Question

You will have 4 capital components in your wacc estimate: short-term debt, long-term debt, preferred stock, and common equity. Assume that Lawns capital structure is

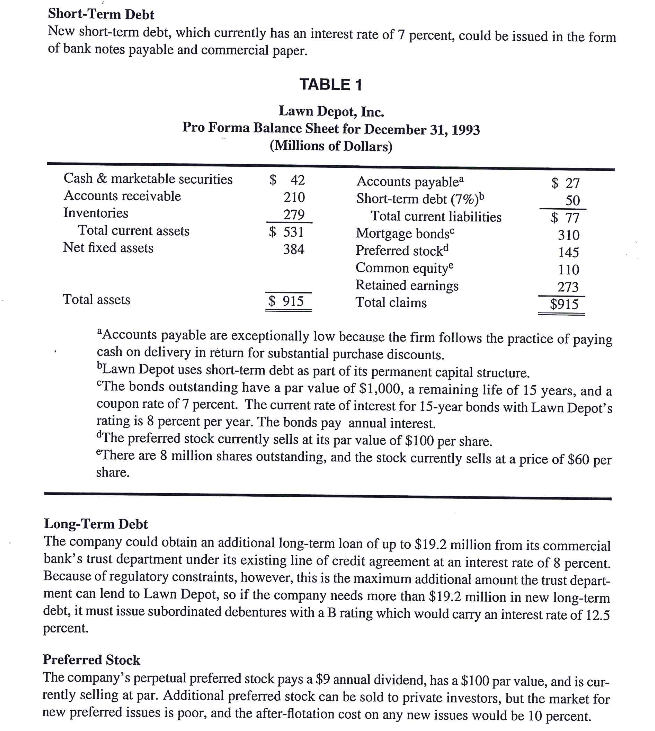

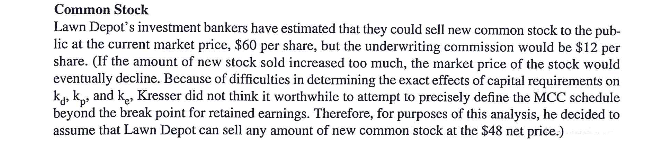

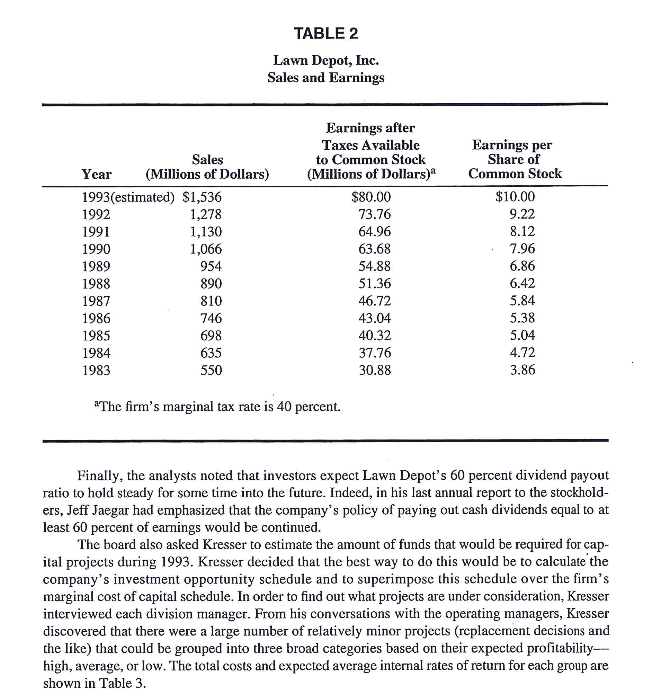

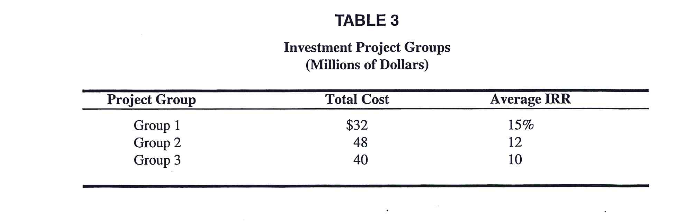

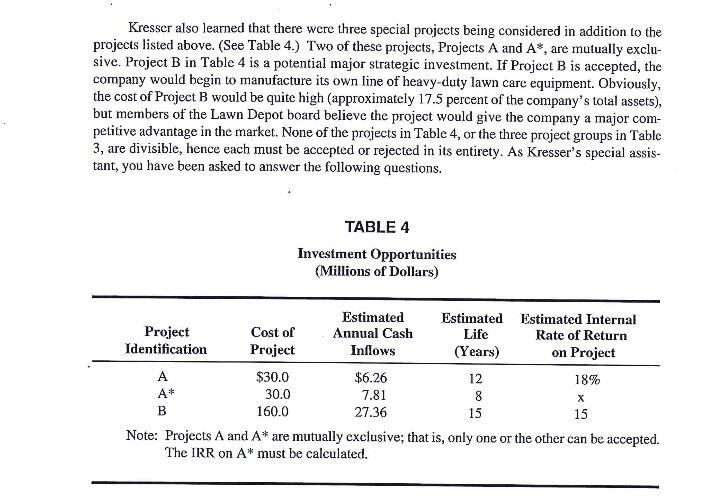

You will have 4 capital components in your wacc estimate: short-term debt, long-term debt, preferred stock, and common equity. Assume that Lawns capital structure is 5% short-term debt, 30% long-term debt, 15% preferred stock, and 50% common equity. Estimate expected future growth as 0.5 x historical growth rate of EPS. Note that using more than $19.2M of long-term debt will see the pre-tax cost of long-term debt rise from 8% to 12.5%. Note also that the firm expects a finite amount of earnings that it will generate and retain next year, and if Lawn needs more equity than that to finance capital investment, then it will need to issue new common stock. You will have to estimate the cost of reinvested profit (retained earnings) and the cost of new common stock. Please use the constant growth discounted dividend model only to estimate the cost of equity, both retained earnings and new common stock.

