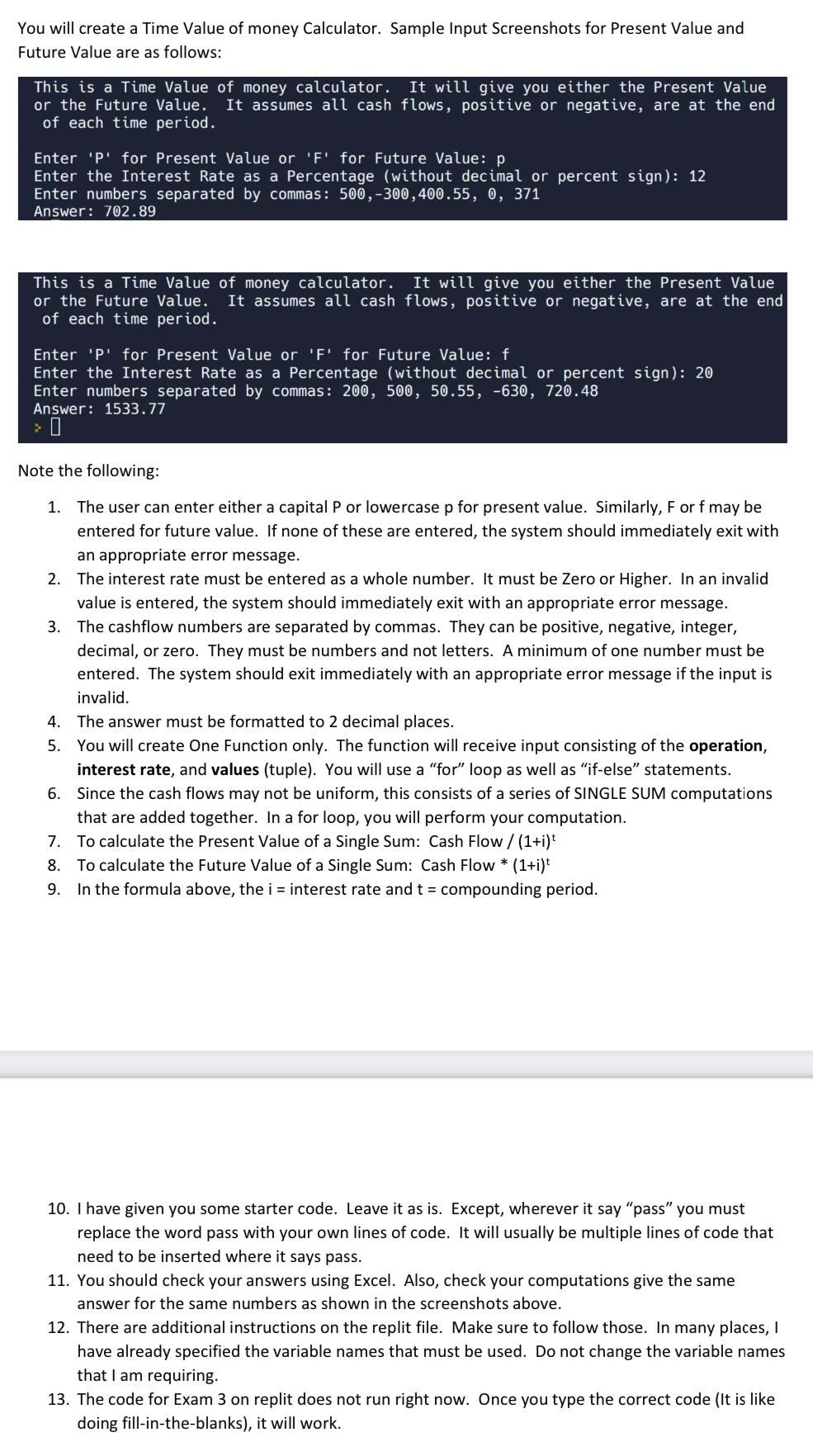

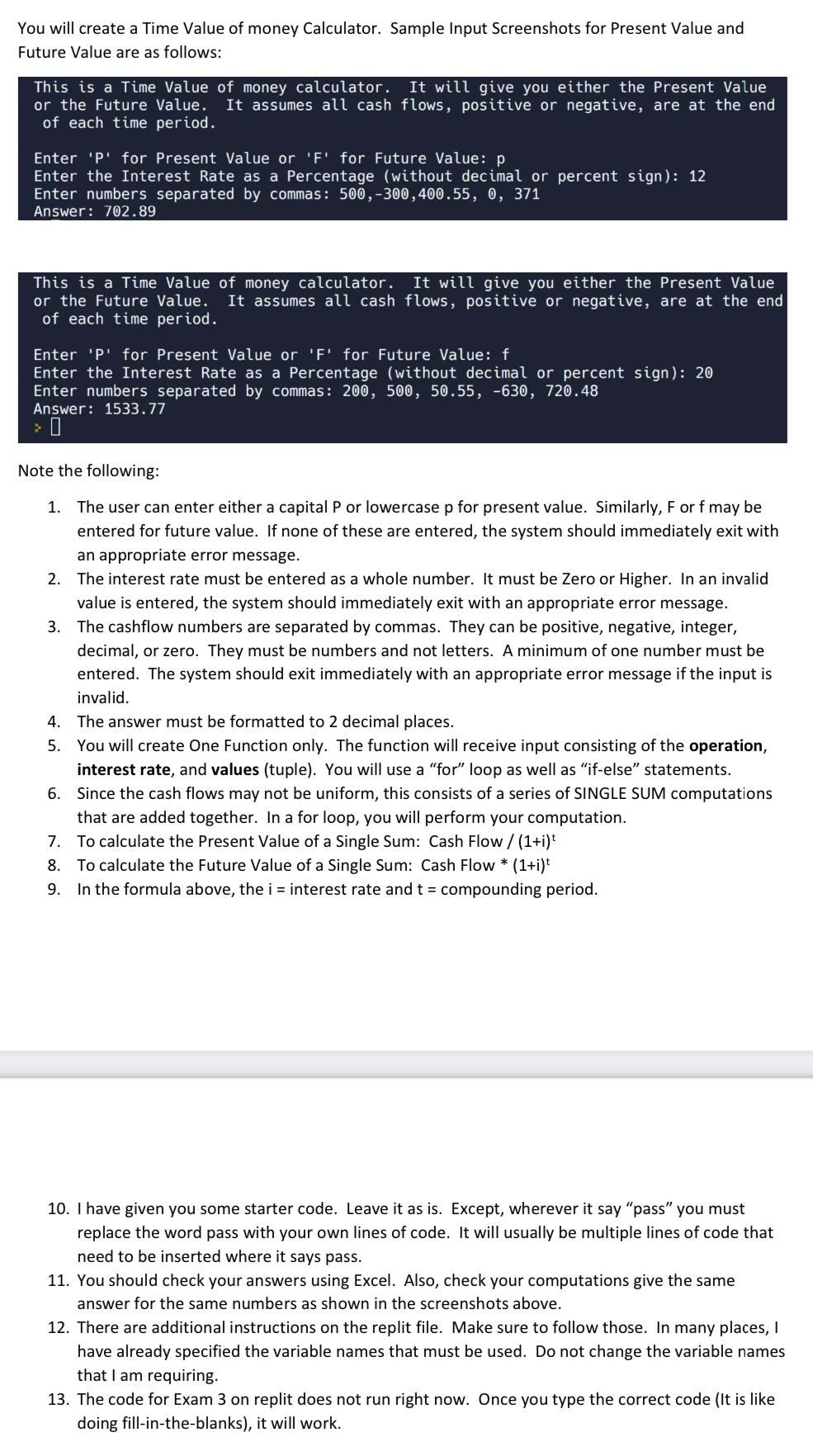

You will create a Time Value of money Calculator. Sample Input Screenshots for Present Value and Future Value are as follows: This is a Time Value of money calculator. It will give you either the Present Value or the Future Value. It assumes all cash flows, positive or negative, are at the end of each time period. Enter ' P ' for Present Value or ' F ' for Future Value: p Enter the Interest Rate as a Percentage (without decimal or percent sign): 12 Enter numbers separated by commas: 500,300,400.55,0,371 Answer: 702.89 This is a Time Value of money calculator. It will give you either the Present Value or the Future Value. It assumes all cash flows, positive or negative, are at the end of each time period. Enter ' P ' for Present Value or ' F ' for Future Value: f Enter the Interest Rate as a Percentage (without decimal or percent sign): 20 Enter numbers separated by commas: 200,500,50.55,630,720.48 Answer: 1533.77 : : Anser Note the following: 1. The user can enter either a capital P or lowercase p for present value. Similarly, F or f may be entered for future value. If none of these are entered, the system should immediately exit with an appropriate error message. 2. The interest rate must be entered as a whole number. It must be Zero or Higher. In an invalid value is entered, the system should immediately exit with an appropriate error message. 3. The cashflow numbers are separated by commas. They can be positive, negative, integer, decimal, or zero. They must be numbers and not letters. A minimum of one number must be entered. The system should exit immediately with an appropriate error message if the input is invalid. 4. The answer must be formatted to 2 decimal places. 5. You will create One Function only. The function will receive input consisting of the operation, interest rate, and values (tuple). You will use a "for" loop as well as "if-else" statements. 