Question

You will demonstrate your mastery of the following competencies: Evaluate tax laws, regulations, and codes for diverse financial situations Prepare complex income tax returns that

You will demonstrate your mastery of the following competencies:

- Evaluate tax laws, regulations, and codes for diverse financial situations

- Prepare complex income tax returns that adhere to tax laws, regulations, and codes

- Advise clients on tax positions to achieve desired outcomes

Scenario

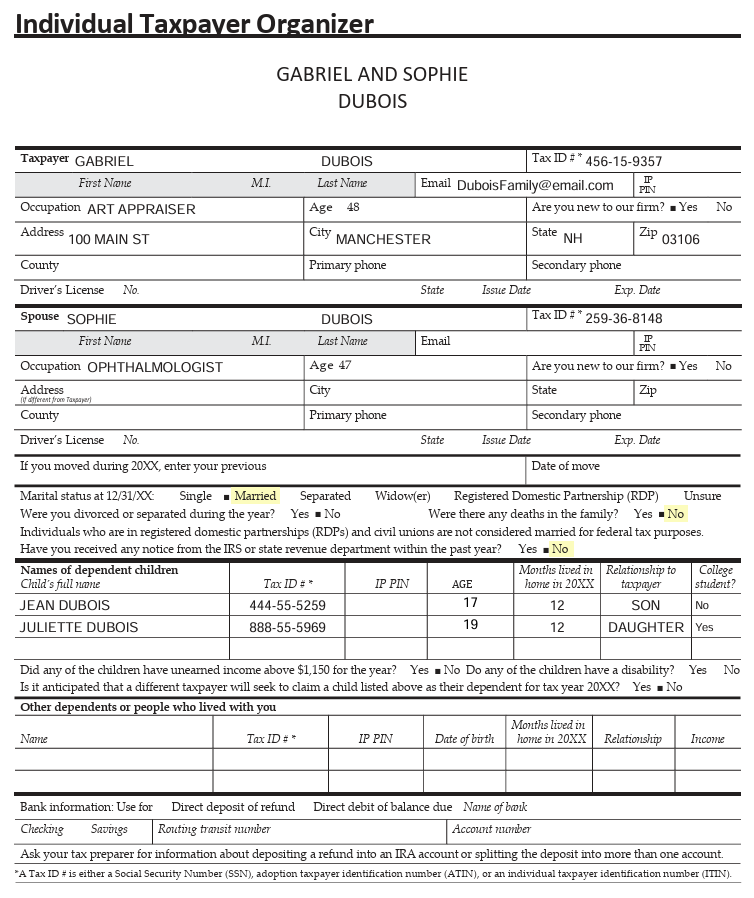

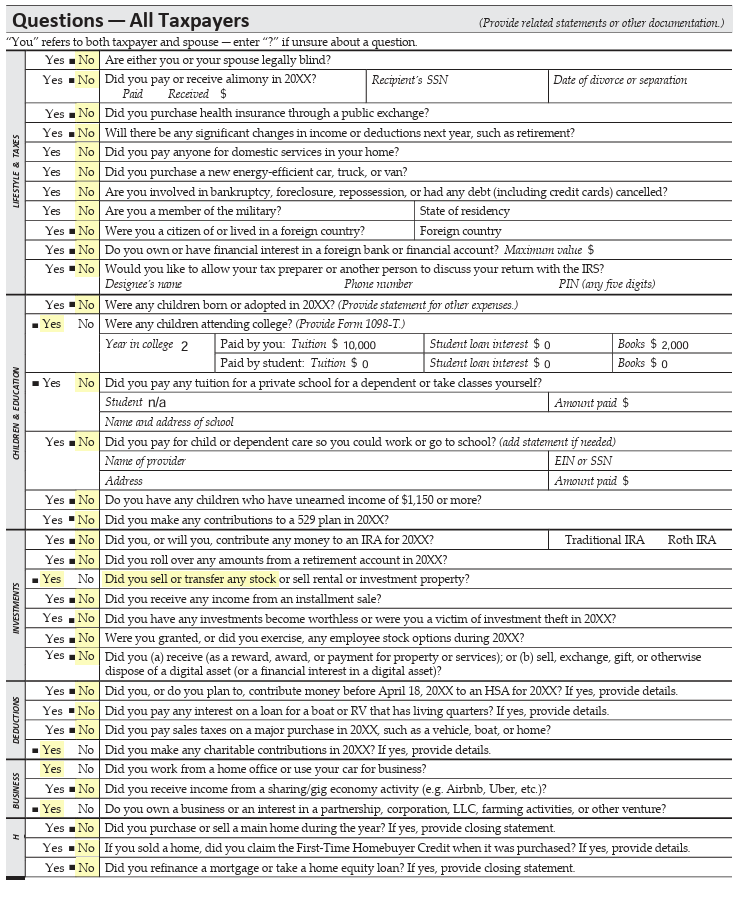

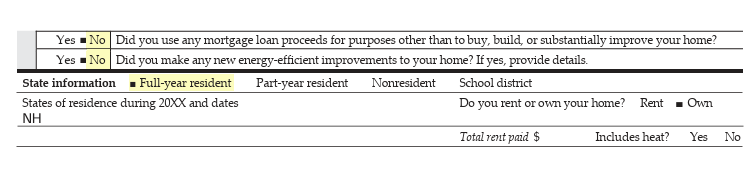

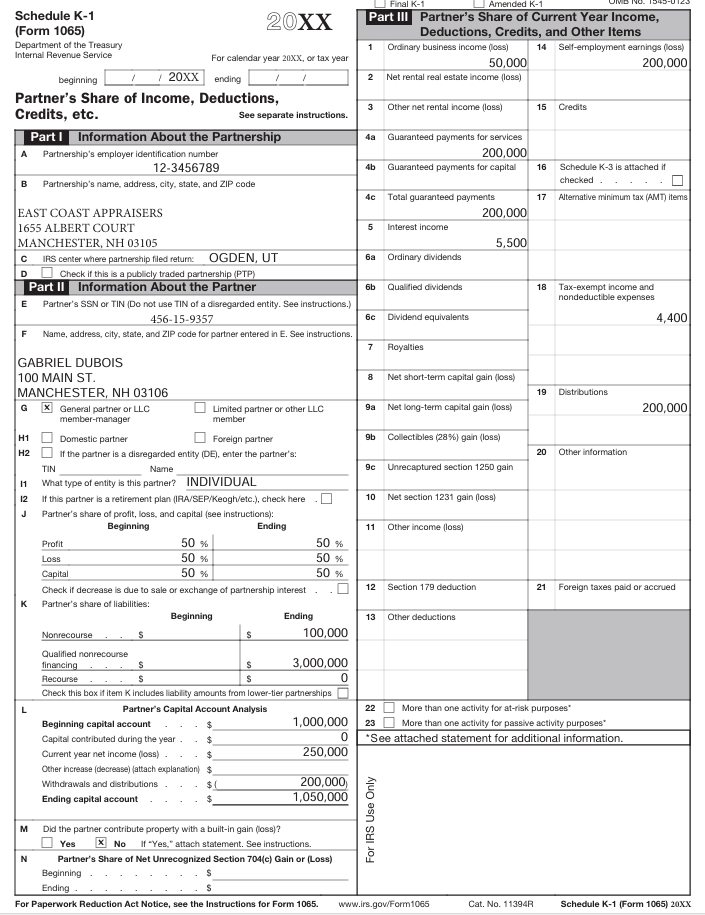

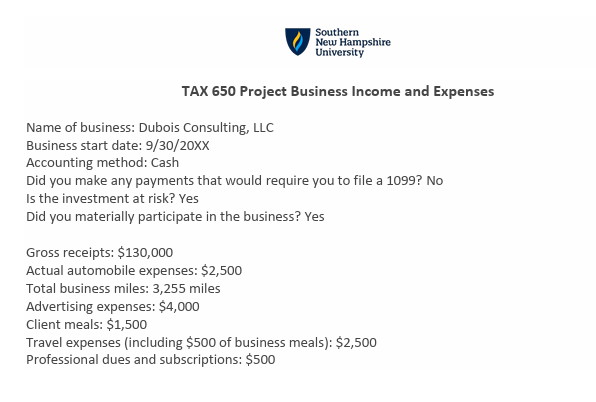

You are a tax preparer and have been asked to complete the previous year's tax return for new client Gabriel and Sophie Dubois. Because the Dubois children, Jean and Juliette, are now in college or soon to enter college, Gabriel and Sophie decided to pursue opportunities that resulted in additional streams of income. Gabriel is employed as an appraiser, and Sophie is an ophthalmologist at the local clinic. The Dubois couple provided the tax documents and additional information you requested for their tax return during their interview. In this interview, Sophie mentioned that she hates owing money with her tax return and wants to know how to avoid that scenario. To properly prepare the complex income tax return and advise your client, you will need to apply the appropriate tax laws, regulations, and codes.

Directions

Complete an individual federal tax return for the current year and construct a memo for sharing results and recommendations with the client. Refer to the Supporting Materials and module resources for access to the correct tax return forms. Use any necessary documents from Milestone One and Milestone Two for this project. Remember to address and incorporate any feedback you may have received from your instructor on your milestone assignments.

Specifically, you must address the following rubric criteria:

Part One: Tax Code and Planning: Use the client's tax profile and provided documents to identify the appropriate tax forms that are needed to complete the tax return. These criteria will be assessed through the completion of the tax form.

- Connect the client's information to the appropriate tax forms needed to complete the tax return.

