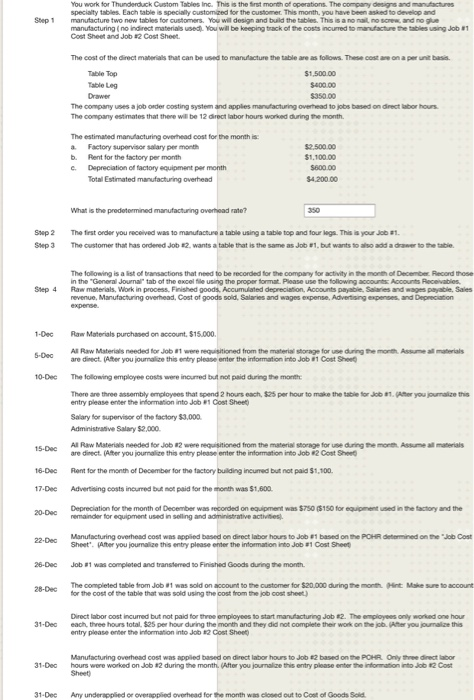

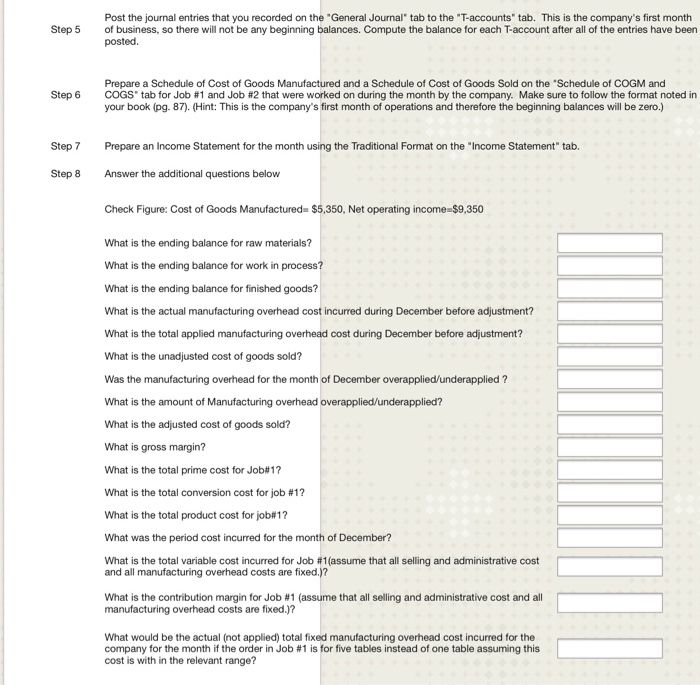

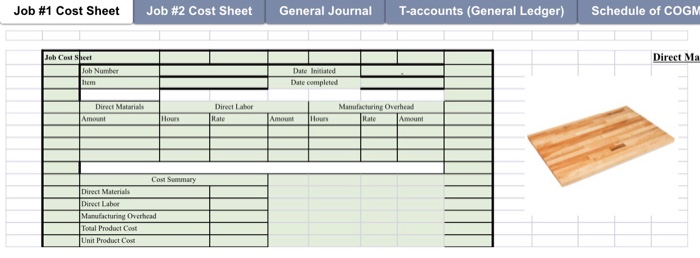

You work for Thunderack Custom Tables Inc. This the snt month, of operations. The company deegs ard mar specialty tables. Ea table i5 specially customeed for the customer This month, you have been asked to develop hctns Step 1 manutacture two new tables for customers. Your wll design and build the tables. This is a no nail no screw and no glue manutactunng(noindrect materials use cost Sheet and Job Cost Sheet. You will be keeprg tack of the costs ncurred to mavtact ete tables usrg Job #1 The cost of the direct materials that can be used to manulacture the table are as followS. These cost are on a per unit basis. Table Top Table Leg Drawer $1,500.00 $400.00 $350.00 The company uses a job order costing system and applies manufacturing overhead to jobs based on direct labor hours The company estimates that thene will be 12 direct labor hours worked during the month. The estimated manufacturing overhead cost for the morth is a. Factory supervisor salary per month b. Rent for the factory per month e. Depreciation of factory equipment per month 2500.00 $1.100.00 $600.00 $4.200.00 Total Estimated manufacturing overhead wat the predetermined manufactung overhead rate? soep 2 Step 3 Te list order you received was to manufactue a tatle using a table top and tour leg. This s your Job #1. Tea stomer that has ordered Job E2. wants a table that is the same as Job 1-but wants to add adaser to tette. The folowing is a list of transactions that need to be recorded for the oompany for activity in the month of December. Record those n the "General Journal" tab of the excel file using the proper format. Ploase use the following accounts Accounts Receivables Step 4 Raw materials, Work in process, Finished goods, Accumulated depreciation, Accounts payable, Salaries and wages payable, Sales revenue, Manufactung overhead. Cost of goods sold. Solanes and wages ense. Advertsng expees. vd Deprecaton 1-Dec Raw Materials purchased on account, $15.000. AlRaw Materials needed for Job #1 were requisitioned from the material storage for " dng the are diect(Aher you oumakn this e try please enter the rformaton ito Job #1 Cost Shen terals -D. 10-Dec The folowing employee costs were incured but not paid during the month There are three assembly employees that spend 2 hours each,$25 per hour to make the table tr Job (Aher you pralae entry please enter the information into Job 1 Cost Sheet) Salary for supervisor of the factory $3,000 Administrative Salary $2,000 1SD Al Raw Materiais needed for Job 2 were requisitioned from the material storage for-dnghe-Atine aimats 16-Dc Rent for the month of December for the factory building incumed but not paid $1,100 17-Dee Advertising costs incurred but not paid for the honth was $1,600 are direct(Aher you purnito this e try please enter the informaton rto Job#2Cost Sheed Depreciation for the month of December was recorded on equipment was $750 ($150 for equipment used in the factory and the 20-Dac remainder for equipment used in selling and administrative activies Manufacturing overhead cost was applied based on direct labor hours to Job 1 based onthe deterred on telob Cost 22-Dec Sheet". (After you journal2e this entry please enter the intrmaton into Job #1 Cost Sheen Job #1 wascompleted andtransferred to FinshedGoodsang The completed table tom Job #1 was sold on account to the customer for S20.000 dmg te 26-Dec month. Nt Mae sre to account 28-Dec for the cost of the table that was sold using the cost from the job cost sheet) Direct lator oost ncurred but