Answered step by step

Verified Expert Solution

Question

1 Approved Answer

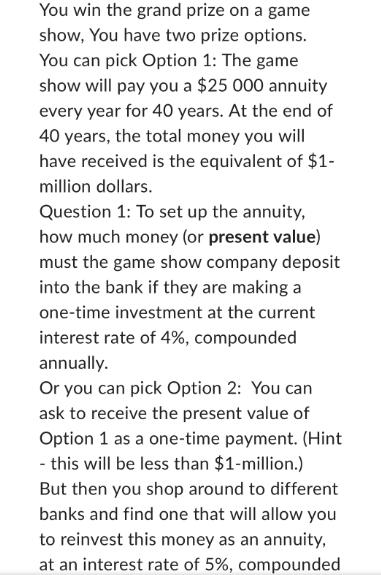

You win the grand prize on a game show, You have two prize options. You can pick Option 1: The game show will pay

You win the grand prize on a game show, You have two prize options. You can pick Option 1: The game show will pay you a $25 000 annuity every year for 40 years. At the end of 40 years, the total money you will have received is the equivalent of $1- million dollars. Question 1: To set up the annuity, how much money (or present value) must the game show company deposit into the bank if they are making a one-time investment at the current interest rate of 4%, compounded annually. Or you can pick Option 2: You can ask to receive the present value of Option 1 as a one-time payment. (Hint - this will be less than $1-million.) But then you shop around to different banks and find one that will allow you to reinvest this money as an annuity, at an interest rate of 5%, compounded annually over 40 years. (You will still get a yearly payment from the annuity for 40 years, and it may be more that $25 000.) Question 2: At the end of 40 years, how much interest would you have earned? How much more money, in total, would you have received if you picked Option 2 rather than if you picked Option 1? Be sure to show your work clearly.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started