Question

-You will act as the owner of a company called A-Z Computer Repair -You will complete the month of June Journal Entries (J/Es) for the

- -You will act as the owner of a company called A-Z Computer Repair

- -You will complete the month of June Journal Entries (J/E’s) for the transactions listed below

- -After completing the J/E’s, you will complete a worksheet that includes:

- -Adjusting Journal Entries

- -Financial Statement preparation

- -Posting Closing Journal Entries and preparing Post-Closing Trial Balance

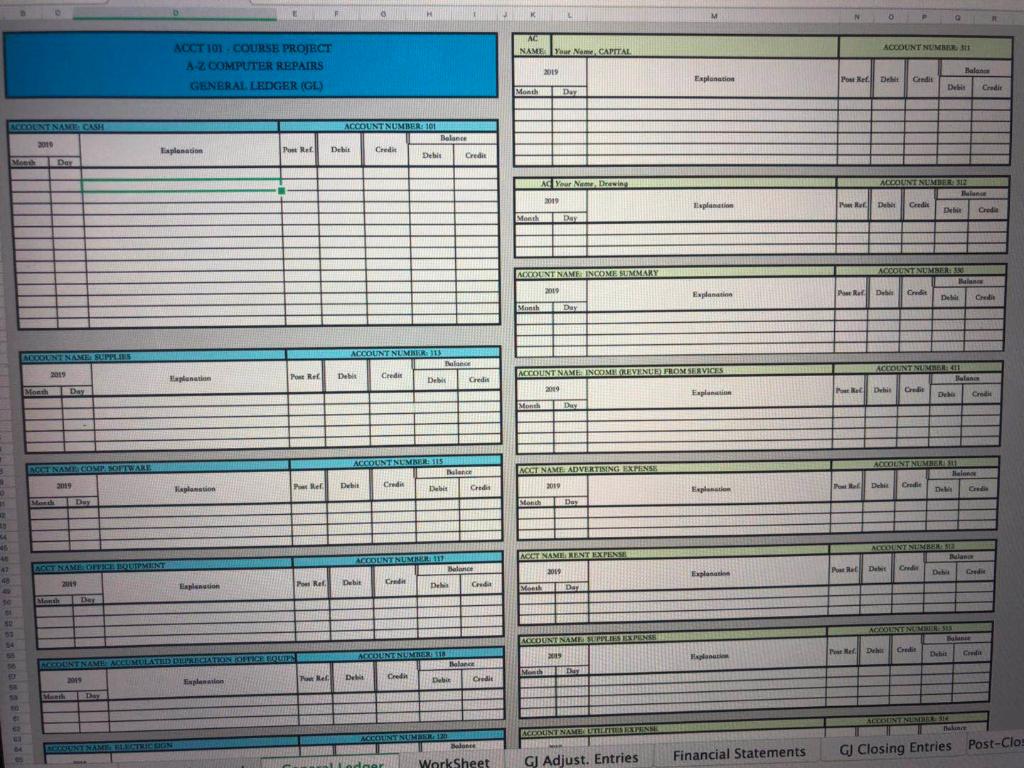

- 1. The Chart of Accounts for your company is listed below and lists all of the accounts used by A-Z Computer Repair. Again, read the “2. PROJECT INSTRUCTIONS” listed Ledger

- 2. Based on the General Journal entries you make for the Transactions below, Post the Journal Entries (J/Es) to the general ledger accounts. Be sure and use the Post Reference #s for each posting

- 3. Prepare the Trial Balance section of the Worksheet within the “Worksheet” tab

- 1. The Trial Balance and the Adjusted Trial Balance on the worksheet are self-correcting.

- 2. If you get an error message, the number you are entering in the current cell is incorrect for that cell. Please review the input information for that cell and try again.

- 4. Prepare the General Journal (GJ) Adjustments section of the worksheet base on the following information:

- 1. Compute and record the adjustment for supplies used during the month. An inventory showed supplies on hand of $645.

- 2. Record the adjustment for depreciation of Office Equipment of $42 for the month.

- 3. Record the adjustment for depreciation of Electric Sign of $120 for the month.

- 5. Complete the Worksheet within the “Worksheet” tab

- 6. Prepare the Income Statement for the month, Statement of Owner’s Equity, and a Balance Sheet, which is found in the “Financial Statement” tab

- Journalize and post the Adjusting and Closing entries. (About half of students forget, and it is worth about 25% of grade)

- Prepare a Post-Closing Trial Balance.

