Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You want to start saving money each year by putting $3,000 per year at the end of the year each year in your bank account.

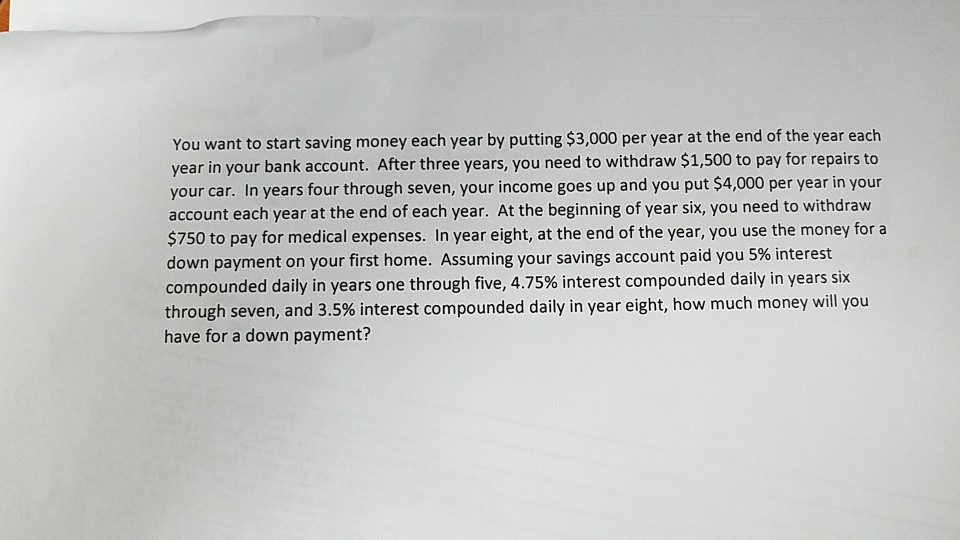

You want to start saving money each year by putting $3,000 per year at the end of the year each year in your bank account. After three years, you need to withdraw $1,500 to pay for repairs to your car. In years four through seven, your income goes up and you put $4,000 per year in your account each year at the end of each year. At the beginning of year six, you need to withdraw $750 to pay for medical expenses. In year eight, at the end of the year, you use the money fora down payment on your first home. Assuming your savings account paid you 5% interest compounded daily in years one through five, 4.75% interest compounded daily in years six through seven, and 3.5% interest compounded daily in year eight, how much money will you have for a down payment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started