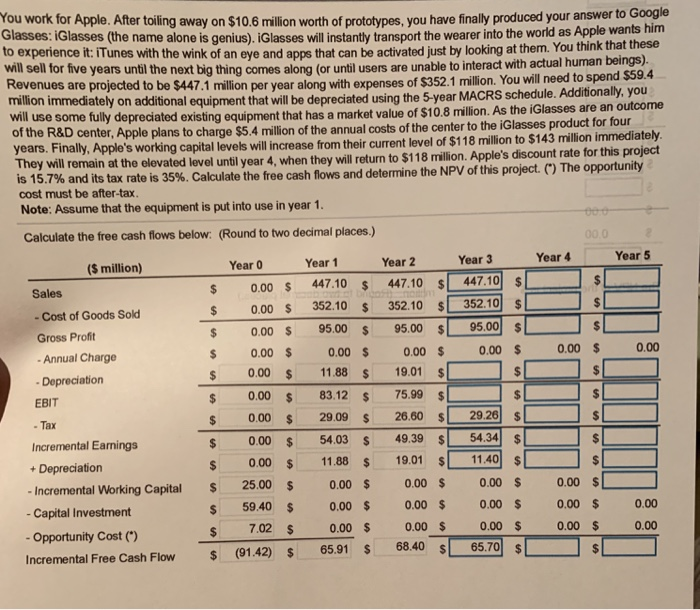

You work for Apple. After toiling away on $10.6 million worth of prototypes, you have finally produced your answer to Goog Glasses: iGlasses (the name alone is genius). iGlasses will instantly transport the wearer into the world as Apple wants him to experience it: iTunes with the wink of an eye and apps that can be activated just by looking at them. You think t will sell for five years until the next big thing comes along (or until users are unable to interact with actual human Revenues are projected to be $447.1 million per year along with expenses of $352.1 million. You will need to spe hat these nd $59.4 million immediately on additional equipment that will be depreciated using the 5-year MACRS schedule. Additionally, you will use some fully depreciated existing equipment that has a market value of $10.8 million. As the iGlasses are an of the R&D center, Apple plans to charge $5.4 million of the annual costs of the center to the ic years. Finally, Appl They will remain at the elevated level until year 4, wh is 15.7% and its tax rate is 35%. Calculate the free cash flows and determine the NPV of this project. (*) cost must be after-tax lasses product for four e's working capital levels will increase from their current level of $118 million to $143 million immediately en they will return to $118 million. Apple's discount rate for this project Note: Assume that the equipment is put into use in year 1 Calculate the free cash flows below: (Round to two decimal places.) Year 4 Year 3 Year 5 Year 2 Year 1 (S million) 0.00 s 447.10 447.10 447.10 $ 0.00 s 352.10 s 352.10 s 352.10 $ 0.00 $ 95.00 Cost of Goods Sold 95.0095.00 Gross Profit 0.00 $ 0.00 $ 0.00 $ 0.00 $ Annual Charge 0.00 $ 0.00 0.00 11.88 S 19.01$ Depreciation 0.00$ 83.12 $ 75.99$ 0.00 s 29.09 s 26.60 29.26s 0.00 54.03 49.39 5434s s 0.00 s 11.88 19.01 s1.40$ 0 EBIT . Tax Incremental Earnings Depreciation 0.00 Incremental Working Capital 25.00 0.00 $ 0.00 $ 0.00 $ 59.40 $ 0.00 $ 0.00 $ 0.00 $ Capital Investment 0.00 $ 0.00 $ 7.02 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ Opportunity Cost 0.00 s- Incremental Free Cash Flow (91.42) 65.91 68.40