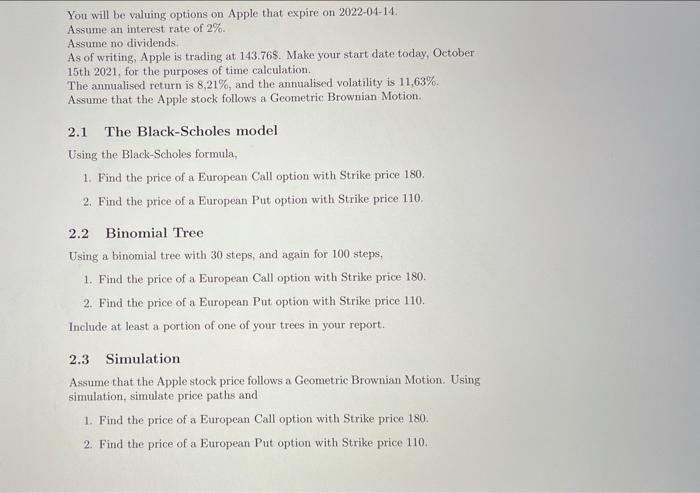

You will be valuing options on Apple that expire on 2022-04-14 Assume an interest rate of 2%. Assume no dividends As of writing, Apple is trading at 143.768. Make your start date today, October 15th 2021, for the purposes of time calculation. The annualised return is 8,21%, and the annualised volatility is 11,63%. Assume that the Apple stock follows a Geometric Brownian Motion 2.1 The Black-Scholes model Using the Black-Scholes formula, 1. Find the price of a European Call option with Strike price 180 2. Find the price of a European Put option with Strike price 110. 2.2 Binomial Tree Using a binomial tree with 30 steps, and again for 100 steps, 1. Find the price of a European Call option with Strike price 180. 2. Find the price of a European Put option with Strike price 110 Include at least a portion of one of your trees in your report. 2.3 Simulation Assume that the Apple stock price follows a Geometric Brownian Motion. Using simulation, simulate price paths and 1. Find the price of a European Call option with Strike price 180 2. Find the price of a European Put option with Strike price 110. You will be valuing options on Apple that expire on 2022-04-14 Assume an interest rate of 2%. Assume no dividends As of writing, Apple is trading at 143.768. Make your start date today, October 15th 2021, for the purposes of time calculation. The annualised return is 8,21%, and the annualised volatility is 11,63%. Assume that the Apple stock follows a Geometric Brownian Motion 2.1 The Black-Scholes model Using the Black-Scholes formula, 1. Find the price of a European Call option with Strike price 180 2. Find the price of a European Put option with Strike price 110. 2.2 Binomial Tree Using a binomial tree with 30 steps, and again for 100 steps, 1. Find the price of a European Call option with Strike price 180. 2. Find the price of a European Put option with Strike price 110 Include at least a portion of one of your trees in your report. 2.3 Simulation Assume that the Apple stock price follows a Geometric Brownian Motion. Using simulation, simulate price paths and 1. Find the price of a European Call option with Strike price 180 2. Find the price of a European Put option with Strike price 110