Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You work as a personal financial adviser in a small town in Nova Scotia. Today you have an initial meeting with your new clients:

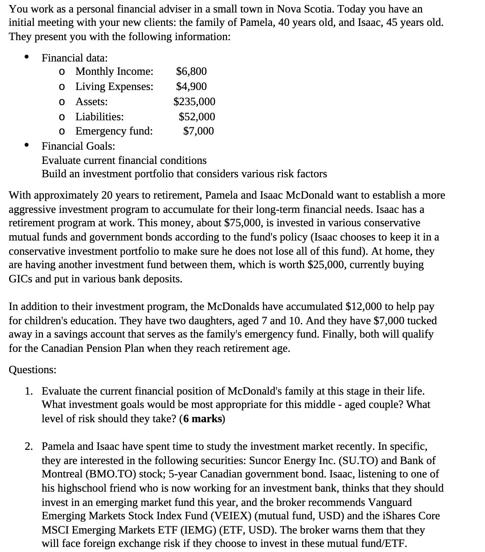

You work as a personal financial adviser in a small town in Nova Scotia. Today you have an initial meeting with your new clients: the family of Pamela, 40 years old, and Isaac, 45 years old. They present you with the following information: Financial data: o Monthly Income: o Living Expenses: o Assets: o Liabilities: o Emergency fund: Financial Goals: $6,800 $4,900 $235,000 $52,000 $7,000 Evaluate current financial conditions Build an investment portfolio that considers various risk factors With approximately 20 years to retirement, Pamela and Isaac McDonald want to establish a more aggressive investment program to accumulate for their long-term financial needs. Isaac has a retirement program at work. This money, about $75,000, is invested in various conservative mutual funds and government bonds according to the fund's policy (Isaac chooses to keep it in a conservative investment portfolio to make sure he does not lose all of this fund). At home, they are having another investment fund between them, which is worth $25,000, currently buying GICS and put in various bank deposits. In addition to their investment program, the McDonalds have accumulated $12,000 to help pay for children's education. They have two daughters, aged 7 and 10. And they have $7,000 tucked away in a savings account that serves as the family's emergency fund. Finally, both will qualify for the Canadian Pension Plan when they reach retirement age. Questions: 1. Evaluate the current financial position of McDonald's family at this stage in their life. What investment goals would be most appropriate for this middle-aged couple? What level of risk should they take? (6 marks) 2. Pamela and Isaac have spent time to study the investment market recently. In specific, they are interested in the following securities: Suncor Energy Inc. (SU.TO) and Bank of Montreal (BMO.TO) stock; 5-year Canadian government bond. Isaac, listening to one of his highschool friend who is now working for an investment bank, thinks that they should invest in an emerging market fund this year, and the broker recommends Vanguard Emerging Markets Stock Index Fund (VEIEX) (mutual fund, USD) and the iShares Core MSCI Emerging Markets ETF (IEMG) (ETF, USD). The broker warns them that they will face foreign exchange risk if they choose to invest in these mutual fund/ETF.

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Evaluating the current financial position of the McDonald family Monthly Income 6800 Living Expenses 4900 Assets 235000 Liabilities 52000 Emergency Fund 7000 To evaluate the current financial positi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started