not paid for three omployees to stat marufacturng Job E2The eployees onty worted one hour entry please enter the norm aton nto Job 2 Cost Sheep 31-Dea each, three hours total, $25 per hour duing the month and they did not complete their work on the jpb. (Ater you journalize this Manufacturing overhead cost was appled based on direct labor hours to Job #2 based on the POHR Only three direct labor hours were voied on Job #2 dunngthe month, (After you journalze his entry please en er terto Sheet) 31-Dec nto "2 Cost 31-Dec Any underapplied or overapplied overhead for the month was closed out to Cost of Goods Sold Post the journal entries that you recorded on the "General Journal" tab to the "T-accounts" tab. This is the company's first month Step 5 of business, so there will not be any beginning balances. Compute the balance for each T-account after all of the entries have been posted Prepare a Schedule of Cost of Goods Manufactured and a Schedule of Cost of Goods Sold on the Schedule of COGM and COGS" tab for Job #1 and Job #2 that were worked on during the month by the company. Make sure to follow the format noted in your book (pg. 87). (Hint: This is the company's first month of operations and therefore the beginning balances will be zero.) Step 6 Step 7 Prepare an Income Statement for the month using the Traditional Format on the "Income Statement" tab. Step 8 Anser the additional questions below Check Figure: Cost of Goods Manufactured $5,350, Net operating income $9,350 What is the ending balance for raw materials? What is the ending balance for work in process? What is the ending balance for finished goods? What is the actual manufacturing overhead cost incurred during December before adjustment? What is the total applied manufacturing overhead cost during December before adjustment? What is the unadjusted cost of goods sold? Was the manufacturing overhead for the month of December overapplied/underapplied? What is the amount of Manufacturing overhead overapplied/underapplied? What is the adjusted cost of goods sold? What is gross margin? What is the total prime cost for Job#17 What is the total conversion cost for job #1? What is the total product cost for job#1? What was the period cost incurred for the month of December? What is the total variable cost incurred for Job #1 (assume that all selling and administrative cost and all manufacturing overhead costs are fixed.)? What is the contribution margin for Job #1 (assume that all selling and administrative cost and all manufacturing overhead costs are fixed.)? What would be the actual (not applied) total fixed manufacturing overhead cost incurred for the company for the month if the order in Job #1 is for five tables instead of one table assuming this cost is with in the relevant range? Job #1 Cost Sheet Job #2 Cost Sheet General Journal T-accounts (General Ledger) Schedule of COGM ob Cost S Direct Ma Date cempleted Direct Matarials Direct Labor Manufacturing Overhead Cost Summary Direct Laboe Overhead Total Product Cost Unit Product C Job #1 Cost Sheet Job #2 Cost Sheet General Journal T-accounts (General Ledger) Schedule of COGM lab Numbor ate Initiated Date complcted Direct Matarials Direct Labor Manufacturing Overhcad Rate Cest Summary Direct Materials Direct Labor ing Overhead Total Product Cost Unit Product Cost Job #1 Cost Sheet Job #2 Cost Sheet General Journal T-accounts (General Ledger) Schedule of COGM Thunderduck Custom Tables, Ine Schedule of cost of goods manufactured For the month Ended December 31, 20x0x Thunderduck Custom Tables, Inc. Cost of goods sold For the month Ended December 31, 200xx Thunderduck Custom