- 7. Complete the “Audit Report” document that you downloaded from the Canvas Modules section, and submit the following completed files in Canvas:

- “Project Workbook – A-Z Computer Repair”

- “Project Audit Report”

A – Z COMPUTER REPAIR CHART OF ACCOUNTS

ASSETS

101 – Cash

113 – Supplies

115 – Computer Software

117 – Office Equipment

118 – Accumulated Depreciation (Office Equipment)

120 – Electric Sign

121 – Accumulated Depreciation (Electric Sign)

LIABILITIES

201 – Accounts Payable

REVENUE

411 – Income from Repair

EXPENSES

511 – Advertising Expense

512 – Rent Expense

513 – Supplies Expense

514 – Utility Expense

515 – Wages Expense

516 – Miscellaneous Expense

517 – Depreciation Expense (Office Equipment)

518 – Depreciation Expense (Electric Sign)

OWNER’S EQUITY

311 – (insert your name here), Capital

312 – (insert your name here), Drawing

330 – Income Summary

The following lists all transactions A-Z COMPUTER REPAIR made during June:

June 1 You deposited $19,250 cash in a bank account in the name of the business.

3 Bought office equipment from XYZ Office Mart for cash, $685, Ck. #1000, Invoice #2375.

5 Bought computer software from Flash Computer Center, $760, putting $500 down and putting the balance on account, Ck. #1001, Invoice #244.

6 Paid current month’s rent, $1,075 Ck. #1002.

7 Performed services for cash, $2,240.

10 Bought an electric sign from Bright Light Signs, $1,675, putting $725 down, and placing the balance on account, Ck. #1003, Inv. #6172.

12 Received a bill from The Times Review for advertising, $775, Inv. TR198.

13 Bought supplies on account from XYZ Office Mart, $1,550, Inv. #2425.

15 Received and paid the electric bill, $387, Ck. #1004.

20 Paid on account to The Times Review, $775, Ck. #1005, Inv. #TR198.

21 Performed services for cash, $1,742.

25 Paid sales clerk’s wages, $857, Ck. #1006.

27 You invested your personal computer (Office Equipment) in the business with a fair market value of $1,425.

29 You withdrew cash for personal use, $640, Ck. #1007.

30 Received and paid the bill for the city business license, $150, Ck. #1008, (Miscellaneous Expense).

AC. ACCT 101 COURSE PROJECT NAME Yaue Name. CAPITAL ACCOUNT NUMBER A-Z COMPUTER REPAIRS 2019 Balan Explanation Post Ref. Dehit Cendis GENERAL LEDGER (GL) Debit Credir Month Day ACCOUNT NAME CASH ACCOUNTNUMBER: 101 Belance 2010 Eaplanaion Post Ref Debit Credit Debis Credi Menth Day Der AG Your Neme, Drewing ACCOUNT NUMBER S12 Belane 2019 Esplanation P Ret Deb Credi Dehie Credia Month Day ACCOUNT NAME INCOME SUMMARY ACCOUNT NUMSER Balane 2019 P Ref Debe Credit Explanation Debi Credi Monsh Day ACCOUNT NUMBER J1S ACOOUNT NAME SUPPLES Balanor ACCOUNT NUMBER 411 ACCOUNT NAME INCOMEL OLEVENUE) FROM SERVICE 2019 Eaplanation Pot Ref Debit Credir Debis Credis Balanon Month Day 2019 Esplansion Kec Dehi Credie Deb Credic Month Duy ACCOUNTNUMBER: 1IS ACCOUNT NUMBERS lalan ACCT NAME. COMP SOFIWARE Bulance ACCT NAMEADVERTISING EXPENSS Credi 2019 Kaplanstion P Ref Debi Credis 2019 P el Dehi Credie Debir Explanation Debis Credie Monch Duy Monih Day ACCOUNT NIMBER S ACCT NAME RENT EXPENS Belana ACCOUNT NUMMER 1 ACCT NAME OFFICE BOUIPMENT Belance Pu Ret Deber 47 2019 Explanation Credi Debit Credie 48 Pos Ref Debit Credi Cendi Eaplenution Deb Meesh Dar 30 Month Dey ACCOUNT NUMBER SIA ACCOUNT NAM SUPPLIES EXPENSS Bobanse 84 Per Ref Dehi Credi Credi 5S ACCOUNT NUMBER 1I8 2019 Haplonusion Dehit ACCOUNT NAMIE ACCUMULATHD T RECIATION OFTICE EQUIPN Belance fonth Day 2019 Pue Rel. Debi Credit Debin Credie Explenasion 58 5O Manth t Thay TO ACCOUNT NAMEUTILITESEXPENN ACCOUNT NUMBER 12n MOODUNT NAME ELECTRICNON Belonee Financial Statements GJ Closing Entries Post-Clo GJ Adjust. Entries RUS WorkSheet

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started