Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You will create a start-up company of your desire/interest. The company can either sell products, sell a service or a combination of both. Your role

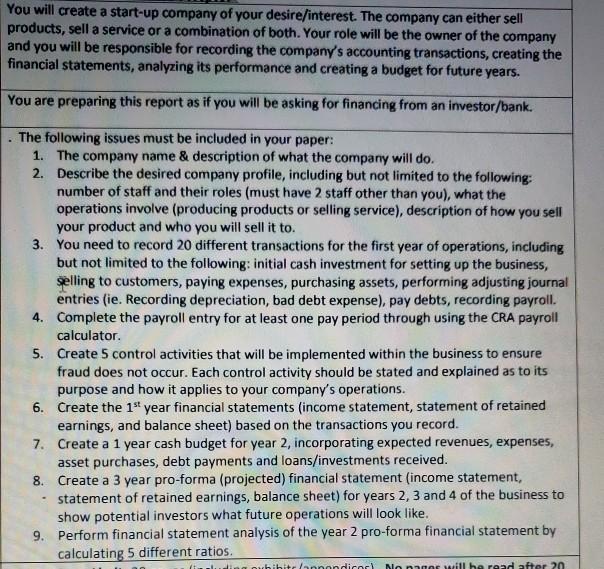

You will create a start-up company of your desire/interest. The company can either sell products, sell a service or a combination of both. Your role will be the owner of the company and you will be responsible for recording the companys accounting transactions, creating the financial statements, analyzing its performance and creating a budget for future years.

*20 transactions are needed.

You will create a start-up company of your desire/interest. The company can either sell products, sell a service or a combination of both. Your role will be the owner of the company and you will be responsible for recording the company's accounting transactions, creating the financial statements, analyzing its performance and creating a budget for future years. You are preparing this report as if you will be asking for financing from an investor/bank. The following issues must be included in your paper: 1. The company name & description of what the company will do. 2. Describe the desired company profile, including but not limited to the following: number of staff and their roles (must have 2 staff other than you), what the operations involve (producing products or selling service), description of how you sell your product and who you will sell it to. 3. You need to record 20 different transactions for the first year of operations, including but not limited to the following: initial cash investment for setting up the business, Selling to customers, paying expenses, purchasing assets, performing adjusting journal entries (ie. Recording depreciation, bad debt expense), pay debts, recording payroll. 4. Complete the payroll entry for at least one pay period through using the CRA payroll calculator 5. Create 5 control activities that will be implemented within the business to ensure fraud does not occur. Each control activity should be stated and explained as to its purpose and how it applies to your company's operations. 6. Create the 1"' year financial statements (income statement, statement of retained earnings, and balance sheet) based on the transactions you record. 7. Create a 1 year cash budget for year 2, incorporating expected revenues, expenses, asset purchases, debt payments and loans/investments received. 8. Create a 3 year pro-forma (projected) financial statement (income statement, statement of retained earnings, balance sheet) for years 2, 3 and 4 of the business to show potential investors what future operations will look like. 9. Perform financial statement analysis of the year 2 pro-forma financial statement by calculating 5 different ratios. using hihitr annondicarl Nonnor will be read after 20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started