Please answer and explain the following, show work:

a)estimate the multiple wacc's: one original wacc, one for the rising cost of debt, and one for the rising cost of common equity.

b) How much can the company spend on new capital budget projects before its wacc rises? using the breakpoint formula.

c) Which projects should be accepted? A and A* are mutually exclusive, while B and the three groups are independent.

d) What is the company's marginal cost of capital?

Lawn Depot, Inc., is a nationwide retailer of lawn and garden supplies and equipment. The company operates a chain of 380 retail outlets located throughout the United States. Lawn Depot sells all types of lawn and garden supplies and equipment, including pesticides, fertilizers, seed, sod, hand tools, and heavy-duty equipment. Each outlet also offers lawn care and maintenance services and equip- ment repair services as well. Lawn Depot began operations as a small, family-owned lawn care center in Champaign, lli nois. The company carries a large inventory of supplies and equipment to meet almost any customer's needs. In addition, the stores are open when customers most often need them-namely, on Satur days and Sundays and until 9 PM on weeknights -and competent employees are available to advise customers and to provide first-rate service. As the firm's reputation for service and convenience grew, Lawn Depot began to expand within the state of Illinois and, later, throughout the country The high standards and business acumen of Michael Jacgar, the founder of the company, were responsible for the firm's success. Lawn Depot remained privately held by the Jaegar family until 1983, when 70 percent of the outstanding stock was sold in a public offering to raise funds for expansion. The firm continued to be managed by members of the Jacgar family. After Michael Jae- gar retired early in 1993, his nephew, Jeff Jacgar, was unanimously elected to the company's top post by the board of directors. Jeff Jaegar's background was in marketing, so he decided to bring in Eric Kresser, who has an MBA in finance, to be his assistant and to provide expertise in the areas of finance and operations. Kresser would be responsible for looking for problems in Lawn Depot's operations and then determining how they could be eliminated. As he began to familiarize himself with the activities of the various departments and the company's operations, Kresser became aware of the fairly haphazard way capital-investment deci sions were made. Mike Doyle, the company's financial vice president, is responsible for capital bud- geting at Lawn Depot. He usually approves all capital investment requests as they come in from the district managers. Recently, however, Doyle has begun to calculate the return on investment (ROI) for each district and to let managers know if their districts' ROIs are below the company aver- age. Kresser noticed that with this procedure, managers in districts with low returns on investment typically do not make substantial capital investment requests until they are able to pull up their dis- trict's ROI to that of the overall company. Thus, funds for projects are simply allotted to those dis- tricts that have had above-average ROIs in the past. In addition, in those years in which there were many project requests, or in which funds for capital expenditures were limited, Doyle had the finance department calculate the payback period on larger investments. Several potential capital investments whose payback periods were fairly long had been rejected in favor of projects with quicker returns. Lawn Depot, Inc., is a nationwide retailer of lawn and garden supplies and equipment. The company operates a chain of 380 retail outlets located throughout the United States. Lawn Depot sells all types of lawn and garden supplies and equipment, including pesticides, fertilizers, seed, sod, hand tools, and heavy-duty equipment. Each outlet also offers lawn care and maintenance services and equip- ment repair services as well. Lawn Depot began operations as a small, family-owned lawn care center in Champaign, lli nois. The company carries a large inventory of supplies and equipment to meet almost any customer's needs. In addition, the stores are open when customers most often need them-namely, on Satur days and Sundays and until 9 PM on weeknights -and competent employees are available to advise customers and to provide first-rate service. As the firm's reputation for service and convenience grew, Lawn Depot began to expand within the state of Illinois and, later, throughout the country The high standards and business acumen of Michael Jacgar, the founder of the company, were responsible for the firm's success. Lawn Depot remained privately held by the Jaegar family until 1983, when 70 percent of the outstanding stock was sold in a public offering to raise funds for expansion. The firm continued to be managed by members of the Jacgar family. After Michael Jae- gar retired early in 1993, his nephew, Jeff Jacgar, was unanimously elected to the company's top post by the board of directors. Jeff Jaegar's background was in marketing, so he decided to bring in Eric Kresser, who has an MBA in finance, to be his assistant and to provide expertise in the areas of finance and operations. Kresser would be responsible for looking for problems in Lawn Depot's operations and then determining how they could be eliminated. As he began to familiarize himself with the activities of the various departments and the company's operations, Kresser became aware of the fairly haphazard way capital-investment deci sions were made. Mike Doyle, the company's financial vice president, is responsible for capital bud- geting at Lawn Depot. He usually approves all capital investment requests as they come in from the district managers. Recently, however, Doyle has begun to calculate the return on investment (ROI) for each district and to let managers know if their districts' ROIs are below the company aver- age. Kresser noticed that with this procedure, managers in districts with low returns on investment typically do not make substantial capital investment requests until they are able to pull up their dis- trict's ROI to that of the overall company. Thus, funds for projects are simply allotted to those dis- tricts that have had above-average ROIs in the past. In addition, in those years in which there were many project requests, or in which funds for capital expenditures were limited, Doyle had the finance department calculate the payback period on larger investments. Several potential capital investments whose payback periods were fairly long had been rejected in favor of projects with quicker returnsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started