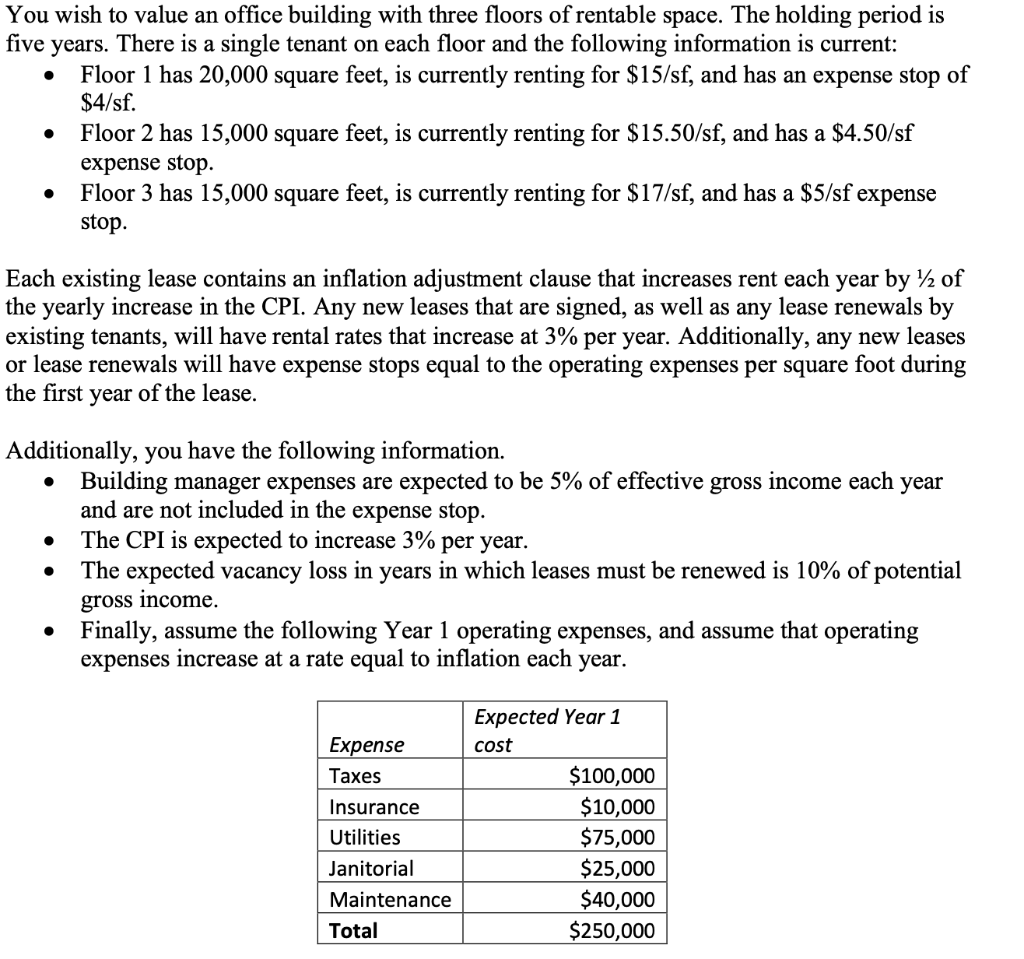

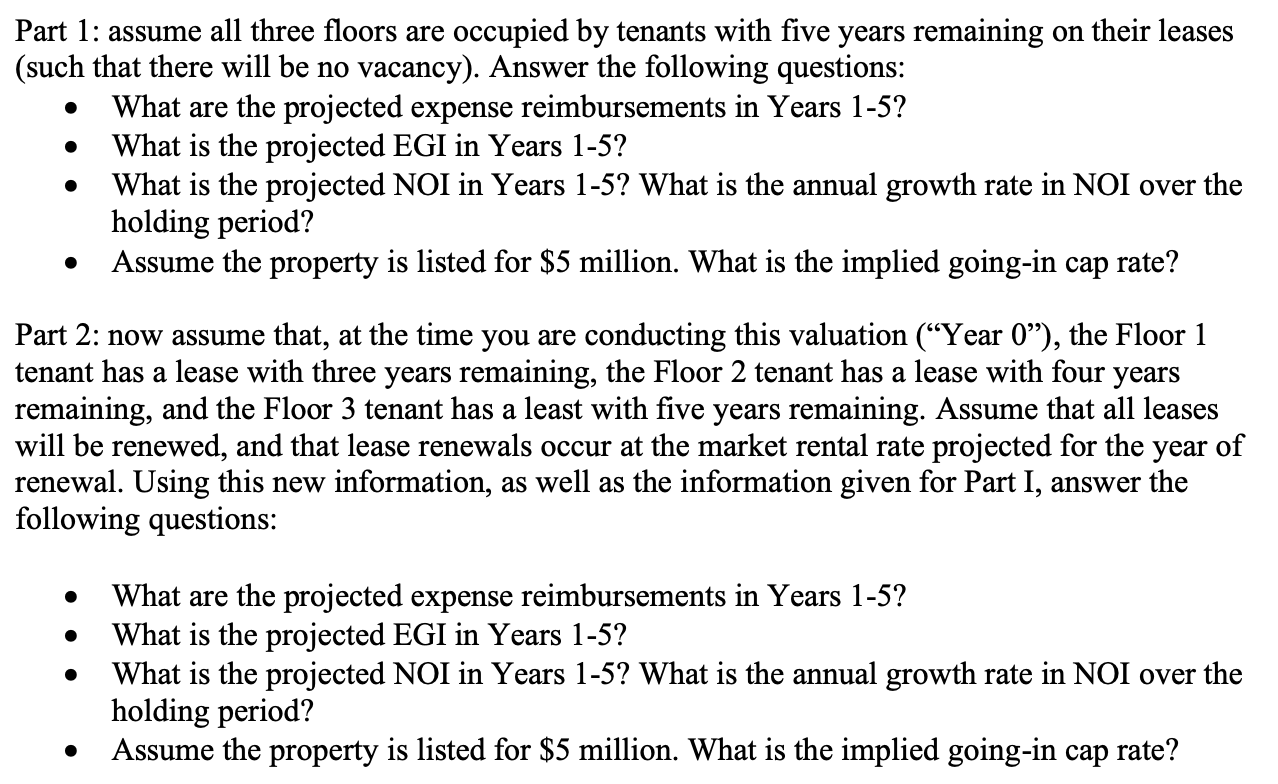

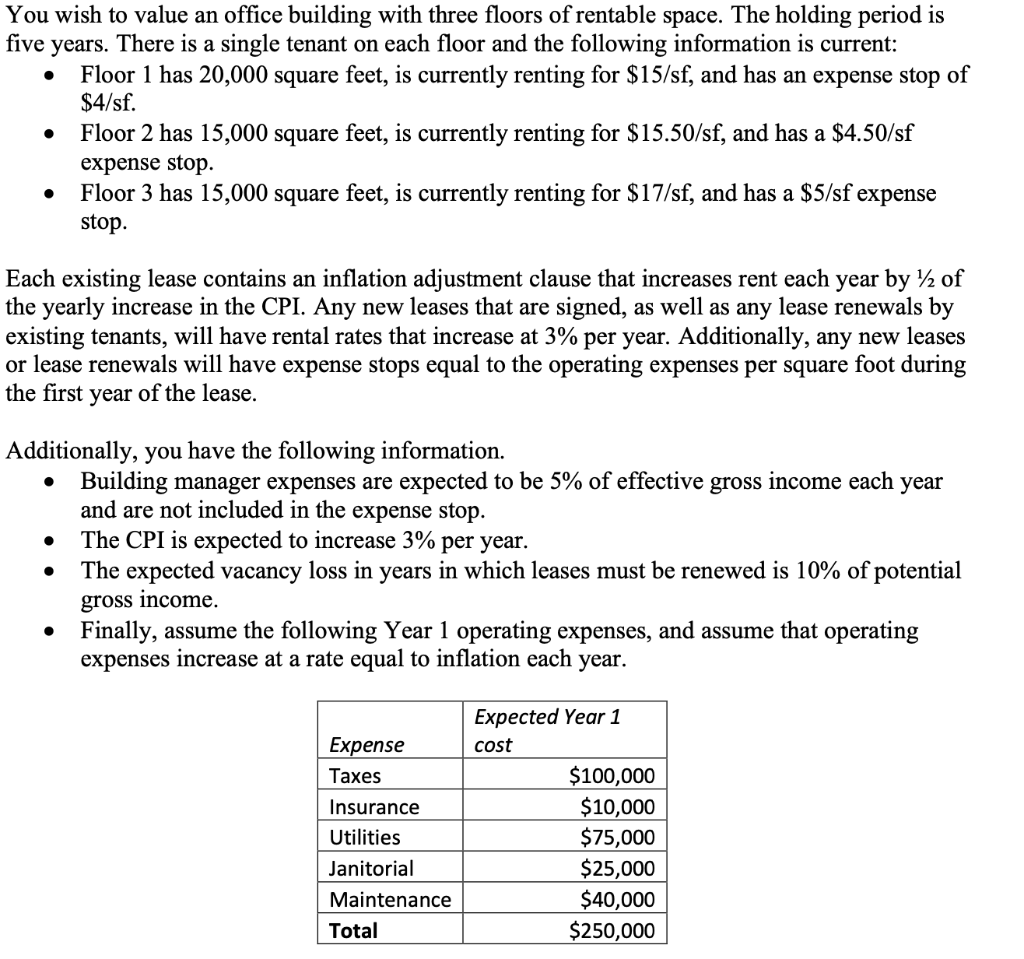

You wish to value an office building with three floors of rentable space. The holding period is five years. There is a single tenant on each floor and the following information is current: - Floor 1 has 20,000 square feet, is currently renting for $15/sf, and has an expense stop of $4/sf. - Floor 2 has 15,000 square feet, is currently renting for $15.50/sf, and has a $4.50/sf expense stop. - Floor 3 has 15,000 square feet, is currently renting for $17/sf, and has a $5/sf expense stop. Each existing lease contains an inflation adjustment clause that increases rent each year by 1/2 of the yearly increase in the CPI. Any new leases that are signed, as well as any lease renewals by existing tenants, will have rental rates that increase at 3% per year. Additionally, any new leases or lease