Question

You were trying to make investments between bonds and preferred stocks. You invested in XYZ preferred stocks, and you selected the best preferred stocks, which

You were trying to make investments between bonds and preferred stocks. You invested in XYZ preferred stocks, and you selected the best preferred stocks, which gave you an annual dividend of $35. The risk-free rate was 2.5% and the face value of the bond was $1,000. You decided it to buy 100 shares of preferred stocks at $350/shares.

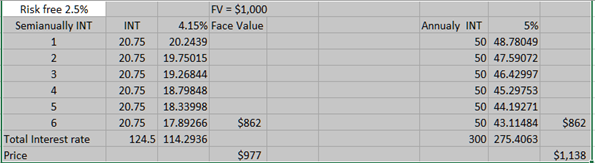

There were two different bonds that your brokerage offered you. Bond A will pay a semiannual interest rate of 4.15%, bond B will pay an annual interest rate of 5%.

The preferred stock and both bonds have a six-year term. Whether you like it or not, your preferred stock will be converted to common stock after 6 years. You may, however, change your preferred stocks to common stocks whenever you want. The conversion ratio is 1:75 (preferred: common stocks) if you decide to convert your preferred stocks to common stocks. Please answer the following questions.

1. Which bond will you select: bond A or bond B and why? Show your calculations.

2. Which bond has greater price change and why?

3. If on the 3rd year you decided to convert your preferred stocks to common stocks, what would be:

What would be your minimum conversion price?

What would be your dividend yield?

Which assets are best to invest in: bond A, bond B, or preferred stock if you want to keep it for six years? Why?

If the price of the common stock at the end of the 3rd year will be $17.85, will you have the capital gain or loss? If yes, how much?

Risk free 2.5% Semianually INT 1 2 3 FV = $1,000 INT 4.15% Face Value 20.75 20.2439 20.75 19.75015 20.75 19.26844 20.75 18.79848 20.75 18.33998 20.75 17.89266 $862 124.5 114.2936 $977 Annualy INT 5% 50 48.78049 50 47.59072 50 46.42997 50 45.29753 50 44.19271 50 43.11484 300 275.4063 4 $862 5 6 Total Interest rate Price $1,138 Risk free 2.5% Semianually INT 1 2 3 FV = $1,000 INT 4.15% Face Value 20.75 20.2439 20.75 19.75015 20.75 19.26844 20.75 18.79848 20.75 18.33998 20.75 17.89266 $862 124.5 114.2936 $977 Annualy INT 5% 50 48.78049 50 47.59072 50 46.42997 50 45.29753 50 44.19271 50 43.11484 300 275.4063 4 $862 5 6 Total Interest rate Price $1,138

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started