6. Since the cash flows may not be uniform, this consists of a series of SINGLE SUM computations that are added together. In a for loop, you will perform your computation. 7. To calculate the Present Value of a Single Sum: Cash Flow /(1+i)t 8. To calculate the Future Value of a Single Sum: Cash Flow * (1+i)t 9. In the formula above, the i= interest rate and t= compounding period. 10. I have given you some starter code. Leave it as is. Except, wherever it say "pass" you must replace the word pass with your own lines of code. It will usually be multiple lines of code that need to be inserted where it says pass. 11. You should check your answers using Excel. Also, check your computations give the same answer for the same numbers as shown in the screenshots above. 12. There are additional instructions on the replit file. Make sure to follow those. In many places, I have already specified the variable names that must be used. Do not change the variable names that I am requiring. 13. The code for Exam 3 on replit does not run right now. Once you type the correct code (It is like doing fill-in-the-blanks), it will work. You will create a Time Value of money Calculator. Sample Input Screenshots for Present Value and Future Value are as follows: This is a Time Value of money calculator. It will give you either the Present Value or the Future Value. It assumes all cash flows, positive or negative, are at the end of each time period. Enter ' P ' for Present Value or ' F ' for Future Value: p Enter the Interest Rate as a Percentage (without decimal or percent sign): 12 Enter numbers separated by commas: 500,300,400.55,0,371 Answer: 702.89 This is a Time Value of money calculator. It will give you either the Present Value or the Future Value. It assumes all cash flows, positive or negative, are at the end of each time period. Enter ' P ' for Present Value or ' F ' for Future Value: f Enter the Interest Rate as a Percentage (without decimal or percent sign): 20 Enter numbers separated by commas: 200,500,50.55,630,720.48 Answer: 1533.77 : : Anser Note the following: 1. The user can enter either a capital P or lowercase p for present value. Similarly, F or f may be entered for future value. If none of these are entered, the system should immediately exit with an appropriate error message. 