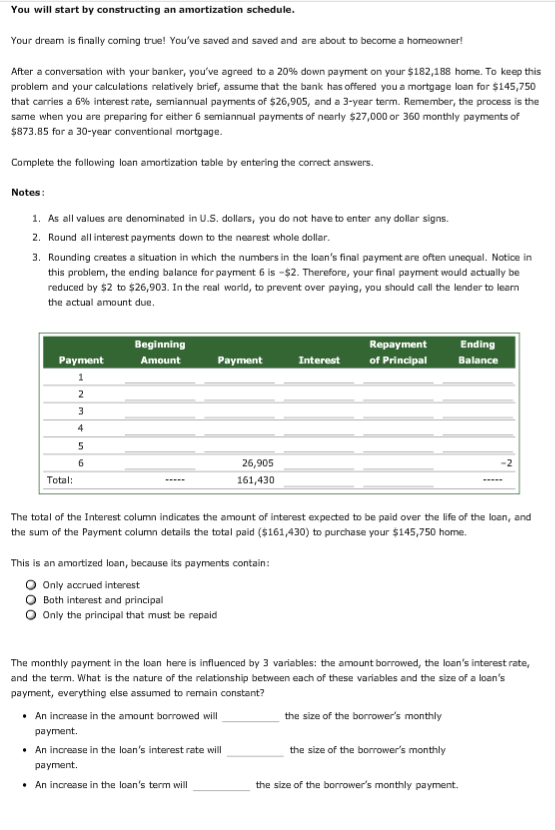

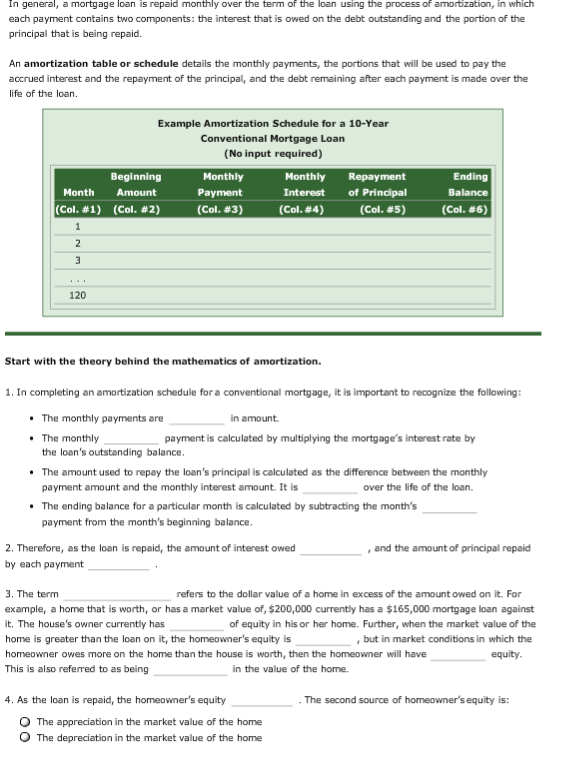

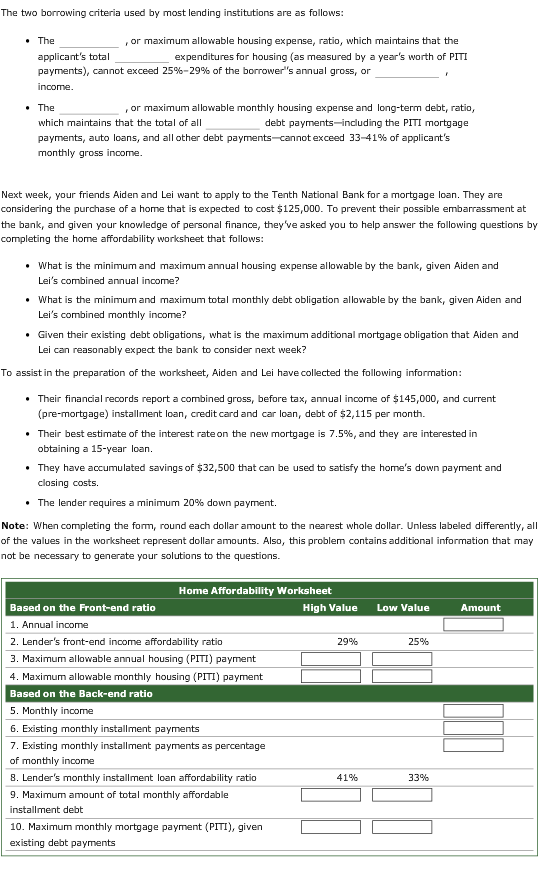

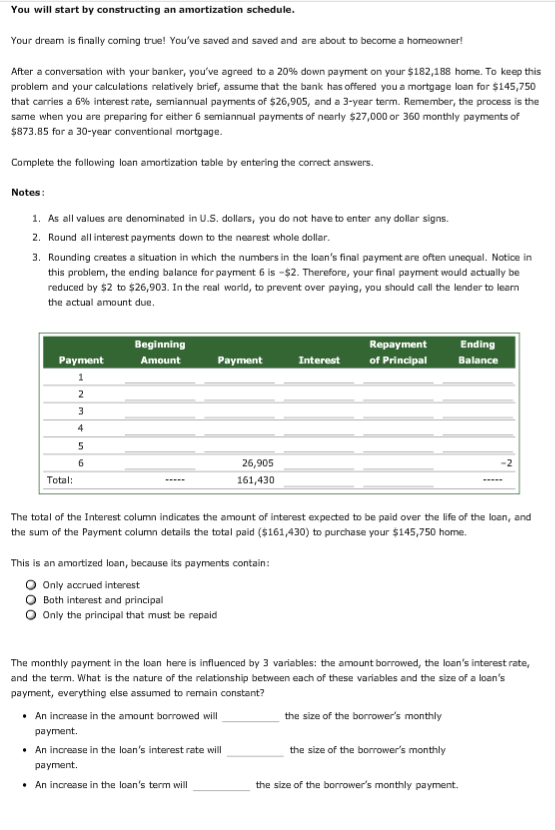

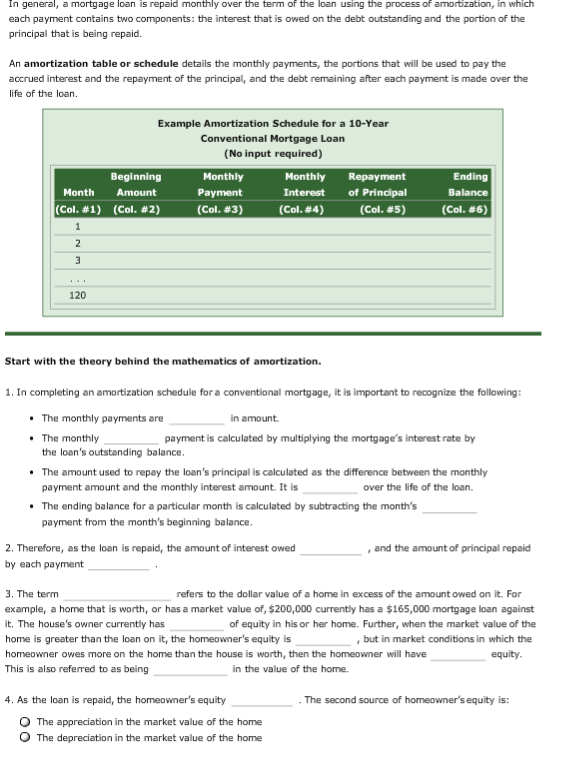

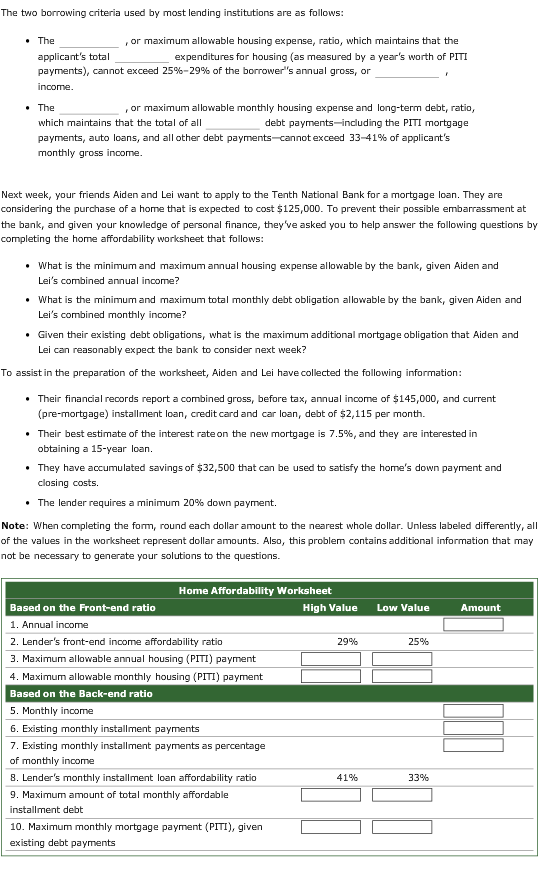

You will start by constructing an amortization schedule Your dream is finally coming true! You've saved and saved and are about to become a homeowner! After a conversation with your banker, you've agreed to a 20% down payment on your S 182,188 home. To keep this problem and your calculations relatively brief, assume that the bank has offered you a mortgage loan for $145,750 that carries a 6% interest rate, semiannual payments of $26,905, and a 3-year term. Remember, the process is the same when you are preparing for either 6 semiannual payments of nearly $27,000 or 360 monthly payments of 873.85 for a 30-year conventional mortgage. Complete the following loan amortization table by entering the correct answers. Notes 1 As all values are denominated in U.S. dollars, you do not have to enter any dollar signs 2. Round all interest payments down to the nearest whole dollar 3. Rounding creates a situation in which the numbers in the loan's final payment are often unequal. Notice in this problem, the ending balance for payment 6 is-$2. Therefore, your final payment would actually be reduced by $2 to $26,903. In the real world, to prevent over paying, you should call the lender to learn the actual amount due Beginning Ending Balance Payment Payment Interest of Principal 26,905 161,430 Total: The total of the Interest column indicates the amount of interest expected to be paid over the life of the loan, and the sum of the Payment column details the total paid ($161,430) to purchase your $145,750 home. This is an amortized loan, because its payments contain: O Only accrued interest O Both interest and principal O Only the principal that must be repaid The monthly payment in the loan here is influenced by 3 variables: the amount borrowed, the loan's interest rate, and the term. What is the nature of the relationship between each of these variables and the size of a loan's payment, everything else assumed to remain constant? .An increase in the amount borrowed will the size of the borrower's monthly payment. An increase in the loan's interest rate will the size of the borrower's monthly payment. An increase in the loan's term will the size of the borrower's monthly payment. In general, a mortgage loan is repaid monthly over the term of the loan using