Question

You were recently hired as an assistant controller at the Hairy Yak Yarn Company (the Company). Your employer manufactures and sells a single product: balls

You were recently hired as an assistant controller at the Hairy Yak Yarn Company ("the Company"). Your employer manufactures and sells a single product: balls of yarn! With people learning to knit because of the COVID-19 pandemic, the Company has seen a significant increase in demand for their yarn.

The first task you have been assigned in your new role is to prepare the master budget for the quarter ended March 31st, 2023.

You have assembled the following information.

Information on sales

The yarn balls sell for $25 each. Recent and budgeted sales (in units) are as follows:

November (actual) 10,000

December (actual) 11,000

January 12,000

February 11,000

March 11,000

April 9,000

May 10,000

All sales are on credit, with no discount. The company has found that only 25% of a month's sales are collected by month-end. An additional 70% is collected in the month following the sale, and the remaining 5% is collected in the second month following the sale. Bad debts have been negligible, so they can be ignored for the purposes of the budget.

Information on inventory and production

Inventories offinished goods on hand at the end of each month are to be equal to 10% of the following months budgeted sales. As of December 31st, 2022, the company had 1,200 balls of yarn in finished goods inventory. The company has no work-in-process (WIP) inventory.

Each ball of yarn requires 2 yards of fleece, which the company purchases for $5.00 per yard. It is company policy to keep enough fleece in raw materials to meet 50% of the next month's production needs. As of December 31st, the Company had 11,900 yards of fleece in raw materials inventory. Purchases of raw materials are paid for as follows: 50% in the month of purchase and the remaining 50% in the following month.

Each ball of yarn requires only 0.5 labour hours (30 minutes) to assemble by hand, as most of the work is done by machine. Employees making the yarn are paid $15.00 per hour, and do not work overtime. The Company has enough casual/on-call workers that they can call in if additional work is required.

Manufacturing overhead includes all the costs of production other than direct materials and direct labour. The variable component of manufacturing overhead is $1.00 per ball of yarn in production, and the fixed component is $17,000 per month. The $17,000 of fixed manufacturing overhead includes depreciation of $2,000 per month on the machines used to manufacture the yarn. Direct labour hours is used as an allocation base for assigning manufacturing overhead to units produced.

Required

1 - Prepare the following for the company for the quarter ending March 31st:

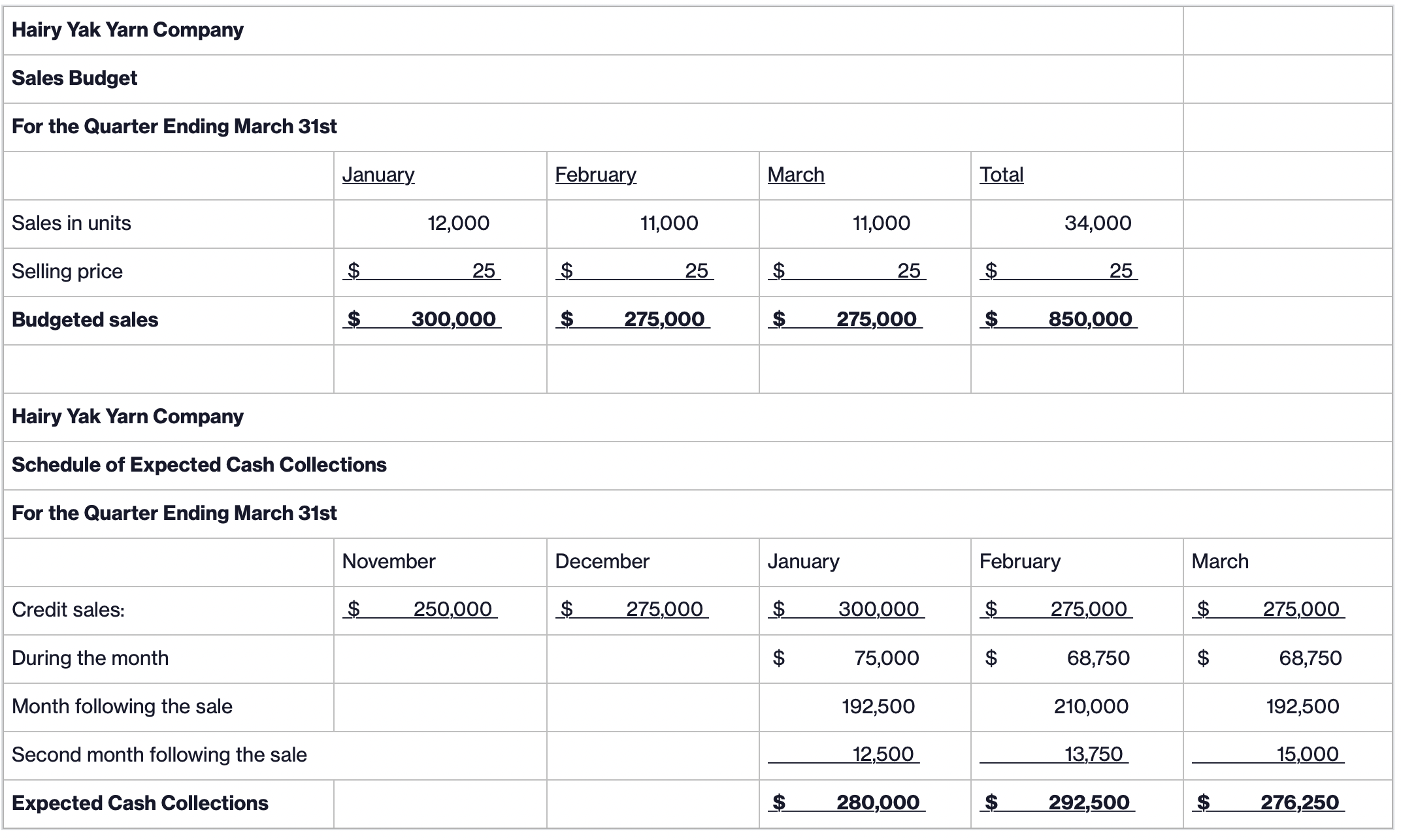

- Sales Budget and Schedule of Expected Cash Collections

- Production Budget

Heres the answer for 1.) to help with 2.)

Hairy Yak Yarn Company Sales Budget For the Quarter Ending March 31st Sales in units Selling price Budgeted sales January February March Total 12,000 11,000 11,000 34,000 25 25 25 25 300,000 275,000 275,000 850,000 Hairy Yak Yarn Company Schedule of Expected Cash Collections For the Quarter Ending March 31st Credit sales: During the month Month following the sale Second month following the sale Expected Cash Collections November December January February March $ 250,000 $ 275,000 $ 300,000 275,000 275,000 75,000 68,750 68,750 192,500 210,000 192,500 12,500 13,750 15,000 280,000 292,500 276,250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started