renewals will have expense stops equal to the operating expenses per square foot during the first year of the lease. Additionally, you have the following information. - Building manager expenses are expected to be 5% of effective gross income each year and are not included in the expense stop. - The CPI is expected to increase 3% per year. - The expected vacancy loss in years in which leases must be renewed is 10% of potential gross income. - Finally, assume the following Year 1 operating expenses, and assume that operating expenses increase at a rate equal to inflation each year. Part 1: assume all three floors are occupied by tenants with five years remaining on their leases (such that there will be no vacancy). Answer the following questions: - What are the projected expense reimbursements in Years 1-5? - What is the projected EGI in Years 1-5? - What is the projected NOI in Years 1-5? What is the annual growth rate in NOI over the holding period? - Assume the property is listed for $5 million. What is the implied going-in cap rate? Part 2: now assume that, at the time you are conducting this valuation ("Year 0"), the Floor 1 tenant has a lease with three years remaining, the Floor 2 tenant has a lease with four years remaining, and the Floor 3 tenant has a least with five years remaining. Assume that all leases will be renewed, and that lease renewals occur at the market rental rate projected for the year of renewal. Using this new information, as well as the information given for Part I, answer the following questions: - What are the projected expense reimbursements in Years 1-5? - What is the projected EGI in Years 1-5? - What is the projected NOI in Years 1-5? What is the annual growth rate in NOI over the holding period? - Assume the property is listed for $5 million. What is the implied going-in cap rate