Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. You work in the Finance Department for Flynn, Inc. Your firm needs to raise $8,500,000,000 ($8.5B) to finance new capital investments. Your boss

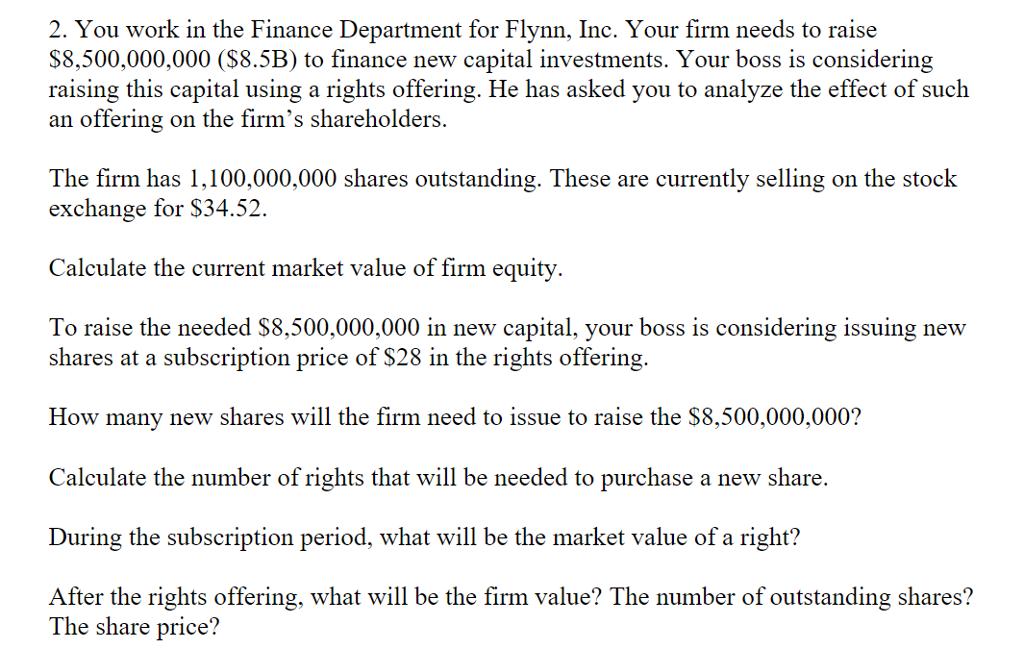

2. You work in the Finance Department for Flynn, Inc. Your firm needs to raise $8,500,000,000 ($8.5B) to finance new capital investments. Your boss is considering raising this capital using a rights offering. He has asked you to analyze the effect of such an offering on the firm's shareholders. The firm has 1,100,000,000 shares outstanding. These are currently selling on the stock exchange for $34.52. Calculate the current market value of firm equity. To raise the needed $8,500,000,000 in new capital, your boss is considering issuing new shares at a subscription price of $28 in the rights offering. How many new shares will the firm need to issue to raise the $8,500,000,000? Calculate the number of rights that will be needed to purchase a new share. During the subscription period, what will be the market value of a right? After the rights offering, what will be the firm value? The number of outstanding shares? The share price?

Step by Step Solution

★★★★★

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Conditional Format Cell ke Microsoft Excel File Home Insert Page Layout Formulas Data Review View Ad...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started