2. The interest rate must be entered as a whole number. It must be Zero or Higher. In an invalid value is entered, the system should immediately exit with an appropriate error message. 3. The cashflow numbers are separated by commas. They can be positive, negative, integer, decimal, or zero. They must be numbers and not letters. A minimum of one number must be entered. The system should exit immediately with an appropriate error message if the input is invalid. 4. The answer must be formatted to 2 decimal places. 5. You will create One Function only. The function will receive input consisting of the operation, interest rate, and values (tuple). You will use a "for" loop as well as "if-else" statements. 6. Since the cash flows may not be uniform, this consists of a series of SINGLE SUM computations that are added together. In a for loop, you will perform your computation. 7. To calculate the Present Value of a Single Sum: Cash Flow /(1+i)t 8. To calculate the Future Value of a Single Sum: Cash Flow * (1+i)t 9. In the formula above, the i= interest rate and t= compounding period. 10. I have given you some starter code. Leave it as is. Except, wherever it say "pass" you must replace the word pass with your own lines of code. It will usually be multiple lines of code that need to be inserted where it says pass. 11. You should check your answers using Excel. Also, check your computations give the same answer for the same numbers as shown in the screenshots above. 12. There are additional instructions on the replit file. Make sure to follow those. In many places, I have already specified the variable names that must be used. Do not change the variable names that I am requiring. 13. The code for Exam 3 on replit does not run right now. Once you type the correct code (It is like doing fill-in-the-blanks), it will work