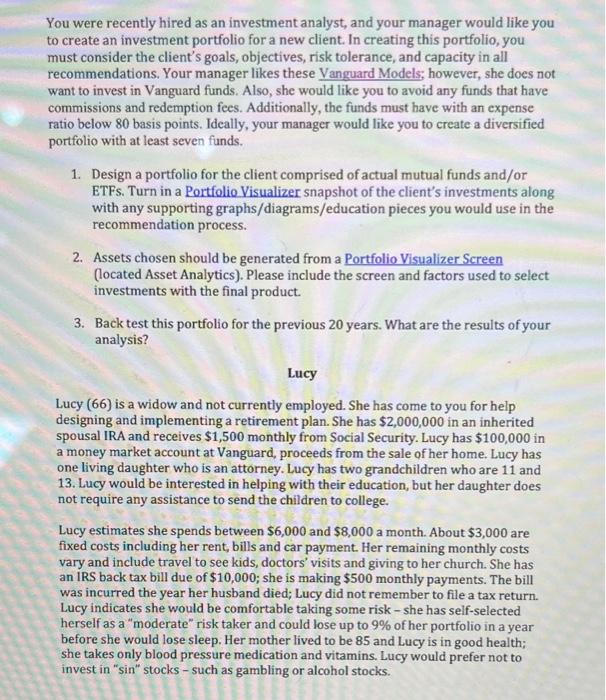

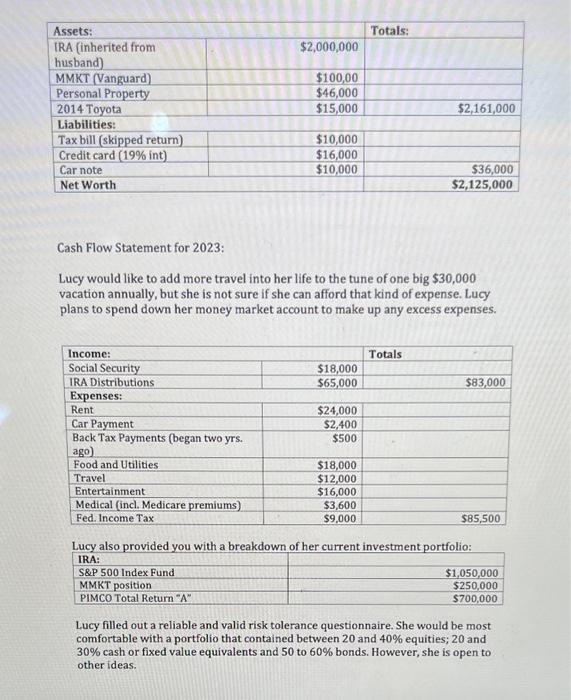

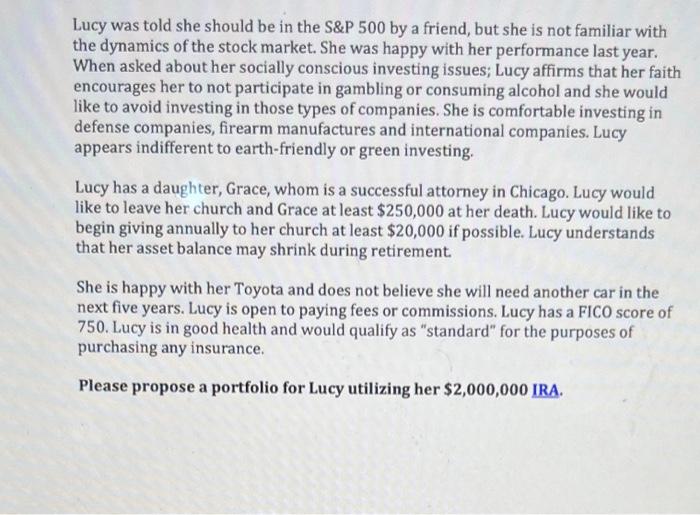

You were recently hired as an investment analyst, and your manager would like you to create an investment portfolio for a new client. In creating this portfolio, you must consider the client's goals, objectives, risk tolerance, and capacity in all recommendations. Your manager likes these Vanguard Models; however, she does not want to invest in Vanguard funds. Also, she would like you to avoid any funds that have commissions and redemption fees. Additionally, the funds must have with an expense ratio below 80 basis points. Ideally, your manager would like you to create a diversified portfolio with at least seven funds. 1. Design a portfolio for the client comprised of actual mutual funds and/or ETFS. Turn in a Portfolio Visualizer snapshot of the client's investments along with any supporting graphs/diagrams/education pieces you would use in the recommendation process. 2. Assets chosen should be generated from a Portfolio Visualizer Screen (located Asset Analytics). Please include the screen and factors used to select investments with the final product. 3. Back test this portfolio for the previous 20 years. What are the results of your analysis? Lucy Lucy (66) is a widow and not currently employed. She has come to you for help designing and implementing a retirement plan. She has $2,000,000 in an inherited spousal IRA and receives $1,500 monthly from Social Security. Lucy has $100,000 in a money market account at Vanguard, proceeds from the sale of her home. Lucy has one living daughter who is an attorney. Lucy has two grandchildren who are 11 and 13. Lucy would be interested in helping with their education, but her daughter does not require any assistance to send the children to college. Lucy estimates she spends between $6,000 and $8,000 a month. About $3,000 are fixed costs including her rent, bills and car payment. Her remaining monthly costs vary and include travel to see kids, doctors' visits and giving to her church. She has an IRS back tax bill due of $10,000; she is making $500 monthly payments. The bill was incurred the year her husband died; Lucy did not remember to file a tax return. Lucy indicates she would be comfortable taking some risk - she has self-selected herself as a "moderate" risk taker and could lose up to 9% of her portfolio in a year before she would lose sleep. Her mother lived to be 85 and Lucy is in good health; she takes only blood pressure medication and vitamins. Lucy would prefer not to invest in "sin" stocks - such as gambling or alcohol stocks. Cash Flow Statement for 2023: Lucy would like to add more travel into her life to the tune of one big $30,000 vacation annually, but she is not sure if she can afford that kind of expense. Lucy plans to spend down her money market account to make up any excess expenses. Lucy also provided you with a breakdown of her current investment portfolio: Lucy filled out a reliable and valid risk tolerance questionnaire. She would be most comfortable with a portfolio that contained between 20 and 40% equities; 20 and 30% cash or fixed value equivalents and 50 to 60% bonds. However, she is open to other ideas. Lucy was told she should be in the S\&P 500 by a friend, but she is not familiar with the dynamics of the stock market. She was happy with her performance last year. When asked about her socially conscious investing issues; Lucy affirms that her faith encourages her to not participate in gambling or consuming alcohol and she would like to avoid investing in those types of companies. She is comfortable investing in defense companies, firearm manufactures and international companies. Lucy appears indifferent to earth-friendly or green investing. Lucy has a daughter, Grace, whom is a successful attorney in Chicago. Lucy would like to leave her church and Grace at least $250,000 at her death. Lucy would like to begin giving annually to her church at least $20,000 if possible. Lucy understands that her asset balance may shrink during retirement. She is happy with her Toyota and does not believe she will need another car in the next five years. Lucy is open to paying fees or commissions. Lucy has a FICO score of 750. Lucy is in good health and would qualify as "standard" for the purposes of purchasing any insurance. Please propose a portfolio for Lucy utilizing her $2,000,000 IRA