the process of amortzation, in which each payment contains two components: the interest that is owed on the debt outstanding and the portion of the principal that is being repaid. An amortization table or schedule details the monthly payments, the portions that will be used to pay the accrued interest and the repayment of the principal, and the debt remaining after each payment is made over the life of the loan. Example Amortization Schedule for a 10-Year Conventional Mortgage Loan (No input required Beginning Amount (Col. #2) Monthly Payment (Col. #3) Monthly Interest (Col. #4) Repayment of Principal (Col. #5) Ending Balance (Col. #6) Month (Col. #1) 120 Start with the theory behind the mathematics of amortization 1. In completing an amortization schedule for a conventional mortgage, it is important to recognize the folowing: The monthly payments are The monthly in amount payment is calculated by multiplying the mortgage's interest rate by the loan's outstanding balance The amount used to repay the loan's principal is calculated as the difference between the monthly payment amount and the monthly interest amount. It is over the life of the loan. The ending balance for a particular month is calculated by subtracting the month's payment from the month's beginning balance 2. Therefore, as the loan is repaid, the amount of interest owed , and the amount of principal repaid by each payment 3. The term example, a home that is worth, or has a market value of, $200,000 currently has a $165,000 mortgage loan against it. The house's owner currently has refers to the dollar value of a home in excess of the amount owed on it. For of equity in his or her home. Further, when the market value of the , but in market conditions in which the home is greater than the loan on it, the homeowner's equityis homeowner owes more on the home than the house is worth, then the homeowner will have This is also referred to as being equity n the value of the home 4. As the loan is repaid, the homeowner's equity The second source of homeowner's equity is: O The appreciation in the market value of the home O The depreciation in the market value of the home The two borrowing criteria used by most lending institutions are as follows The or maximum allowable housing expense, ratio, which maintains that the applicant's total payments), cannot exceed 25%-29% of the borrower''s annual gross, or income. expenditures for housing (as measured by a year's worth of PITI The , or maximum allowable monthly housing expense and