Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You work currencies on the trading desk at UBS in Zurich and you're considering investing in either the CHF - EUR or the CHF -

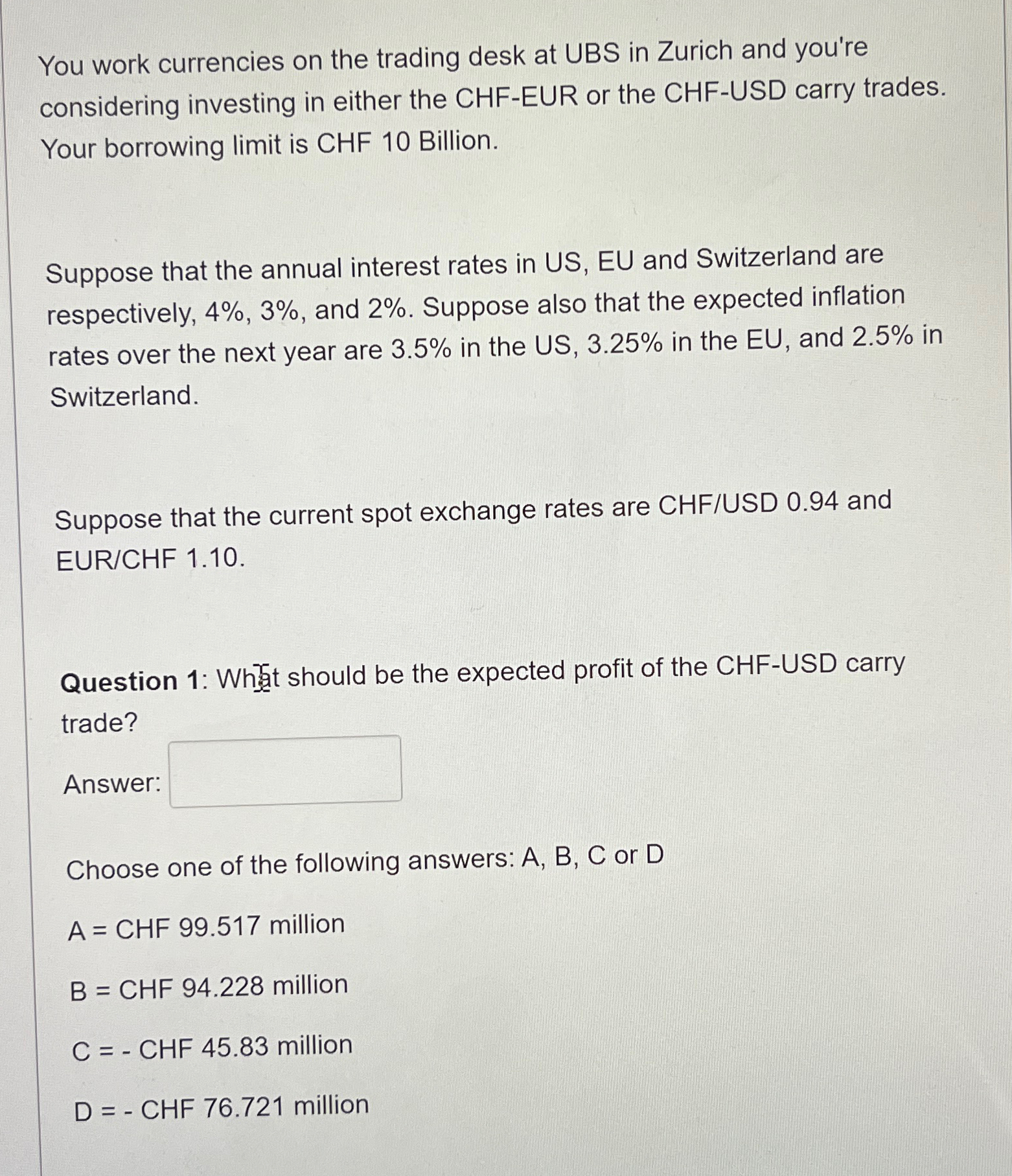

You work currencies on the trading desk at UBS in Zurich and you're considering investing in either the CHFEUR or the CHFUSD carry trades. Your borrowing limit is CHF Billion.

Suppose that the annual interest rates in US EU and Switzerland are respectively, and Suppose also that the expected inflation rates over the next year are in the US in the EU and in Switzerland.

Suppose that the current spot exchange rates are CHFUSD and EURCHF

Question : What should be the expected profit of the CHFUSD carry trade?

Answer:

Choose one of the following answers: or D

million

million

million

million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started