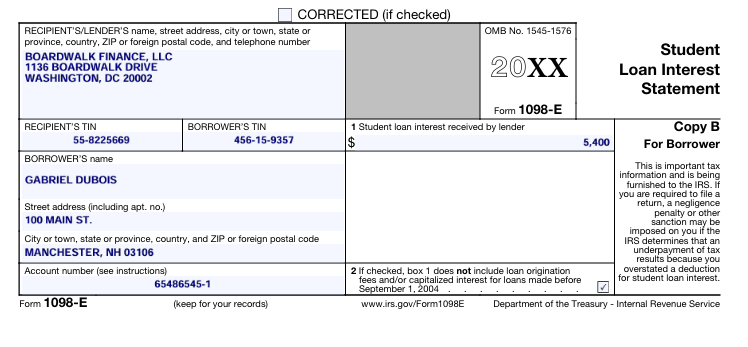

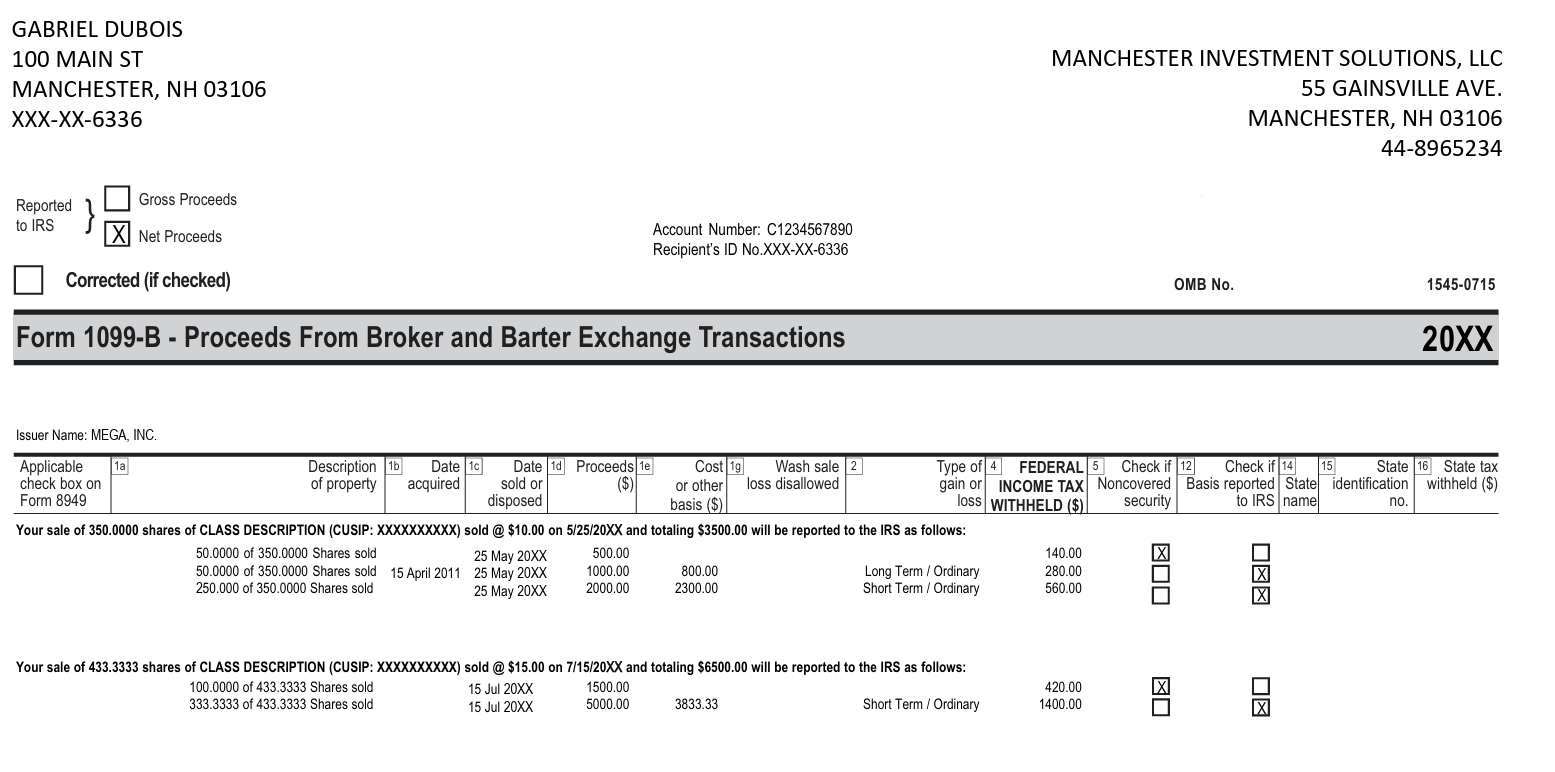

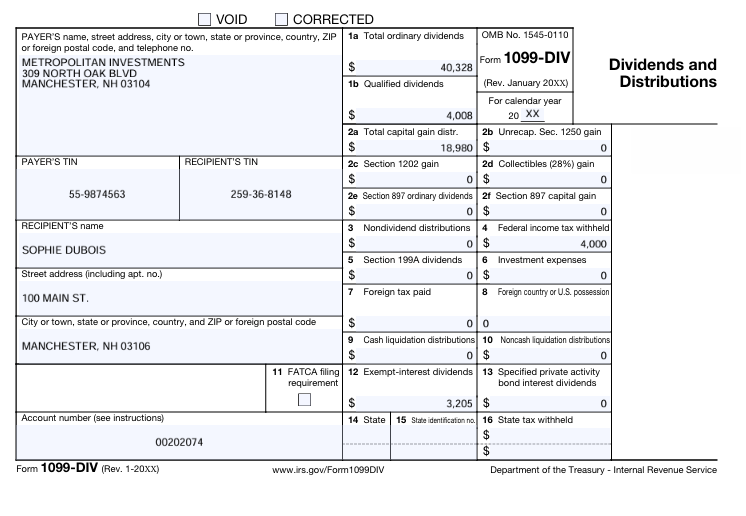

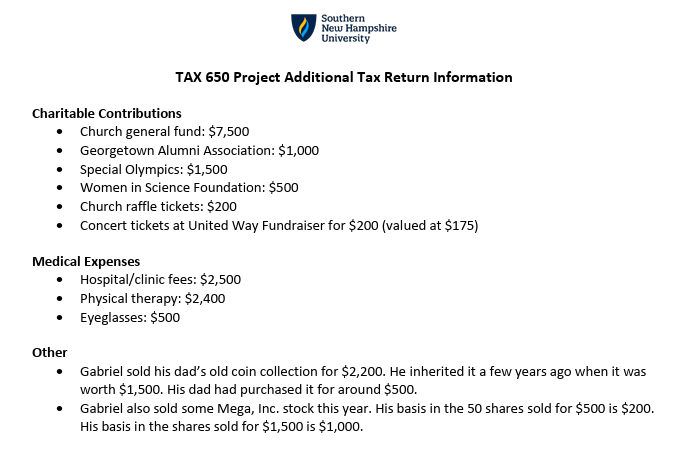

- Apply the relevant information from the provided taxpayer source documentation to the tax forms.

