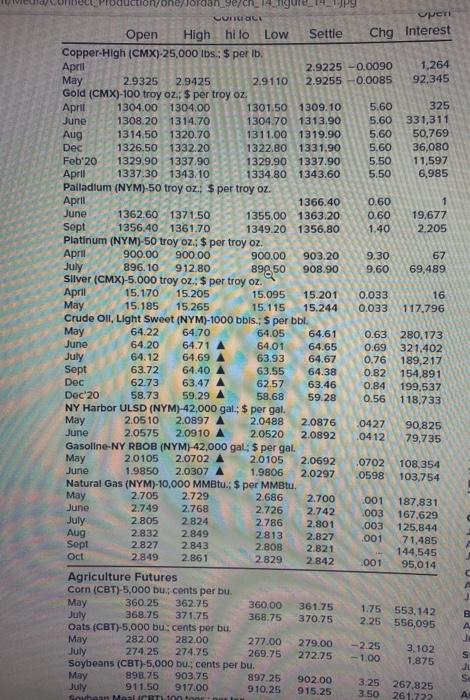

You went long 40 December 2019 crude oil futures contracts at a price of $46.86. Looking at Figure 14.1. if you closed your position at the settle price on this day, what was your profit? Profit Peri Chg interest 5.60 ge/ CORIOL Open High hilo Low Settle Copper-High (CMX)-25,000 lbs.: $ per lb. April 2.9225 -0.0090 1,264 May 2.9325 2.9425 2.9110 2.9255 0.0085 92,345 Gold (CMX)-100 troy oz. $ per troy oz. April 325 1304.00 1304.00 1301.50 1309.10 June 1308.20 1314.70 1304.70 1313.90 5.60 331,311 1314.50 1320.70 Aug 1311.00 1319.90 5.60 50,769 Dec 1326.50 1332.20 1322.80 1331.90 5.60 36,080 Feb'20 1329.90 1337.90 1329.90 1337.90 5,50 11,597 April 1337.30 1343.10 1334.80 1343.60 5.50 6,985 Palladium (NYM)-50 troy oz. $ per troy oz. April 1366.40 0.60 1 June 1362.60 1371.50 1355.00 1363.20 0.60 19,677 Sept 1356.40 1361.70 1349.20 1356.80 1.40 2.205 Platinum (NYM)-50 troy oz.; $ per troy oz. April 900.00 900.00 900.00 903.20 9.30 67 July 896.10 912.80 89850 908.90 9.60 69,489 Silver (CMX)-5.000 troy oz.: $ per troy oz. April 15.170 15.205 15.095 15.201 0.033 16 May 15.185 15.265 15.115 15.244 0.033 117,796 Crude Oil, Light Sweet (NYM)-1000 bbls., $ per bl. May 64.22 64.70 64.05 64.61 0.63 280.173 June 64.20 64.71 64.01 64.65 0.69 321.402 July 64.12 64.69 63.93 64.67 0.76 189,217 Sept 63.72 64.40 63.55 64.38 0.82 154,891 Dec 62.73 63.47 62.57 63.46 0.84 199,537 Dec 20 58.73 59.29 58.68 59.28 0.56 118.733 NY Harbor ULSD (NYM) 42,000 gal: $ per gal. May 2.0510 2.0897 A 2.0488 2.0876 0427 90,825 June 2.0575 2.0910 A 2.0520 2.0892 .04 12 79,735 Gasoline-NY RBOB (NYM) 42,000 gal; $ per gal. May 2.0105 2.0702 A 2.0105 2.0692 0702 108,354 June 1.9850 2.0307 A 1.9806 2.0297 .0598 103,754 Natural Gas (NYM)-10,000 MMBtu. $ per MMBtu, May 2.705 2.729 2.686 2.700 .001 187,831 June 2.749 2.768 2.726 2.742 003 167,629 July 2.805 2.824 2786 2.801 003 125,844 Aug 2.832 2.849 2813 2.827 .001 Sopt 71,485 2.827 2.843 2.808 2.821 144,545 Oct 2.849 2.861 2.829 2.842 3001 95,014 Agriculture Futures Corn (CBT)-5,000 bucents per bu. May 360.25 362.75 360.00 361.75 1.75 553,142 368.75 371.75 368.75 370.75 556,095 Oats (CBT)-5,000 bu: cents per bu. May 282.00 282.00 277.00 279.00 -2.25 3,102 July 274.25 274.75 269.75 272.75 -1.00 1.875 Soybeans (CBT)-5,000 bu cents per bu. May 898.75 903.75 897.25 902.00 3:25 July 911.50 917.00 910.25 915.25 261.722 Sawan Mentette July 2.25 E . S 267,825 3.50 A