Answered step by step

Verified Expert Solution

Question

1 Approved Answer

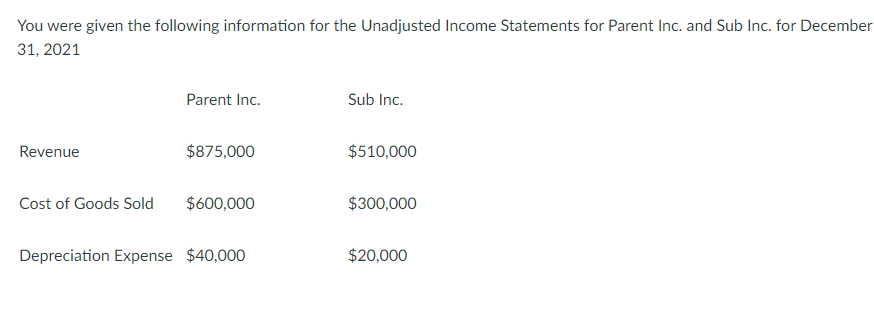

You were given the following information for the Unadjusted IncomeAssume Parent owns 1 0 0 % of Sub. You were also provided with the following

You were given the following information for the Unadjusted IncomeAssume Parent owns of Sub. You were also provided with the following information. Also further assume the percentage breakdown of acquisition differential on the acquisition date was as follows:

Goodwill was valued at $ At the end of goodwill was judged to be impaired by

On the date of acquisition, the fair value of Subs inventory was $ greater than book value. Only of this inventory was sold at the end of The remaining remained unsold.

On December Sub declared a $ dividend.

Required:

Calculate the adjusted Consolidated Net income before Tax. You do NOT need to prepare a complete income statement, but be sure you show how you reached solution number. Statements for Parent Inc. and Sub Inc. for December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started