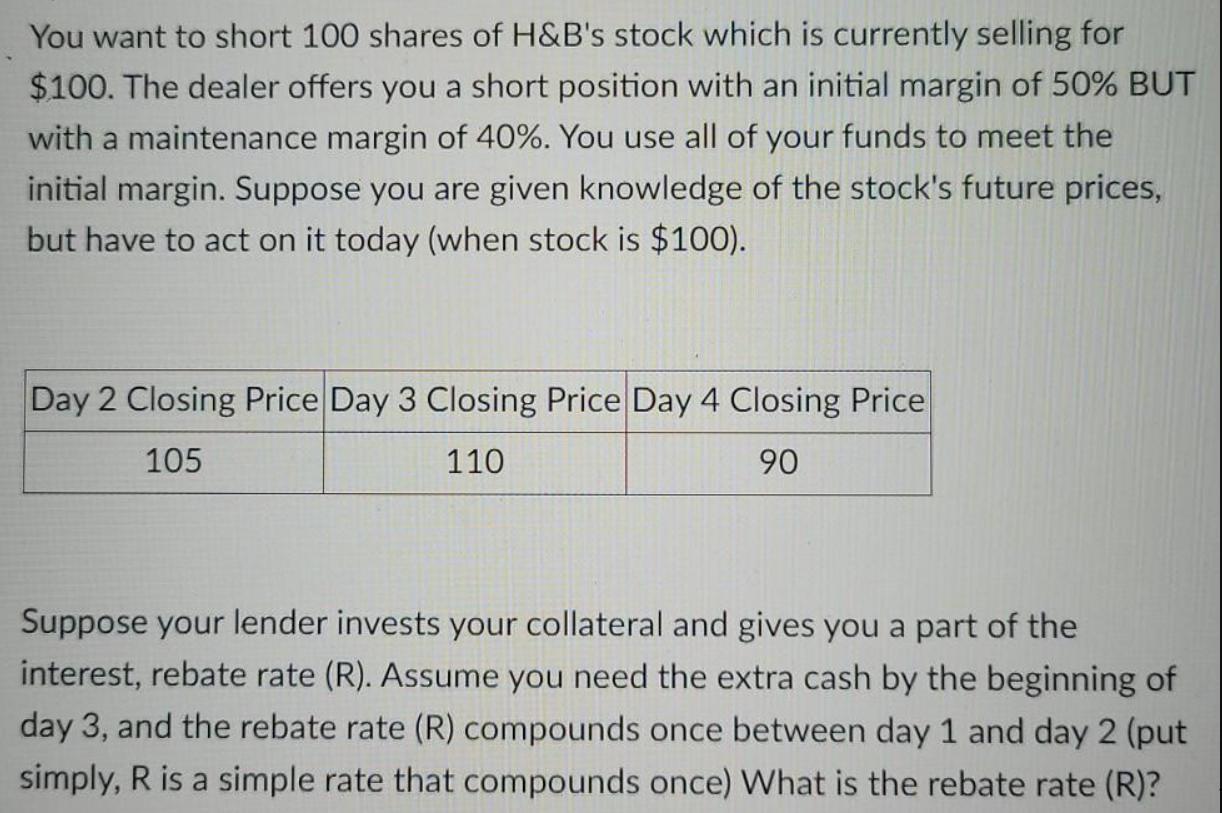

You want to short 100 shares of H&B's stock which is currently selling for $100. The dealer offers you a short position with an initial margin of 50% BUT with a maintenance margin of 40%. You use all of your funds to meet the initial margin. Suppose you are given knowledge of the stock's future prices, but have to act on it today (when stock is $100). Day 2 Closing Price Day 3 Closing Price Day 4 Closing Price 105 110 90 Suppose your lender invests your collateral and gives you a part of the interest, rebate rate (R). Assume you need the extra cash by the beginning of day 3, and the rebate rate (R) compounds once between day 1 and day 2 (put simply, R is a simple rate that compounds once) What is the rebate rate (R)?

Step by Step Solution

3.54 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

For short in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investment Analysis and Portfolio Management

Authors: Frank K. Reilly, Keith C. Brown

10th Edition

538482109, 1133711774, 538482389, 9780538482103, 9781133711773, 978-0538482387

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App