Question

You will find quotes for US Treasury bonds published by the Wall Street Journal in on September 23rd, 2022. All bonds chosen mature on February

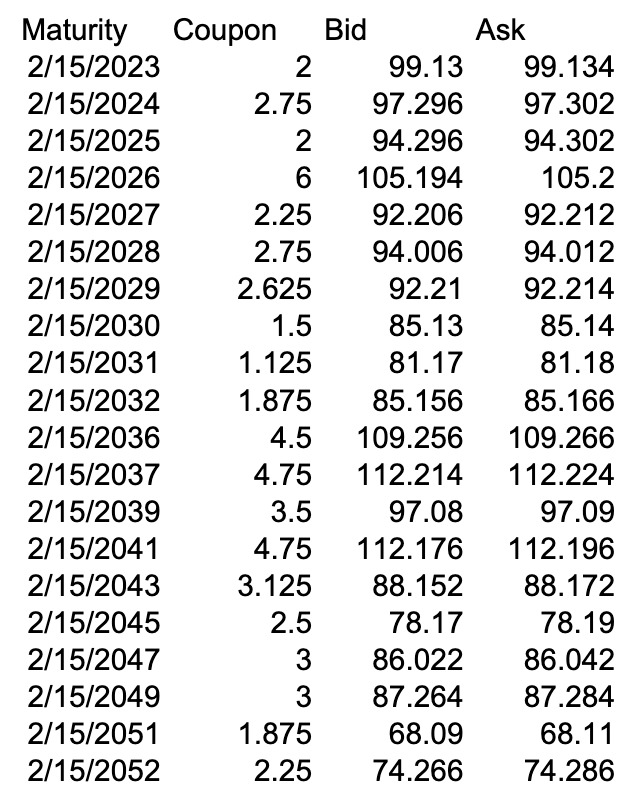

You will find quotes for US Treasury bonds published by the Wall Street Journal in on September 23rd, 2022. All bonds chosen mature on February 15th, in different years, starting from 2023 until 2050. Use the software R for the following calculations. If you need help for question (d), please wait for the TA section where more detailed instructions will be provided. (a) What days of each year do these bond make their semi-annual payments? (b) What was the day of the last semi-annual payment for each bond? (c) What is the accrued interest and the dirty price for each bond? (take the clean price to be the mid point between the bid and the ask price.) (d) Assume that at the current time t, which is September 23, 2022, the spot rate is given by a third order polynomial: rt,u = a1u + a2u2 + a3u3, for some vector of parameters a = (a1, a2, a3) to be determined. Assume that the interest rate is continuously compounded, that is, the present value factor for a riskless payout arriving at time u > t is ert,u(ut). Given any guess for a = (a1, a2, a3) and any bond b, let PVb(a) denote the present value of the payout of bond b given that the spot rate is given by (1). Let Pb denote the true dirty price of the bond. Create a program that chooses a = (a1, a2, a3) in order to minimize the square pricing error between the present value and the actual bond prices, b (Pb PVb(a))2. Plot the implied term structure of interest rates.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started