Answered step by step

Verified Expert Solution

Question

1 Approved Answer

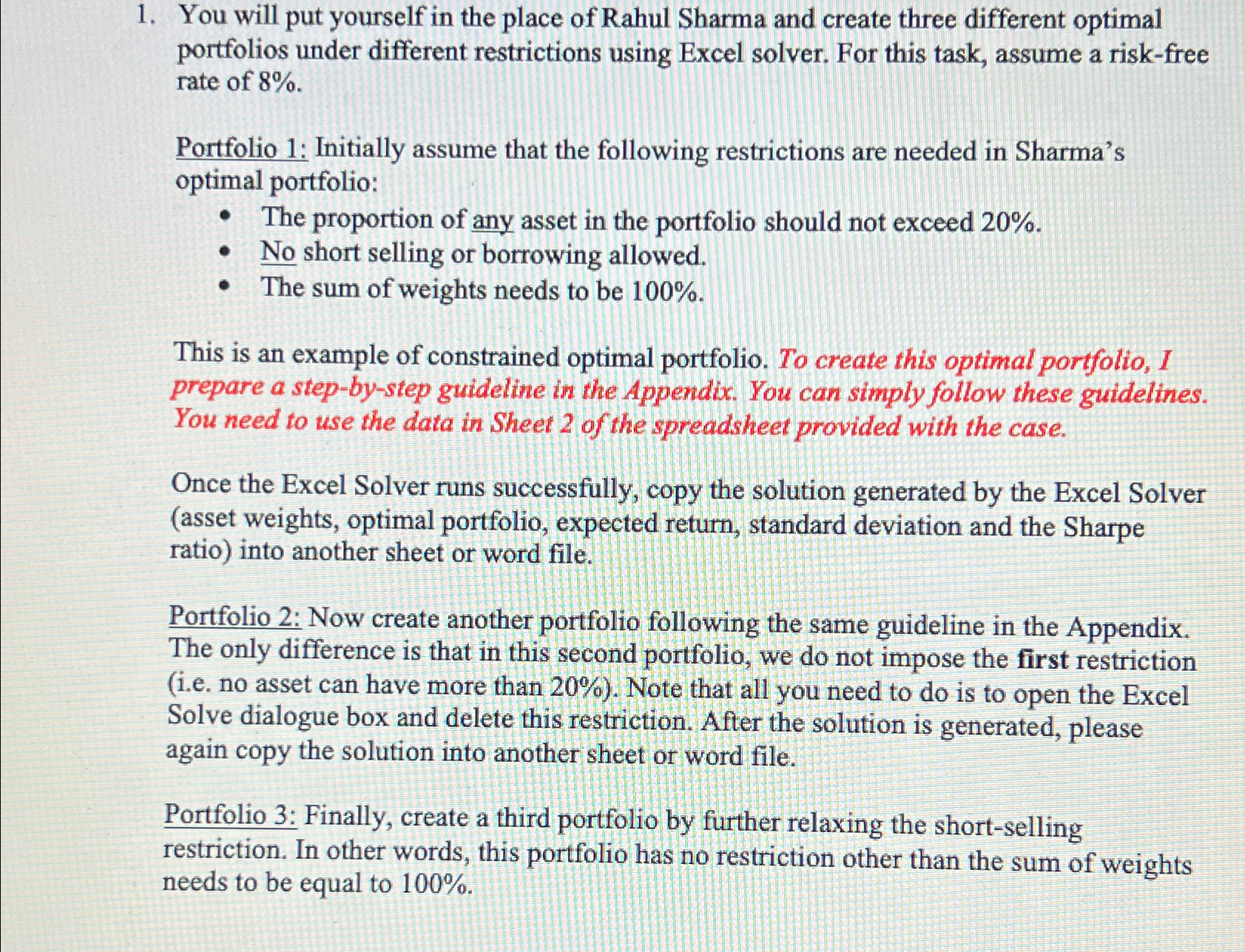

You will put yourself in the place of Rahul Sharma and create three different optimal portfolios under different restrictions using Excel solver. For this task,

You will put yourself in the place of Rahul Sharma and create three different optimal portfolios under different restrictions using Excel solver. For this task, assume a riskfree rate of

Portfolio : Initially assume that the following restrictions are needed in Sharma's optimal portfolio:

The proportion of any asset in the portfolio should not exceed

No short selling or borrowing allowed.

The sum of weights needs to be

This is an example of constrained optimal portfolio. To create this optimal portfolio, I prepare a stepbystep guideline in the Appendi You need to use the data in Sheet of the spreadsheet provided with the case.

Once the Excel Solver runs successfully, copy the solution generated by the Excel Solver asset weights, optimal portfolio, expected return, standard deviation and the Sharpe ratio into another sheet or word file.

Portfolio : Now create another portfolio following the same guideline in the Appendix. The only difference is that in this second portfolio, we do not impose the first restriction ie no asset can have more than Note that all you need to do is to open the Excel Solve dialogue box and delete this restriction. After the solution is generated, please again copy the solution into another sheet or word file.

Portfolio : Finally, create a third portfolio by further relaxing the shortselling restriction. In other words, this portfolio has no restriction other than the sum of weights needs to be equal to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started