Answered step by step

Verified Expert Solution

Question

1 Approved Answer

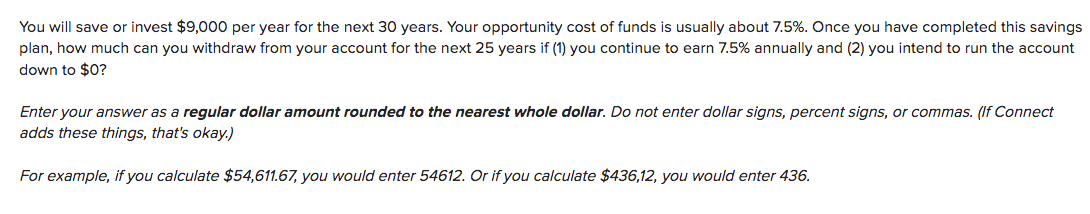

You will save or invest $ 9 , 0 0 0 per year for the next 3 0 years. Your opportunity cost of funds is

You will save or invest $ per year for the next years. Your opportunity cost of funds is usually about Once you have completed this savings

plan, how much can you withdraw from your account for the next years if you continue to earn annually and you intend to run the account

down to $

Enter your answer as a regular dollar amount rounded to the nearest whole dollar. Do not enter dollar signs, percent signs, or commas. If Connect

adds these things, that's okay.

For example, if you calculate $ you would enter Or if you calculate $ you would enter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started