Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You were hired as a consultant to Fama LLC. You were provided with the following data: Target capital structure: 35 percent debt, 10 percent

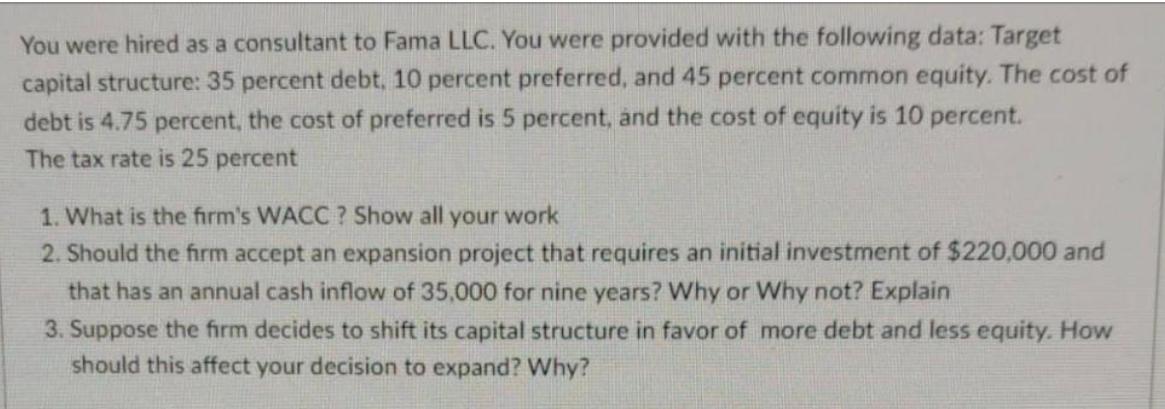

You were hired as a consultant to Fama LLC. You were provided with the following data: Target capital structure: 35 percent debt, 10 percent preferred, and 45 percent common equity. The cost of debt is 4.75 percent, the cost of preferred is 5 percent, and the cost of equity is 10 percent. The tax rate is 25 percent 1. What is the firm's WACC? Show all your work 2. Should the firm accept an expansion project that requires an initial investment of $220,000 and that has an annual cash inflow of 35,000 for nine years? Why or Why not? Explain 3. Suppose the firm decides to shift its capital structure in favor of more debt and less equity. How should this affect your decision to expand? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solutions to Fama LLCs problems 1 Weighted Average Cost of Capital WACC Step 1 Calculate the weights of each capital source Debt weight Wd 35 Preferre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started