Tables, Inc. Income Statement For the month Ended December 31, 20xX You work for Thunderack Custom Tables Inc. This the snt month, of operations. The company deegs ard mar specialty tables. Ea table i5 specially customeed for the customer This month, you have been asked to develop hctns Step 1 manutacture two new tables for customers. Your wll design and build the tables. This is a no nail no screw and no glue manutactunng(noindrect materials use cost Sheet and Job Cost Sheet. You will be keeprg tack of the costs ncurred to mavtact ete tables usrg Job #1 The cost of the direct materials that can be used to manulacture the table are as followS. These cost are on a per unit basis. Table Top Table Leg Drawer $1,500.00 $400.00 $350.00 The company uses a job order costing system and applies manufacturing overhead to jobs based on direct labor hours The company estimates that thene will be 12 direct labor hours worked during the month. The estimated manufacturing overhead cost for the morth is a. Factory supervisor salary per month b. Rent for the factory per month e. Depreciation of factory equipment per month 2500.00 $1.100.00 $600.00 $4.200.00 Total Estimated manufacturing overhead wat the predetermined manufactung overhead rate? soep 2 Step 3 Te list order you received was to manufactue a tatle using a table top and tour leg. This s your Job #1. Tea stomer that has ordered Job E2. wants a table that is the same as Job 1-but wants to add adaser to tette. The folowing is a list of transactions that need to be recorded for the oompany for activity in the month of December. Record those n the "General Journal" tab of the excel file using the proper format. Ploase use the following accounts Accounts Receivables Step 4 Raw materials, Work in process, Finished goods, Accumulated depreciation, Accounts payable, Salaries and wages payable, Sales revenue, Manufactung overhead. Cost of goods sold. Solanes and wages ense. Advertsng expees. vd Deprecaton 1-Dec Raw Materials purchased on account, $15.000. AlRaw Materials needed for Job #1 were requisitioned from the material storage for " dng the are diect(Aher you oumakn this e try please enter the rformaton ito Job #1 Cost Shen terals -D. 10-Dec The folowing employee costs were incured but not paid during the month There are three assembly employees that spend 2 hours each,$25 per hour to make the table tr Job (Aher you pralae entry please enter the information into Job 1 Cost Sheet) Salary for supervisor of the factory $3,000 Administrative Salary $2,000 1SD Al Raw Materiais needed for Job 2 were requisitioned from the material storage for-dnghe-Atine aimats 16-Dc Rent for the month of December for the factory building incumed but not paid $1,100 17-Dee Advertising costs incurred but not paid for the honth was $1,600 are direct(Aher you purnito this e try please enter the informaton rto Job#2Cost Sheed Depreciation for the month of December was recorded on equipment was $750 ($150 for equipment used in the factory and the 20-Dac remainder for equipment used in selling and administrative activies Manufacturing overhead cost was applied based on direct labor hours to Job 1 based onthe deterred on telob Cost 22-Dec Sheet". (After you journal2e this entry please enter the intrmaton into Job #1 Cost Sheen Job #1 wascompleted andtransferred to FinshedGoodsang The completed table tom Job #1 was sold on account to the customer for S20.000 dmg te 26-Dec month. Nt Mae sre to account 28-Dec for the cost of the table that was sold using the cost from the job cost sheet) Direct lator oost ncurred but not paid for three omployees to stat marufacturng Job E2The