Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You work as a financial planner for the Eastpac Banking Corporation. A new client has come to and asked you to (a) give her

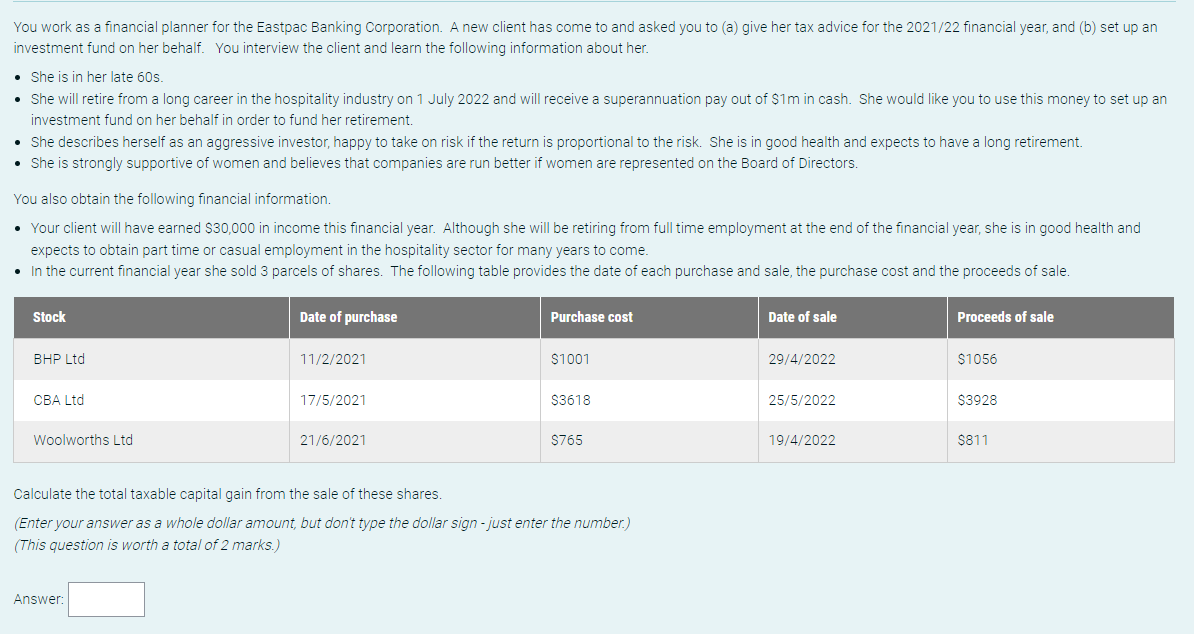

You work as a financial planner for the Eastpac Banking Corporation. A new client has come to and asked you to (a) give her tax advice for the 2021/22 financial year, and (b) set up an investment fund on her behalf. You interview the client and learn the following information about her. . She is in her late 60s. She will retire from a long career in the hospitality industry on 1 July 2022 and will receive a superannuation pay out of $1m in cash. She would like you to use this money to set up an investment fund on her behalf in order to fund her retirement. She describes herself as an aggressive investor, happy to take on risk if the return is proportional to the risk. She is in good health and expects to have a long retirement. She is strongly supportive of women and believes that companies are run better if women are represented on the Board of Directors. You also obtain the following financial information. Your client will have earned $30,000 in income this financial year. Although she will be retiring from full time employment at the end of the financial year, she is in good health and expects to obtain part time or casual employment in the hospitality sector for many years to come. In the current financial year she sold 3 parcels of shares. The following table provides the date of each purchase and sale, the purchase cost and the proceeds of sale. Stock BHP Ltd CBA Ltd Woolworths Ltd Date of purchase Answer: 11/2/2021 17/5/2021 21/6/2021 Purchase cost $1001 $3618 $765 Calculate the total taxable capital gain from the sale of these shares. (Enter your answer as a whole dollar amount, but don't type the dollar sign - just enter the number.) (This question is worth a total of 2 marks.) Date of sale 29/4/2022 25/5/2022 19/4/2022 Proceeds of sale $1056 $3928 $811

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the taxable capital gain from the sale of t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started