Question

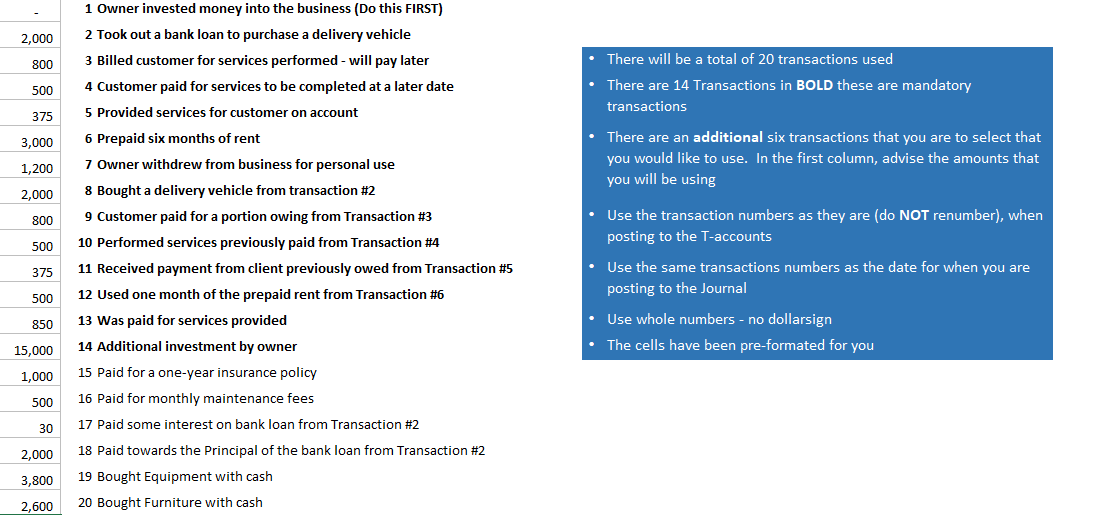

you will then record those transactions to your T-accounts. Remember that there is a minimum of two entries for each transaction for the Accounting Equation

you will then record those transactions to your T-accounts. Remember that there is a minimum of two entries for each transaction for the Accounting Equation to remain in balance. Number your transactions in the T-accounts as they appear on the transaction list to help you stay organized. Provide a final total for each T-account (remember - choose a side that the balance represents. No subtotals are to be recorded (exception of cash).

Once the T-accounts are complete, move the information to the Verify sheet to check if your balance. Finally, complete the Journal entries for the transactions selected. they should reflect the information on the T-accounts also.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started