eployees onty worted one hour entry please enter the norm aton nto Job 2 Cost Sheep 31-Dea each, three hours total, $25 per hour duing the month and they did not complete their work on the jpb. (Ater you journalize this Manufacturing overhead cost was appled based on direct labor hours to Job #2 based on the POHR Only three direct labor hours were voied on Job #2 dunngthe month, (After you journalze his entry please en er terto Sheet) 31-Dec nto "2 Cost 31-Dec Any underapplied or overapplied overhead for the month was closed out to Cost of Goods Sold Post the journal entries that you recorded on the "General Journal" tab to the "T-accounts" tab. This is the company's first month Step 5 of business, so there will not be any beginning balances. Compute the balance for each T-account after all of the entries have been posted Prepare a Schedule of Cost of Goods Manufactured and a Schedule of Cost of Goods Sold on the Schedule of COGM and COGS" tab for Job #1 and Job #2 that were worked on during the month by the company. Make sure to follow the format noted in your book (pg. 87). (Hint: This is the company's first month of operations and therefore the beginning balances will be zero.) Step 6 Step 7 Prepare an Income Statement for the month using the Traditional Format on the "Income Statement" tab. Step 8 Anser the additional questions below Check Figure: Cost of Goods Manufactured $5,350, Net operating income $9,350 What is the ending balance for raw materials? What is the ending balance for work in process? What is the ending balance for finished goods? What is the actual manufacturing overhead cost incurred during December before adjustment? What is the total applied manufacturing overhead cost during December before adjustment? What is the unadjusted cost of goods sold? Was the manufacturing overhead for the month of December overapplied/underapplied? What is the amount of Manufacturing overhead overapplied/underapplied? What is the adjusted cost of goods sold? What is gross margin? What is the total prime cost for Job#17 What is the total conversion cost for job #1? What is the total product cost for job#1? What was the period cost incurred for the month of December? What is the total variable cost incurred for Job #1 (assume that all selling and administrative cost and all manufacturing overhead costs are fixed.)? What is the contribution margin for Job #1 (assume that all selling and administrative cost and all manufacturing overhead costs are fixed.)? What would be the actual (not applied) total fixed manufacturing overhead cost incurred for the company for the month if the order in Job #1 is for five tables instead of one table assuming this cost is with in the relevant range? Job #1 Cost Sheet Job #2 Cost Sheet General Journal T-accounts (General Ledger) Schedule of COGM ob Cost S Direct Ma Date cempleted Direct Matarials Direct Labor Manufacturing Overhead Cost Summary Direct Laboe Overhead Total Product Cost Unit Product C Job #1 Cost Sheet Job #2 Cost Sheet General Journal T-accounts (General Ledger) Schedule of COGM lab Numbor ate Initiated Date complcted Direct Matarials Direct Labor Manufacturing Overhcad Rate Cest Summary Direct Materials Direct Labor ing Overhead Total Product Cost Unit Product Cost Job #1 Cost Sheet Job #2 Cost Sheet General Journal T-accounts (General Ledger) Schedule of COGM Thunderduck Custom Tables, Ine Schedule of cost of goods manufactured For the month Ended December 31, 20x0x Thunderduck Custom Tables, Inc. Cost of goods sold For the month Ended December 31, 200xx Thunderduck Custom Tables, Inc. Income Statement For the month Ended December 31, 20xX