Answered step by step

Verified Expert Solution

Question

1 Approved Answer

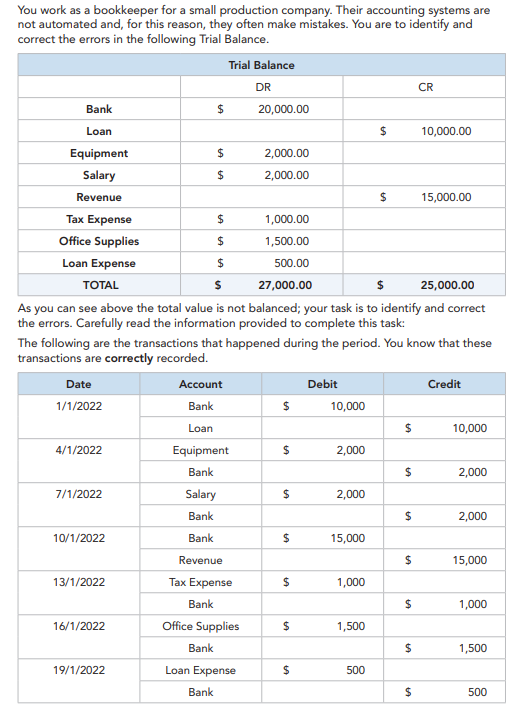

You work as a bookkeeper for a small production company. Their accounting systems are not automated and, for this reason, they often make mistakes.

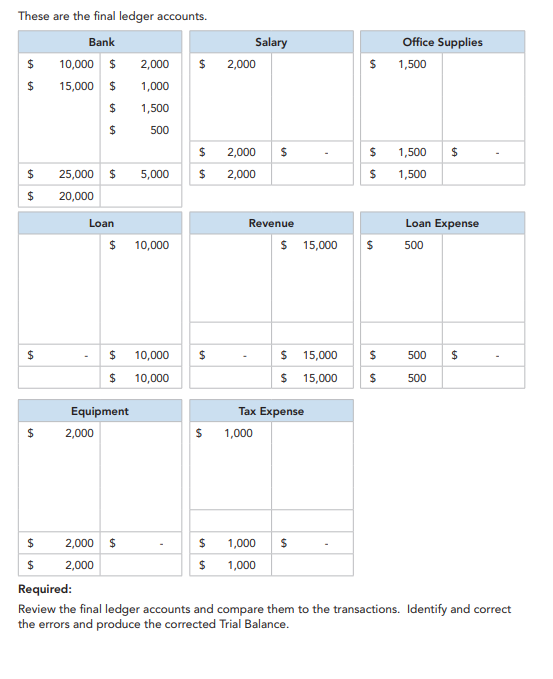

You work as a bookkeeper for a small production company. Their accounting systems are not automated and, for this reason, they often make mistakes. You are to identify and correct the errors in the following Trial Balance. Trial Balance DR CR Bank $ 20,000.00 Loan $ 10,000.00 Equipment $ 2,000.00 Salary $ 2,000.00 Revenue $ 15,000.00 Tax Expense $ 1,000.00 Office Supplies $ 1,500.00 Loan Expense $ 500.00 TOTAL 27,000.00 25,000.00 As you can see above the total value is not balanced; your task is to identify and correct the errors. Carefully read the information provided to complete this task: The following are the transactions that happened during the period. You know that these transactions are correctly recorded. Date 1/1/2022 Account Debit Credit Bank $ 10,000 Loan $ 10,000 4/1/2022 Equipment $ 2,000 Bank $ 2,000 7/1/2022 Salary $ 2,000 Bank $ 2,000 10/1/2022 Bank $ 15,000 Revenue $ 15,000 13/1/2022 Tax Expense $ 1,000 Bank $ 1,000 16/1/2022 Office Supplies $ 1,500 Bank $ 1,500 19/1/2022 Loan Expense $ 500 Bank $ 500 These are the final ledger accounts. Bank Salary Office Supplies $ 10,000 $ 2,000 $ 2,000 $ 1,500 $ 15,000 $ 1,000 $ 1,500 $ 500 $ 2,000 $ $ 1,500 $ $ 25,000 $ 5,000 $ 2,000 $ 1,500 $ 20,000 $ +A Loan $ 10,000 - Revenue $ 15,000 10 Loan Expense 500 $ 10,000 $ $ 15,000 $ 500 $ +A $ 10,000 $ 15,000 10 500 Tax Expense $ 1,000 Equipment $ 2,000 $ 2,000 $ $ 1,000 $ $ 2,000 $ 1,000 Required: Review the final ledger accounts and compare them to the transactions. Identify and correct the errors and produce the corrected Trial Balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started