long-term debt, ratio, which maintains that the total of all payments, auto loans, and all other debt payments-cannot exceed 33-41% of applicant's monthly gross i debt payments including the PITI mortgage income Next week, your friends Aiden and Lei want to apply to the Tenth National Bank for a mortgage loan. They are considering the purchase of a home that is expected to cost $125,000. To prevent their possible embarrassment at the bank, and given your knowledge of personal finance, they've asked you to help answer the following questions by completing the home affordability worksheet that follows . What is the minimum and maximum annual housing expense allowable by the bank, given Aiden and Lei's combined annual income? . What is the minimum and maximum total monthly debt obligation allowable by the bank, given Aiden and Lei's combined monthly income? . Given their existing debt obligations, what is the maximum additional mortgage obligation that Aiden and Lei can reasonably expect the bank to consider next week? To assist in the preparation of the worksheet, Aiden and Lei have collected the following information .Their financial records report a combined gross, before tax, annual income of $145,000, and current (pre-mortgage) installment loan, credit card and car loan, debt of $2,115 per month. . Their best estimate of the interest rate on the new mortgage is 7.5%, and they are interested in obtaining a 15-year loan. . They have accumulated savings of $32,500 that can be used to satisfy the home's down payment and closing costs. * The lender requires a minimum 20% down payment. Note: When completing the form, round each dollar amount to the nearest whole dollar. Unless labeled differently, all of the values in the worksheet represent dollar amounts. Also, this problem contains additional information that may not be necessary to generate your solutions to the questions. Home Affordability Worksheet Based on the Front-end ratio 1. Annual income 2. Lender's front-end income affordability ratio 3. Maximum allowable annual housing (PITI) payment 4. Maximum allowable monthly housing (PITI) payment Based on the Back-end ratio 5. Monthly income 6. Existing monthly installment payments 7. Existing monthly installment payments as percentage of monthly income 8. Lender's monthly installment loan affordability ratio 9. Maximum amount of total monthly affordable installment debt 10. Maximum monthly mortgage payment (PITI), given existing debt payments High Value Low Value Amount 2996 2596 4196 3396