Answered step by step

Verified Expert Solution

Question

1 Approved Answer

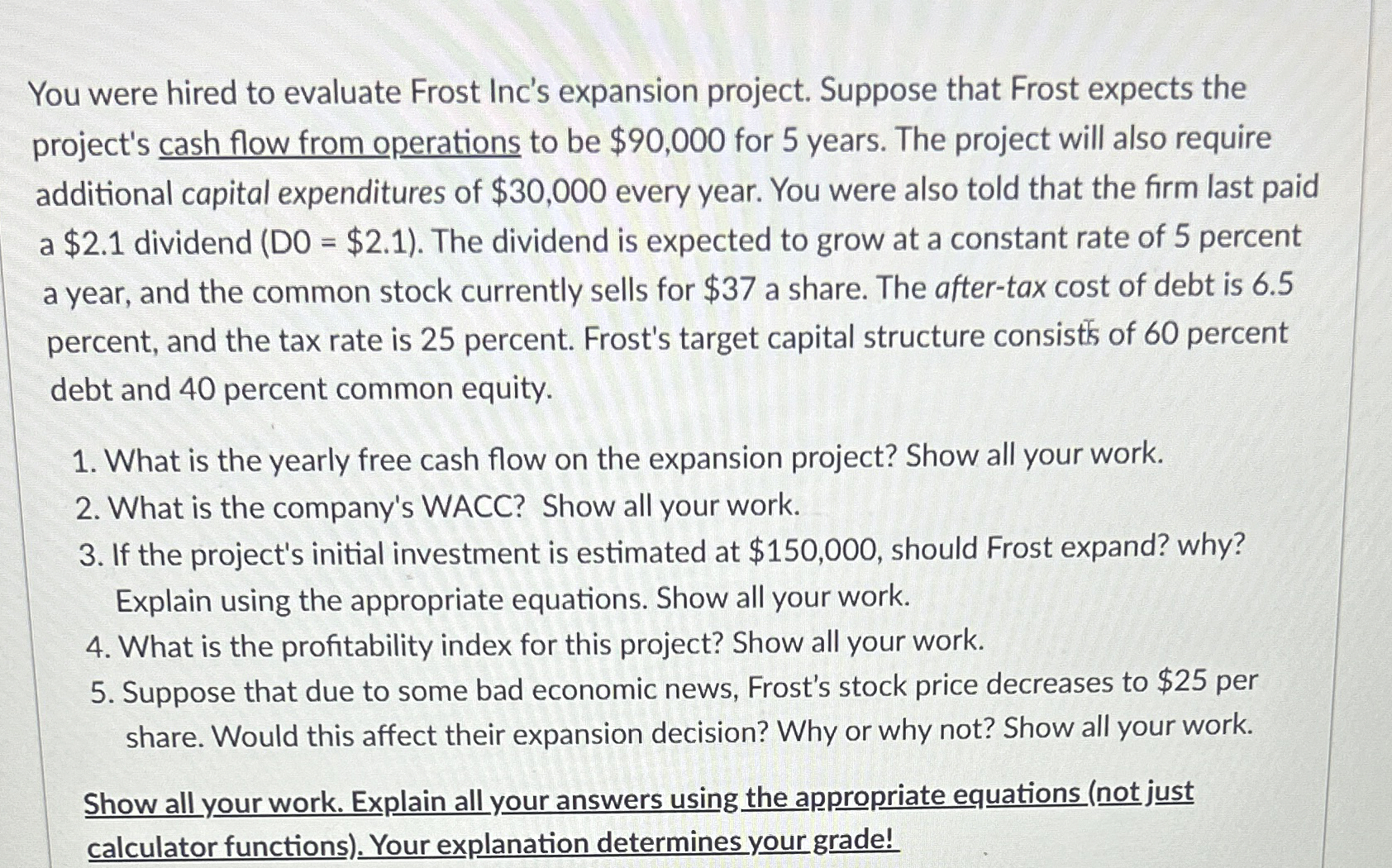

You were hired to evaluate Frost Inc's expansion project. Suppose that Frost expects the project's cash flow from operations to be $ 9 0 ,

You were hired to evaluate Frost Inc's expansion project. Suppose that Frost expects the project's cash flow from operations to be $ for years. The project will also require additional capital expenditures of $ every year. You were also told that the firm last paid a $ dividend $ The dividend is expected to grow at a constant rate of percent a year, and the common stock currently sells for $ a share. The aftertax cost of debt is percent, and the tax rate is percent. Frost's target capital structure consist of percent debt and percent common equity.

What is the yearly free cash flow on the expansion project? Show all your work.

What is the company's WACC? Show all your work.

If the project's initial investment is estimated at $ should Frost expand? why? Explain using the appropriate equations. Show all your work.

What is the profitability index for this project? Show all your work.

Suppose that due to some bad economic news, Frost's stock price decreases to $ per share. Would this affect their expansion decision? Why or why not? Show all your work.

Show all your work. Explain all your answers using the appropriate equations not just calculator functions Your explanation determines your grade!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started