- Assess the character of all income sources.

- Evaluate whether the taxpayer's deductions should be itemized or not based on ethical standards for determining and communicating deductions.

- Distinguish between the expenses connected with the client's employment that are eligible for deduction and those that are not.

Part Two: Prepare a Complex Tax Return: Complete a tax return that adheres to tax laws, regulations, and codes.

- Evaluate which items meet the criteria for being included in gross income.

- Categorize deductions as either being from adjusted gross income or for adjusted gross income, including any variances or inaccuracies in these deductions.

- Calculate the individual taxable income using the tax formula.

- Determine whether the client has overpaid or underpaid their taxes. Include the following in your response:

- The client's calculated tax liability

- The client's subtracted tax withholdings for the current tax year

- Explain the tax laws, regulations, and codes that were used to determine the proper tax reporting.

Part Three: Tax Position Advising: Summarize the results of the tax return in a memo and provide advice to the client explaining how they can avoid having a balance due for future tax returns.

- Summarize the tax issue and possible solutions using concise language and ethical standards for tax preparers.

- Determine the client's potential positions for future tax returns using tax law to support your reasoning.

- Recommend the best and most practical solution for the client based on their goal for future tax returns using concise language.

- Justify whether the client is eligible for VITA or TCE.

- Justify your recommendation to the client using applicable tax laws, regulations, and codes.

Completed Tax Return With Correct Tax Forms Your submission should include the correct tax forms that are applicable to your client's situation and a completed tax return.

Individual Taxpayer Organizer GABRIEL AND SOPHIE DUBOIS Taxpayer GABRIEL First Name Occupation ART APPRAISER Address 100 MAIN ST County DUBOIS Tax ID # 456-15-9357 MI Last Name Email DuboisFamily@email.com IP Age 48 City MANCHESTER State Primary phone Are you new to our firm? Yes Zip 03106 Secondary phone PIN State Issue Date Exp. Date No Driver's License No. Spouse SOPHIE First Name Occupation OPHTHALMOLOGIST DUBOIS ML Last Name Email Age 47 Address (different from Taxpayer) City Tax ID # 259-36-8148 Are you new to our firm? Yes No State IP PIN Zip County Primary phone Secondary phone Driver's License No. State Issue Date Exp. Date If you moved during 20XX, enter your previous Date of move Marital status at 12/31/XX Single Married Separated Widow(er) Unsure Registered Domestic Partnership (RDP) Were you divorced or separated during the year? Yes No Were there any deaths in the family? Yes No Individuals who are in registered domestic partnerships (RDPs) and civil unions are not considered married for federal tax purposes. Have you received any notice from the IRS or state revenue department within the past year? Yes No Names of dependent children Child's full name JEAN DUBOIS JULIETTE DUBOIS Tax ID # * 444-55-5259 888-55-5969 IP PIN AGE Months lived in Relationship to home in 20XX taxpayer College student? 17 12 19 12 SON DAUGHTER Yes No Did any of the children have unearned income above $1,150 for the year? Yes No Do any of the children have a disability? Yes No Is it anticipated that a different taxpayer will seek to claim a child listed above as their dependent for tax year 20XX? Yes No Other dependents or people who lived with you Name Tax ID # * IP PIN Date of birth Months lived in home in 20XX Relationship Income Bank information: Use for Direct deposit of refund Direct debit of balance due Name of bank Checking Savings Routing transit number Account number Ask your tax preparer for information about depositing a refund into an IRA account or splitting the deposit into more than one account. *A Tax ID # is either a Social Security Number (SSN), adoption taxpayer identification number (ATIN), or an individual taxpayer identification number (ITIN).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Thank you for providing additional details regarding the Dubois familys tax situation Based on the information provided here are some key points to consider for their tax return 1 Both Gabriel and Sop...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started