Question

You will undertake a financial valuation of the listed company Regis Healthcare Limited (ASX Code: REG). You are required to value this company's equity. The

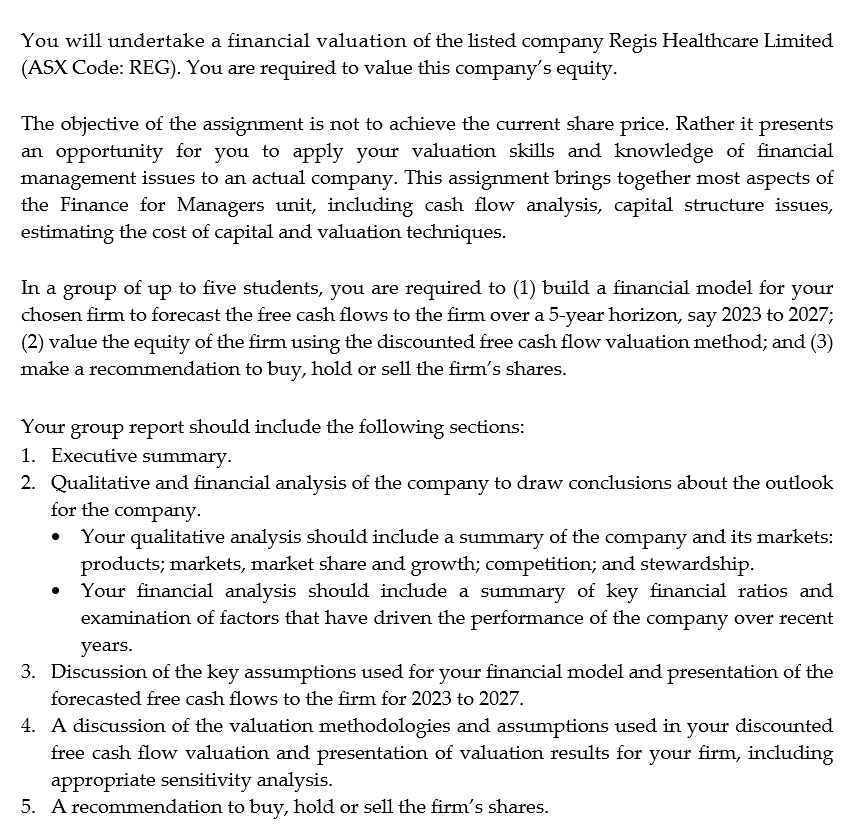

You will undertake a financial valuation of the listed company Regis Healthcare Limited\ (ASX Code: REG). You are required to value this company's equity.\ The objective of the assignment is not to achieve the current share price. Rather it presents\ an opportunity for you to apply your valuation skills and knowledge of financial\ management issues to an actual company. This assignment brings together most aspects of\ the Finance for Managers unit, including cash flow analysis, capital structure issues,\ estimating the cost of capital and valuation techniques.\ In a group of up to five students, you are required to (1) build a financial model for your\ chosen firm to forecast the free cash flows to the firm over a 5-year horizon, say 2023 to 2027;\ (2) value the equity of the firm using the discounted free cash flow valuation method; and (3)\ make a recommendation to buy, hold or sell the firm's shares.\ Your group report should include the following sections:\ Executive summary.\ Qualitative and financial analysis of the company to draw conclusions about the outlook\ for the company.\ Your qualitative analysis should include a summary of the company and its markets:\ products; markets, market share and growth; competition; and stewardship.\ Your financial analysis should include a summary of key financial ratios and\ examination of factors that have driven the performance of the company over recent\ years.\ Discussion of the key assumptions used for your financial model and presentation of the\ forecasted free cash flows to the firm for 2023 to 2027.\ A discussion of the valuation methodologies and assumptions used in your discounted\ free cash flow valuation and presentation of valuation results for your firm, including\ appropriate sensitivity analysis.\ A recommendation to buy, hold or sell the firm's shares.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started